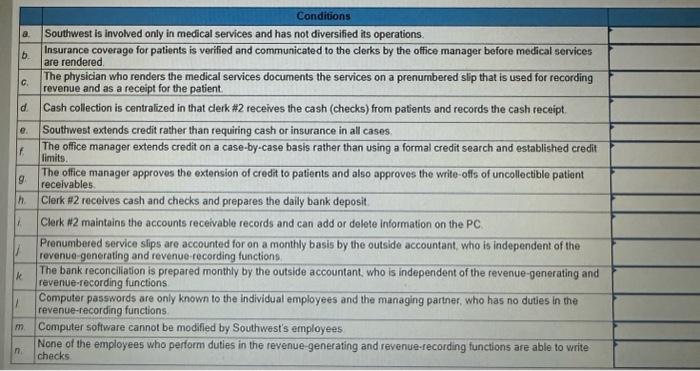

Answer choices are: Strength, Weakness, or Neither

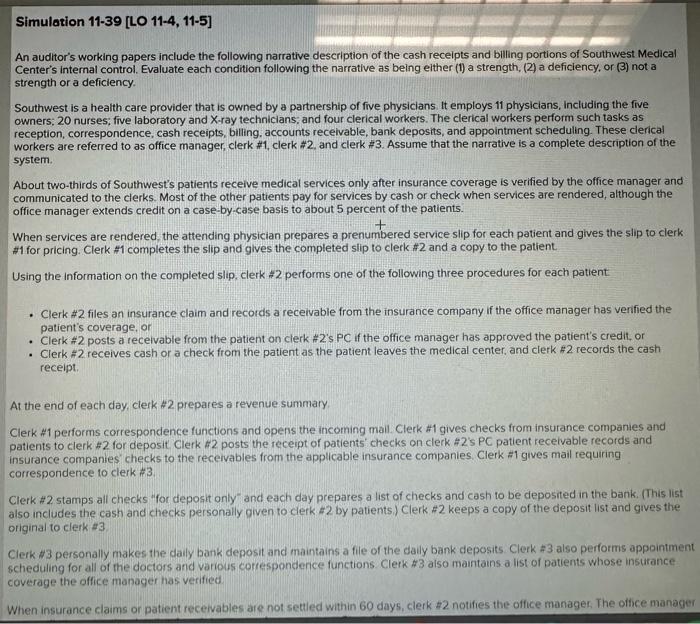

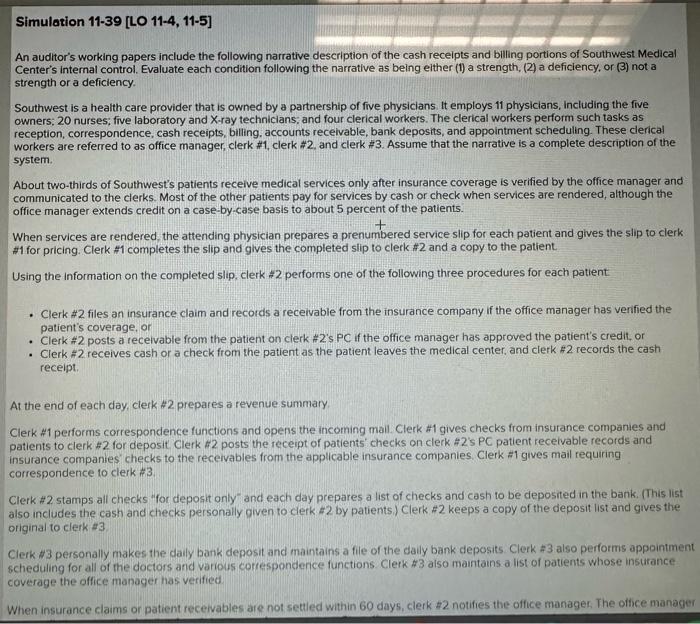

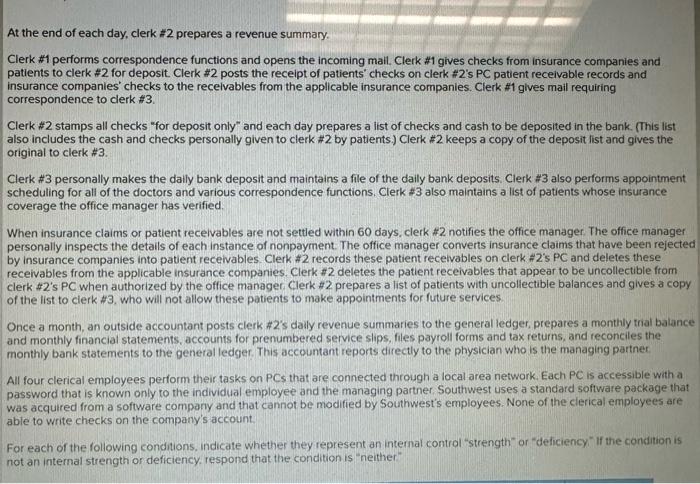

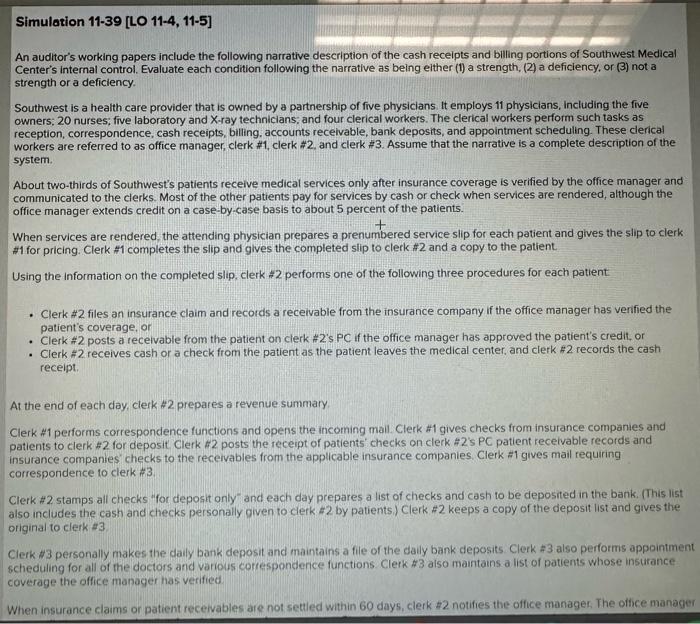

An auditor's working papers include the following narrative description of the cash recelpts and billing portions of Southwest Medical Center's internal control. Evaluate each condition following the narrative as being elther (1) a strength, (2) a deficiency, or (3) not a strength or a deficiency. Southwest is a health care provider that is owned by a partnership of five physicians it employs 11 physicians, including the five owners; 20 nurses; five laboratory and X-ray technicians; and four clerical workers. The clerical workers perform such tasks as reception, correspondence, cash receipts, billing, accounts receivable, bank deposits, and appointment scheduling. These clerical workers are referred to as office manager, clerk #1, clerk #2. and clerk #3. Assume that the narrative is a complete description of the system. About two-thirds of Southwest's patients receive medical services only after insurance coverage is verified by the office manager and communicated to the clerks. Most of the other patients pay for services by cash or check when services are rendered, although the office manager extends credit on a case-by-case basis to about 5 percent of the patients. When services are rendered, the attending physician prepares a prenumbered service slip for each patient and gives the slip to clerk #1 for pricing. Clerk \#1 completes the slip and gives the completed slip to clerk \#2 and a copy to the patient. Using the information on the completed slip, clerk 2 performs one of the following three procedures for each patient: - Clerk \#2 files an insurance claim and records a receivable from the insurance company if the office manager has verified the patient's coverage, or - Clerk \#2 posts a receivable from the patient on clerk #2 's PC if the office manager has approved the patient's credit, or - Clerk #2 receives cash or a check from the patient as the patient leaves the medical center, and clerk #2 records the cash recelpt. At the end of each day, clerk 42 prepares a revenue summary. Clerk #1 performs correspondence functions and opens the incoming mail. Clerk #1 gives checks from insurance companies and patients to clerk #2 for deposit. Clerk #2 posts the receipt of patients' checks on clerk #2 's PC patient receivable records and insurance companies checks to the receivables from the applicable insurance companies. Clerk #1 gives mail requiring correspondence to clerk 43 Clerk \#2 stamps all checks "for deposit only" and each day prepares a list of checks and cash to be deposited in the bank. (This list also includes the cash and checks personally given to cierk $2 by patients) Clerk #2 keeps a copy of the deposit list and gives the original to clerk 33 Clerk #3 personally makes the daily bank deposit and maintains a file of the daily bank deposits. Clerk \#3 also performs appointmer scheduling for all of the doctors and various cotrespondence functions. Clerk 43 also maintains a list of patients whose insurance coverage the office manager has verified At the end of each day, clerk #2 prepares a revenue summary. Clerk \#1 performs correspondence functions and opens the incoming mail. Clerk #1 gives checks from insurance companies and patients to clerk \#2 for deposit. Clerk \#2 posts the receipt of patients' checks on clerk \#2's PC patient receivable records and insurance companies' checks to the recelvables from the applicable insurance companies. Clerk #1 gives mail requiring correspondence to clerk #3. Clerk \#2 stamps all checks "for deposit only" and each day prepares a list of checks and cash to be deposited in the bank. (This list also includes the cash and checks personally given to clerk \#2 by patients.) Clerk \#2 keeps a copy of the deposit list and gives the original to clerk #3. Clerk \#3 personally makes the daily bank deposit and maintains a file of the daily bank deposits. Clerk \#3 also performs appointment scheduling for all of the doctors and various correspondence functions. Clerk $3 also maintains a list of patients whose insurance coverage the office manager has verified. When insurance claims or patient recelvables are not settled within 60 days, clerk 42 notifies the office manager. The office manager personally inspects the details of each instance of nonpayment. The office manager converts insurance claims that have been rejecte by insurance companies into patient receivables. Clerk *2 records these patient receivables on clerk \# 2 's PC and deletes these receivables from the applicable insurance companies. Clerk \# 2 deletes the patient receivables that appear to be uncollectible from clerk \$2's PC when authorized by the office manager. Clerk $2 prepares a list of patients with uncollectible balances and gives a copy of the list to cierk $3, who will not allow these patients to make appointments for future services. Once a month, an outside accountant posts clerk \#2's dauly revenue summaries to the general ledger, prepares a monthly trial balanc and monthly financial statements, accounts for prenumbered service slips, files payroll forms and tax returns, and reconciles the monthly bank statements to the general ledger. This accountant reports directly to the physician who is the managing partner. All four clerical employees perform their tasks on PCs that are connected through a local area network. Each PC is accessible with a password that is known only to the individual employee and the managing parther. Southwest uses a standard software package that was acquired from a software company and that cannot be modified by Southwest's employees. None of the clerical employees are able to write checks on the company's account. For each of the following conditions, indicate whether they represent an internal control "strength" or "deficiency" If the condition is not an internal strength or deficiency, respond that the condition is "neither