Answered step by step

Verified Expert Solution

Question

1 Approved Answer

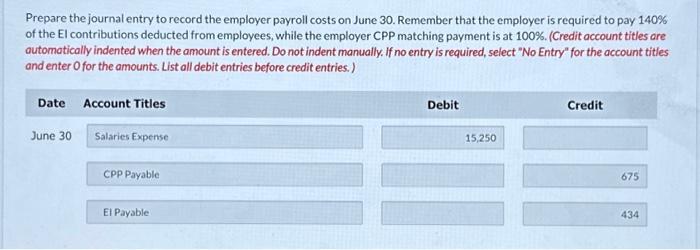

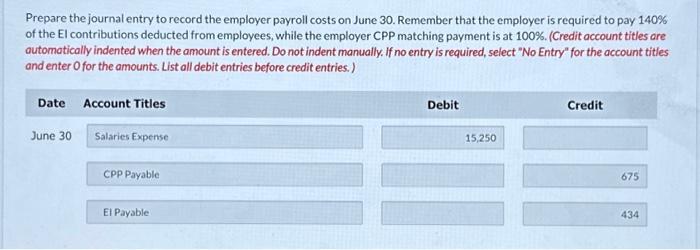

answer (c) please Prepare the journal entry to record the employer payroll costs on June 30 . Remember that the employer is required to pay

answer (c) please

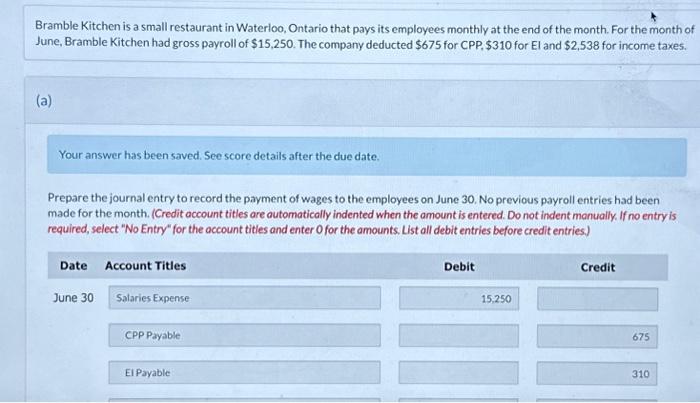

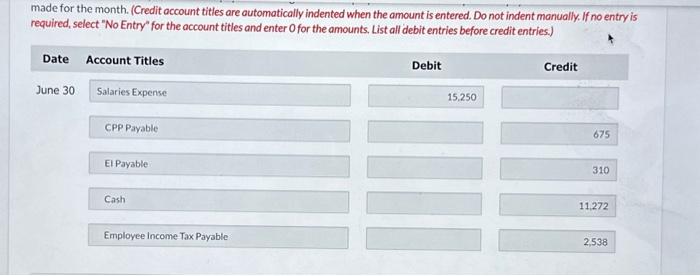

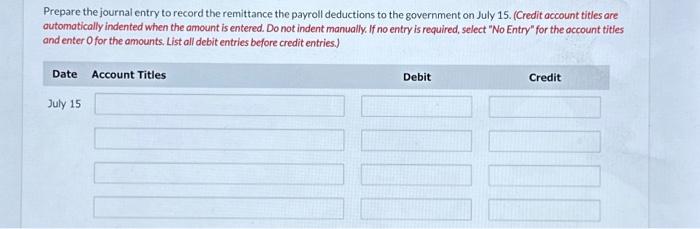

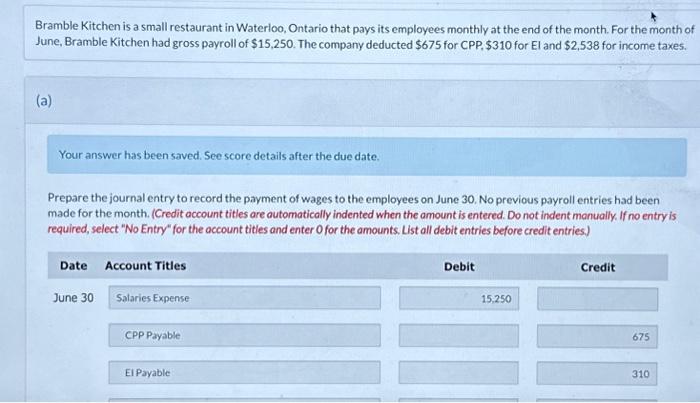

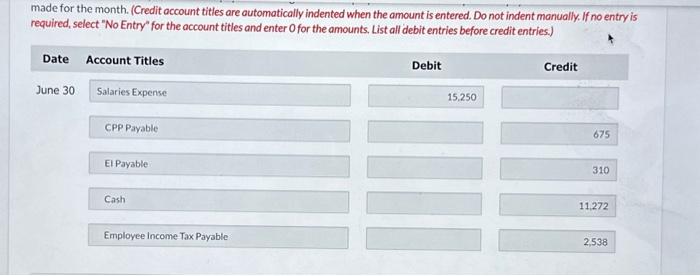

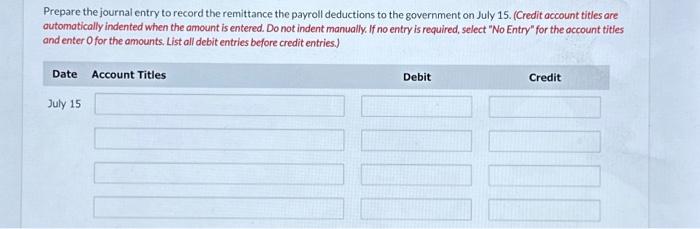

Prepare the journal entry to record the employer payroll costs on June 30 . Remember that the employer is required to pay 140% of the El contributions deducted from employees, while the employer CPP matching payment is at 100%. (Credit occount titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Prepare the journal entry to record the remittance the payroll deductions to the government on July 15. (Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Bramble Kitchen is a small restaurant in Waterloo, Ontario that pays its employees monthly at the end of the month. For the month of June, Bramble Kitchen had gross payroll of $15,250. The company deducted $675 for CPP, $310 for El and $2,538 for income taxes. (a) Your answer has been saved. See score details after the due date. Prepare the journal entry to record the payment of wages to the employees on June 30 . No previous payroll entries had been made for the month. (Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts. List all debit entries before credit entries.) made for the month. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started