Answer Case Questions : (Whatever the relationship EXPLAIN IN DETAIL)

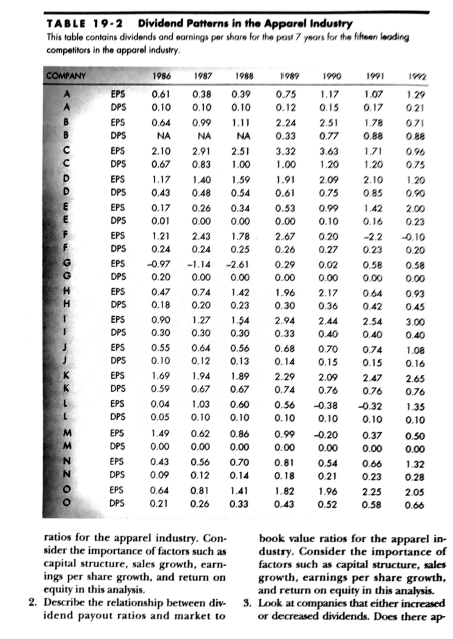

1) Describe the relationship between Dividend Payout ratios and price earnings ratios for the apparel industry. Consider the importance of factors such as capital structure, sales growth, earnings per share growth and return on equity in this analysis.

2) Describe the relationship between dividend payout ratios and market to book valye ratios for the apparel industry. Consider the importance of factors such as capital structure, sales growth, earnings per share growth.

3) Look at companies that either increased or decreased dividends. Does there appear to be any relationship between these changes and price earnings ratio? Consider the importace of factors such as capital structure, sales growth, earnings per share growth, and return on equity in this analysis.

4) Look at companies that either increased or decreased dividend pay out ratios. Does there appear to be any relationship between these changes and price earnings ratio? Consider the importace of factors such as capital structure, sales growth, earnings per share growth, and return on equity in this analysis.

5) What dividend policy do you recommend for Brand-name Corporation

Additional Information Given :

