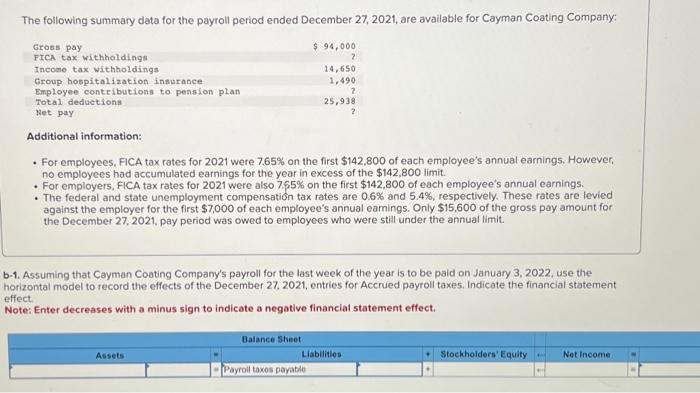

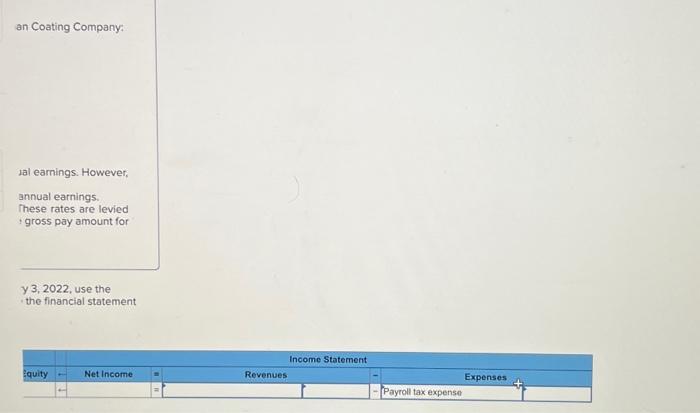

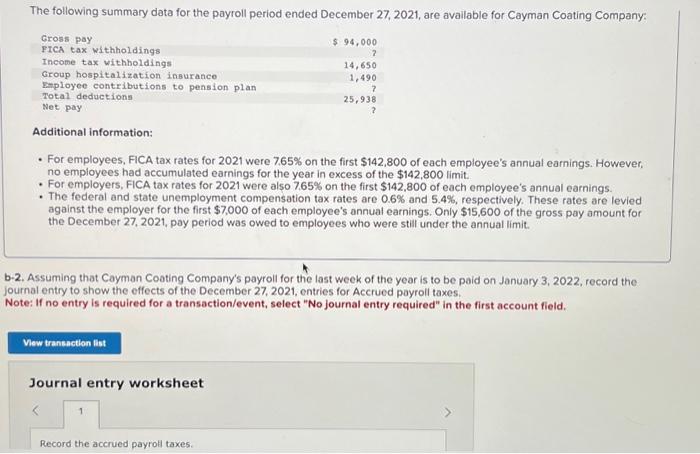

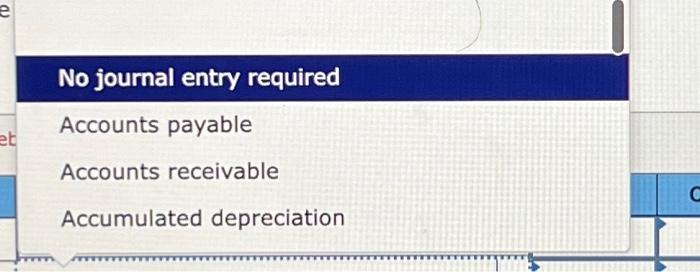

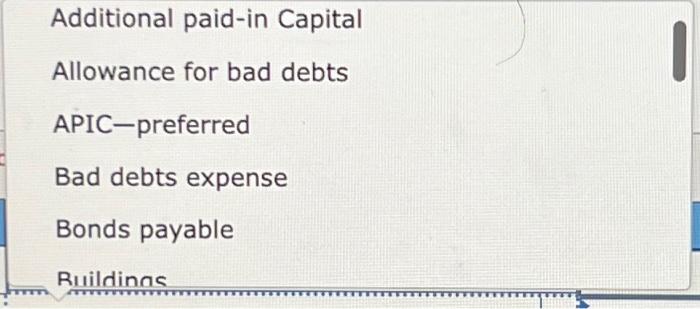

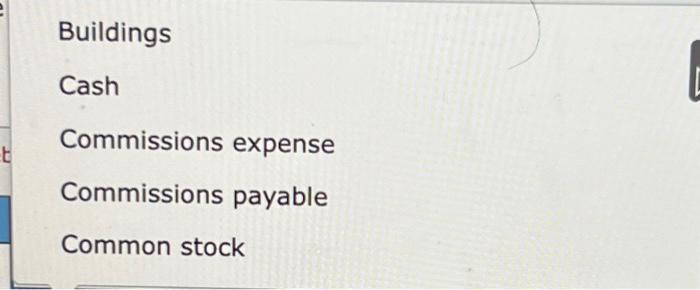

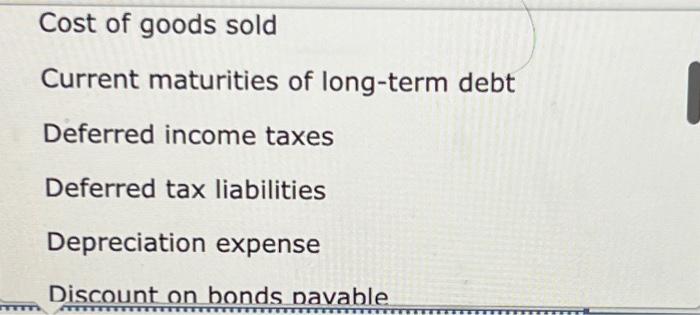

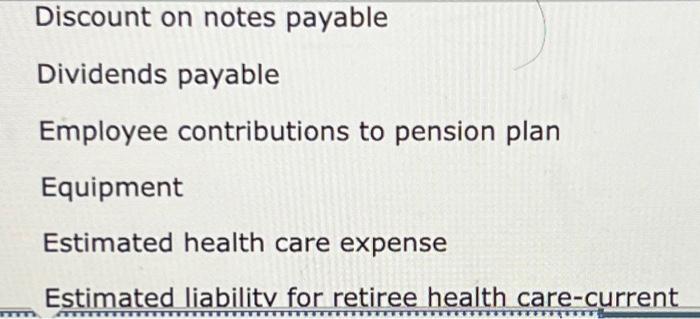

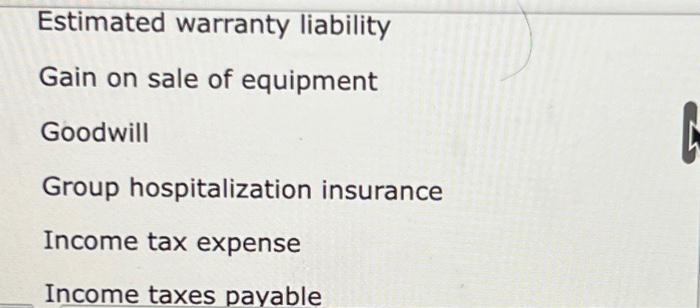

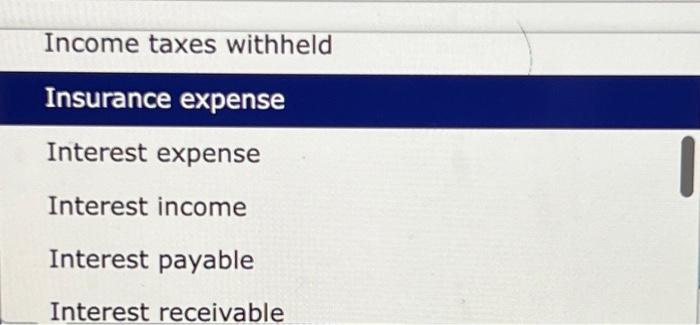

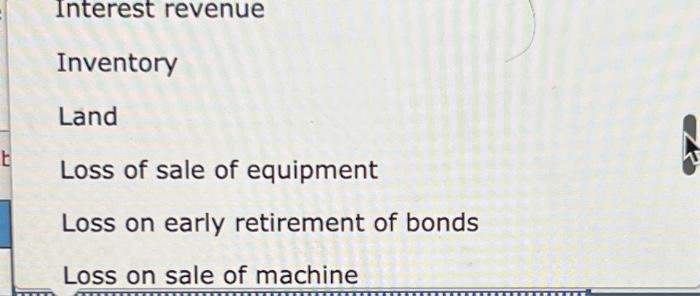

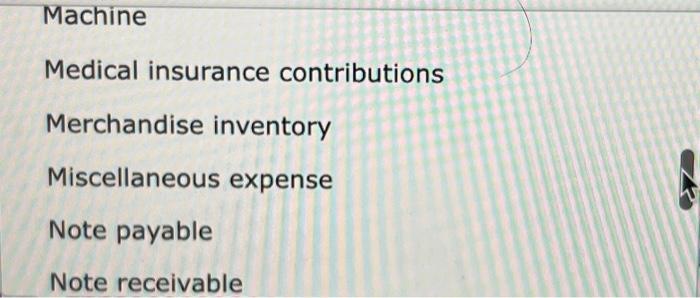

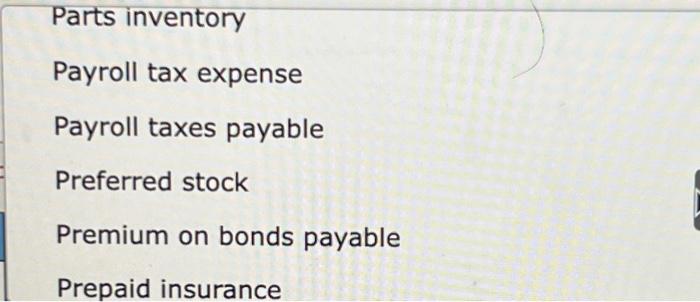

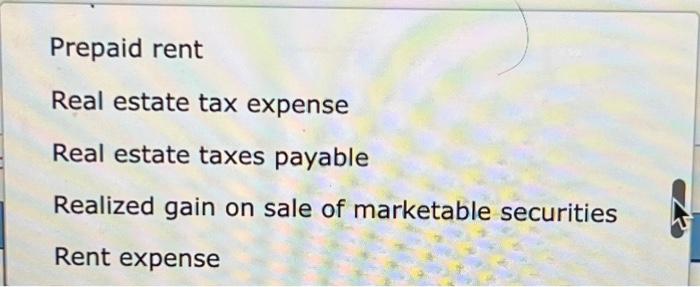

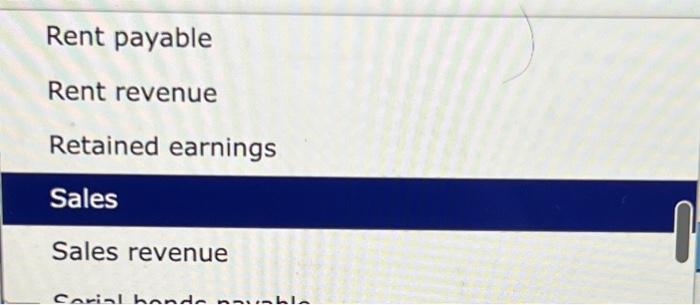

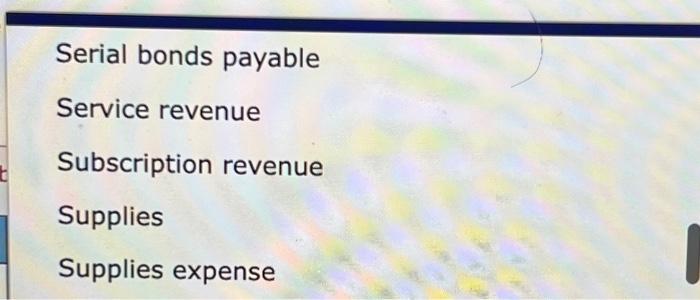

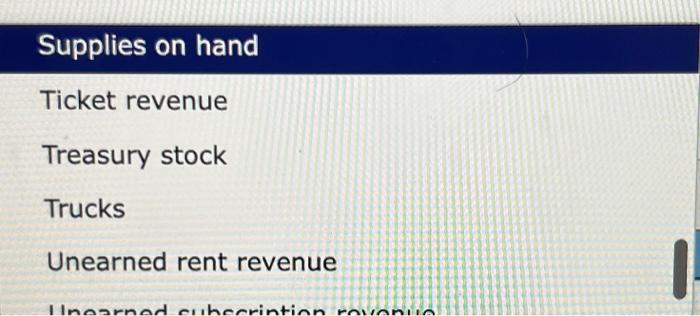

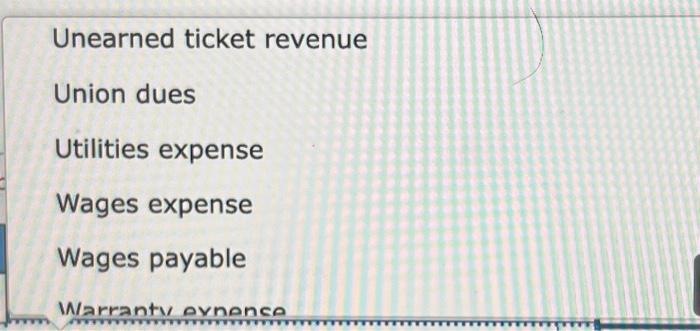

The following summary data for the payroll period ended December 27, 2021, are available for Cayman Coating Company: Additional information: - For employees, FICA tax rates for 2021 were 7.65% on the first $142,800 of each employee's annual earnings. However, no employees had accumulated earnings for the year in excess of the $142,800 limit. - For employers, FiCA tax rates for 2021 were also 7.55% on the first $142,800 of each