Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer Choices: $408,415 $401,310 $470,415 $450,415 $378,495 None of the answer choices provided are correct. Saturday Company, a consulting firm, has provided below various 12/31st

Answer Choices:

$408,415

$401,310

$470,415

$450,415

$378,495

None of the answer choices provided are correct.

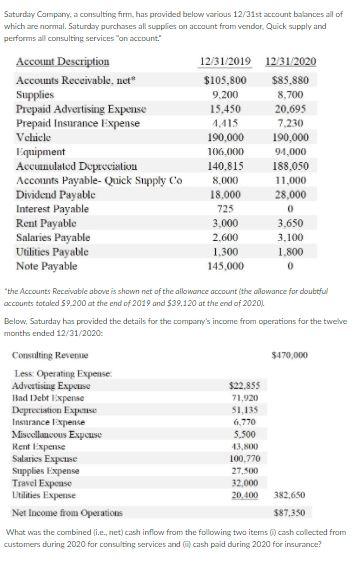

Saturday Company, a consulting firm, has provided below various 12/31st account balances all of which are normal. Saturday purchases al supplies on account from vendor Quick supply and performs all consulting services on account Account Description 12/31/2019 12/31/2020 Accounts Receivable.net $105,800 $89.880 Supplies 9.200 8.700 Prepaid Advertising Expense 15.450 20.695 Prepaid Insurance Expense 1.415 7.230 Vehicle 190,000 190,000 Equipment 106.000 94,000 Accumulated Depreciation 140,815 188.050 Accounts Payable-Quick Supply Co 8.000 11,000 Dividend Payable 18,000 28.000 Interest Payable 725 0 Rent Payable 3.000 3.650 Salaries Payable 2.600 3.100 Utilities Payable 1.300 1.800 Note Payable 145,000 0 the Accounts Receivable above is shown net of the allowance account the clowance for doubtful accounts totaled 59.200 at the end of 2019 and 539,120 at the end of 20201 Below, Saturday has provided the details for the company's income from operations for the twelve months ended 12/31/2020: Consulting Revenue 3470,000 Less Operating Expense Advertising Expouse $22.855 Bad Debt lixpense 71,920 Depreciation Expanse $1,135 Insurance expense 6.770 Miscellaneous Expense 5.500 Rent Expense 13,800 Salaries Expeine 100,770 Supplies Expense 27.500 Travel Expense 32,000 tilities Expense 20.400 382.650 Net Income from Operations $87.350 What was the combined i..., net cash inflow from the following two items) cash collected from customers during 2020 for consulting services and cash paid during 2020 for insuranceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started