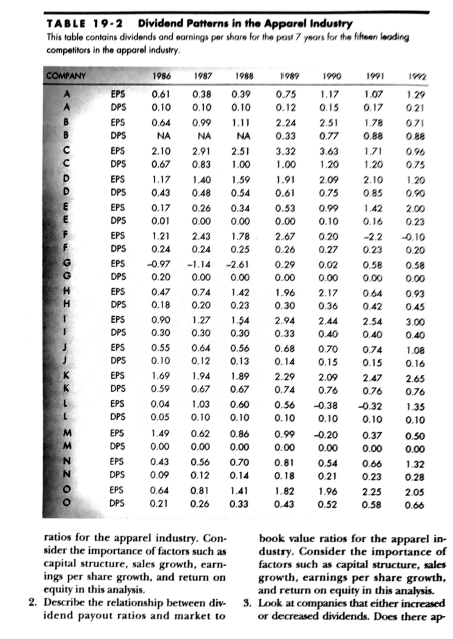

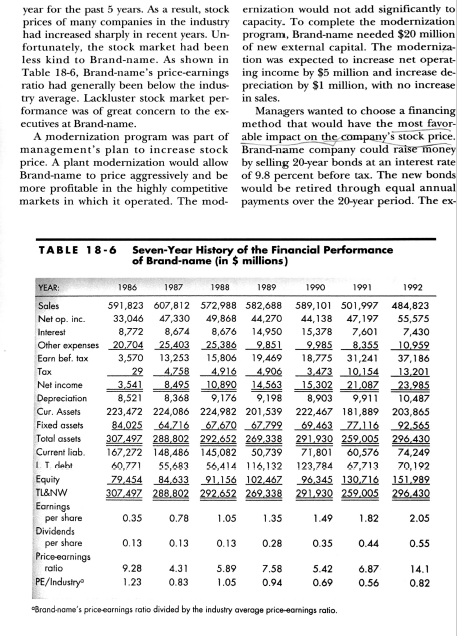

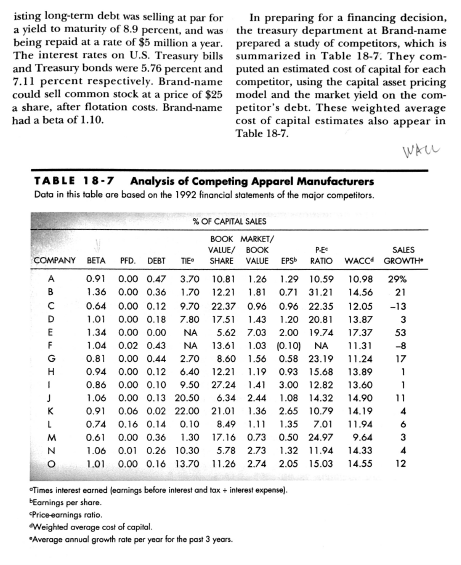

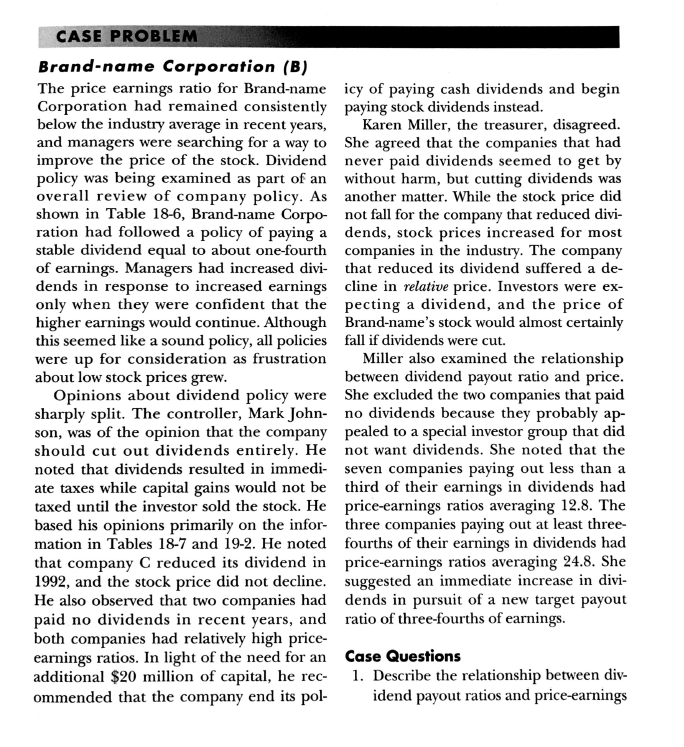

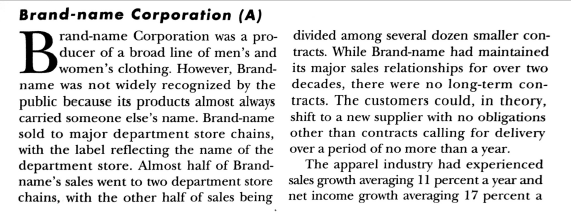

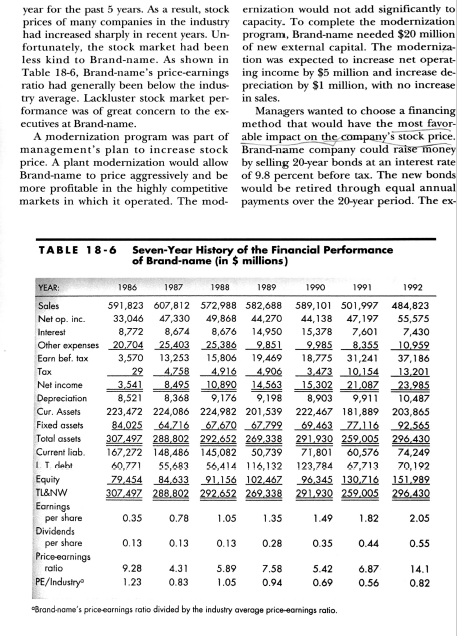

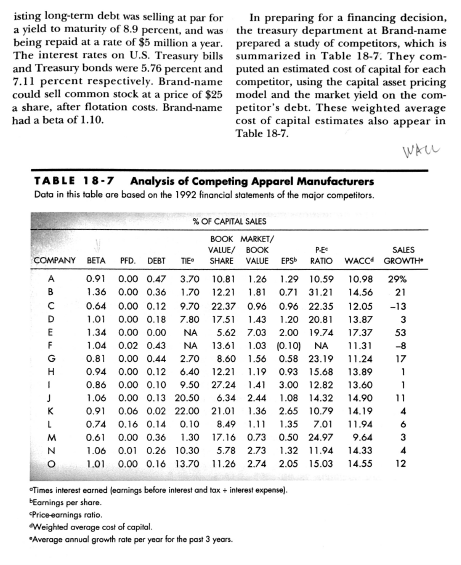

CASE PROBL Brand-name Corporation (B) The price earnings ratio for Brand-name icy of paying cash dividends and begin Corporation had remained consistently paying stock dividends instead. below the industry average in recent years, Karen Miller, the treasurer, disagreed. and managers were searching for a way to She agreed that the companies that had improve the price of the stock. Dividend never paid dividends seemed to get by policy was being examined as part of an without harm, but cutting dividends was overall review of company policy. As another matter. While the stock price did shown in Table 18-6, Brand-name Corpo- not fall for the company that reduced divi- ration had followed a policy of paying a dends, stock prices increased for most stable dividend equal to about one-fourth companies in the industry. The company of earnings. Managers had increased divi- that reduced its dividend suffered a de- dends in response to increased earnings cline in relative price. Investors were ex- only when they were confident that the pecting a dividend, and the price of higher earnings would continue. Although Brand-name's stock would almost certainly this seemed like a sound policy, all policies fall if dividends were cut. were up for consideration as frustration about low stock prices grew Miller also examined the relationship between dividend payout ratio and price Opinions about dividend policy were She excluded the two companies that paid sharply split. The controller, Mark John- no dividends because they probably ap- son, was of the opinion that the company pealed to a special investor group that did should cut out dividends entirely. He not want dividends. She noted that the noted that dividends resulted in immedi- seven companies paying out less than a ate taxes while capital gains would not be third of their earnings in dividends had taxed until the investor sold the stock. He price-earnings ratios averaging 12.8. The based his opinions primarily on the infor- three companies paying out at least three- mation in Tables 18-7 and 19-2. He noted fourths of their earnings in dividends had that company C reduced its dividend in price-earnings ratios averaging 24.8. She 1992, and the stock price did not decline. suggested an immediate increase in divi- He also observed that two companies had dends in pursuit of a new target payout paid no dividends in recent years, and ratio of three-fourths of earnings. both companies had relatively high price- earnings ratios. In light of the need for an Case Questions additional $20 million of capital, he rec- 1. Describe the relationship between div- ommended that the company end its pol- idend payout ratios and price-earnings