Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer Choices: Wholesale Division:10.12%, 9.24%, 8.80%, 3.96% Marketing Division: 14.80%, 16.15%, 17.30%, 15.75% Retail Division:16.75%, 15.55%, 16.85%, 7.52% Answer Choices: 13.65%, 15.55%, 10.80%, 12.10% Divisional

Answer Choices:

Answer Choices:

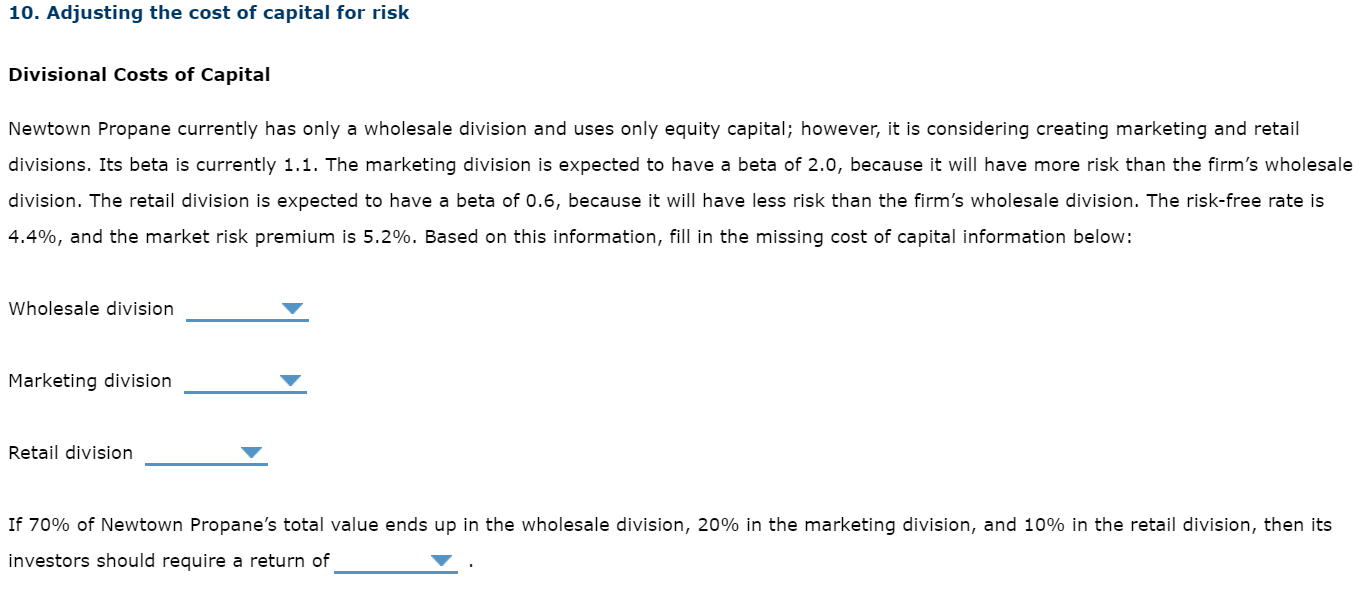

Wholesale Division:10.12%, 9.24%, 8.80%, 3.96%

Marketing Division: 14.80%, 16.15%, 17.30%, 15.75%

Retail Division:16.75%, 15.55%, 16.85%, 7.52%

Answer Choices:

Answer Choices:

13.65%, 15.55%, 10.80%, 12.10%

Divisional Costs of Capital Newtown Propane currently has only a wholesale division and uses only equity capital; however, it is considering creating marketing and retail division. The retail division is expected to have a beta of 0.6, because it will have less risk than the firm. 4.4%, and the market risk premium is 5.2%. Based on this information, fill in the missing cost of capital information below: Wholesale division Marketing division Retail division If 70% of Newtown Propane's total value ends up in the wholesale division, 20% in the marketing division, and 10% in the retail division, then investors should require a return of If 70% of Newtown Propane's total value ends up in the wholesale division, 20% in the marketing division, and 10% in the retail division, then its investors should require a return ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started