employee's annual earnings. - The federal and state unemployment compensation tax rates are 0.6% and 5.4%, respectively. These rates are lovied against the employer for the first $7,000 of each employee's annual earnings. Only $15,600 of the gross pay amount for the December 27,2021 , pay period was owed to employees who were stil under the annual limit. -1. Assuming that Cayman Coating Company's payroll for the last week of the year is to be paid on January 3, 2022, use the orizontal model to record the effects of the December 27, 2021, entries for Accrued payroll taxes. Indicate the financial statement effect. Vote: Enter decreases with a minus sign to indicate a negative financial statement effect. sal earnings. However, annual earnings. These rates are levied : gross pay amount for y 3,2022 , use the the financial statement The following summary data for the payroll period ended December 27,2021 , are avallable for Cayman Coating Company: Additional information: - For employees, FiCA tax rates for 2021 were 7.65% on the first $142,800 of each employee's annual earnings. However, no employees had accumulated earnings for the year in excess of the $142,800 limit. - For employers, FICA tax rates for 2021 were also 7.65% on the first $142,800 of each employee's annual earnings. - The federal and state unemployment compensation tax rates are 0.6% and 5.4%, respectively. These rates are levied against the employer for the first $7,000 of each employee's annual earnings. Only $15,600 of the gross pay amount for the December 27, 2021, pay period was owed to employees who were still under the annual limit. b-2. Assuming that Cayman Coating Company's payroll for the last week of the year is to be paid on January 3, 2022, record the ournal entry to show the effects of the December 27, 2021, entries for Accrued payroll taxes. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the accrued payroll taxes. No journal entry required Accounts payable Accounts receivable Accumulated depreciation Additional paid-in Capital Allowance for bad debts APIC-preferred Bad debts expense Bonds payable Buildings Cash Commissions expense Commissions payable Common stock Cost of goods sold Current maturities of long-term debt Deferred income taxes Deferred tax liabilities Depreciation expense Discount on bonds navable Discount on notes payable Dividends payable Employee contributions to pension plan Equipment Estimated health care expense Estimated warranty liability Gain on sale of equipment Goodwill Group hospitalization insurance Income tax expense Income taxes payable Income taxes withheld Insurance expense Interest expense Interest income Interest payable Interest receivable Interest revenue Inventory Land Loss of sale of equipment Loss on early retirement of bonds Loss on sale of machine Machine Medical insurance contributions Merchandise inventory Miscellaneous expense Note payable Note receivable Parts inventory Payroll tax expense Payroll taxes payable Preferred stock Premium on bonds payable Prepaid insurance Prepaid rent Real estate tax expense Real estate taxes payable Realized gain on sale of marketable securities Rent expense Rent payable Rent revenue Retained earnings Sales Sales revenue Serial bonds payable Service revenue Subscription revenue Supplies Supplies expense Supplies on hand Ticket revenue Treasury stock Trucks Unearned rent revenue Unearned ticket revenue Union dues Utilities expense Wages expense Wages payable Warranty evnonco Union dues Utilities expense Wages expense Wages payable Warranty expense