Answer completely &show work.

Use question six but ONLY ANSWER #7

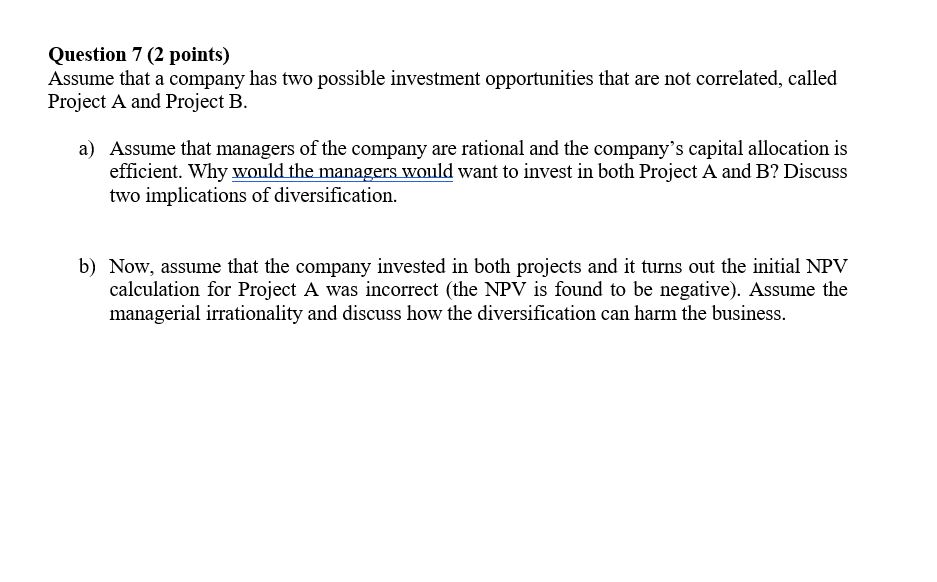

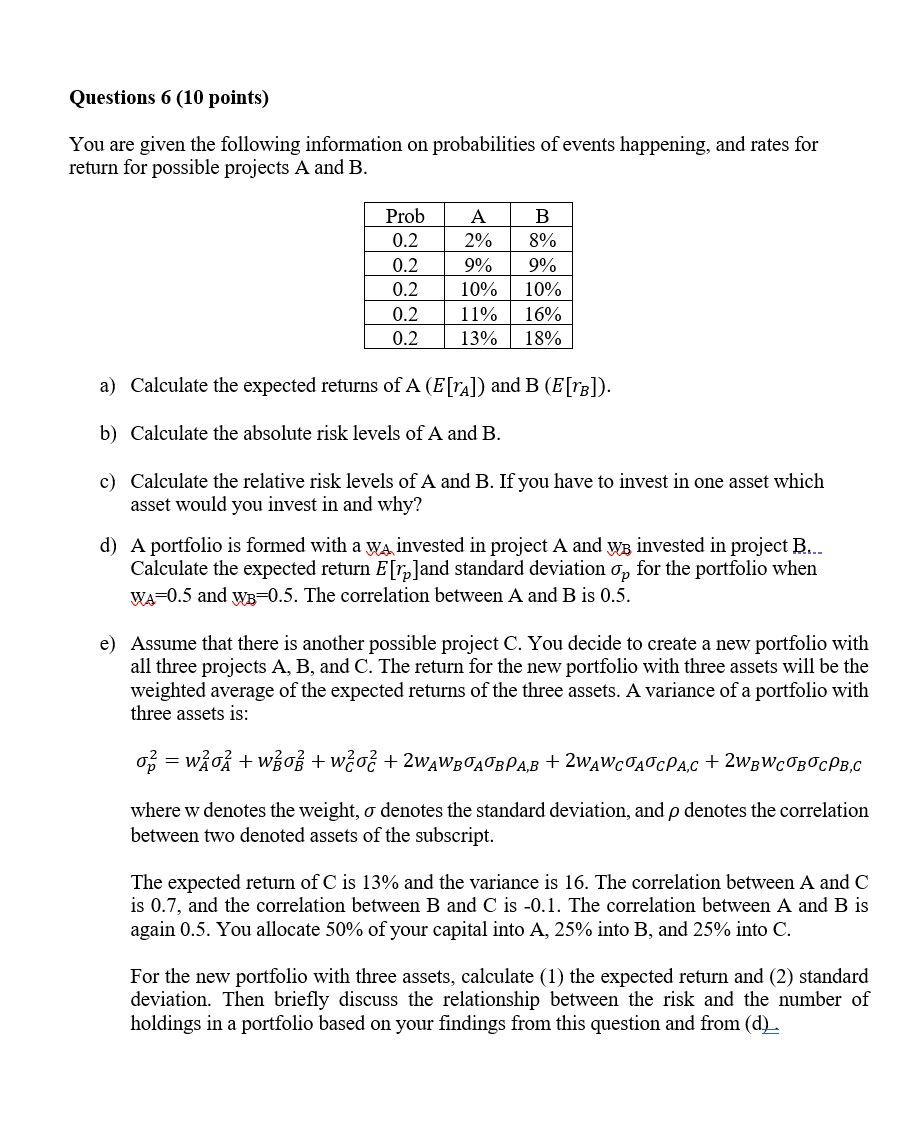

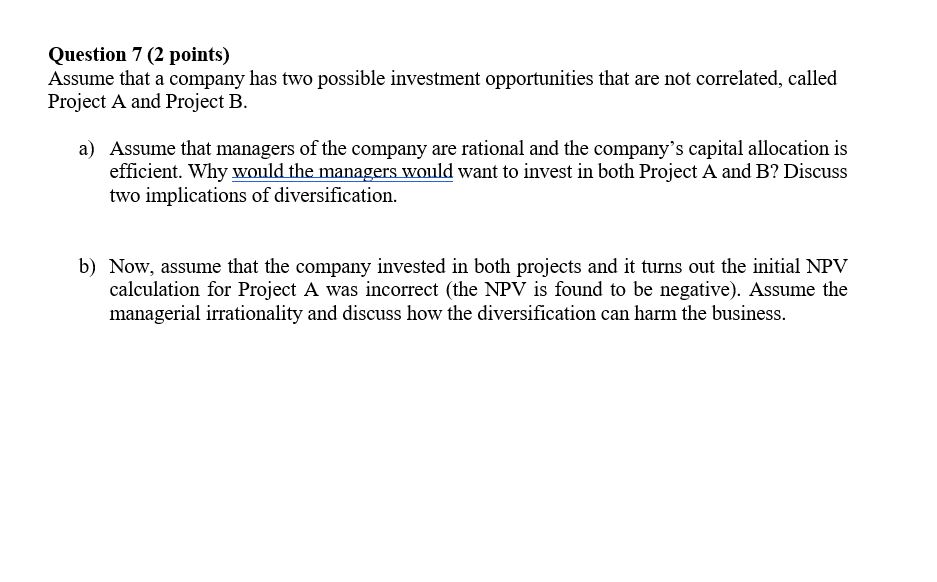

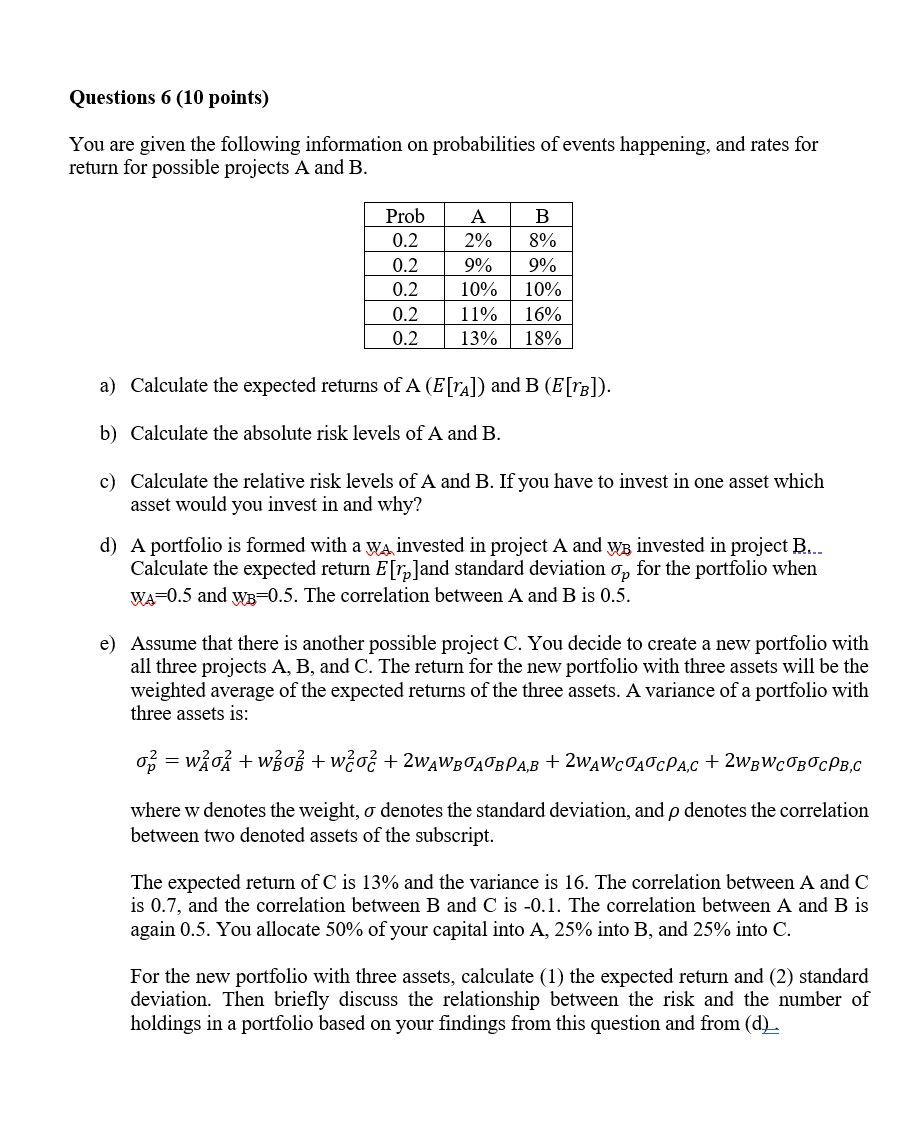

Question 7 (2 points) Assume that a company has two possible investment opportunities that are not correlated, called Project A and Project B. a) Assume that managers of the company are rational and the company's capital allocation is efficient. Why would the managers would want to invest in both Project A and B? Discuss two implications of diversification. b) Now, assume that the company invested in both projects and it turns out the initial NPV calculation for Project A was incorrect (the NPV is found to be negative). Assume the managerial irrationality and discuss how the diversification can harm the business. Questions 6 (10 points) You are given the following information on probabilities of events happening, and rates for return for possible projects A and B. Prob 0. 2 0. 2 0.2 0.2 0.2 A 2 % 9 % 10% 11% 13% B 8% 9% 10% 16% 18% a) Calculate the expected returns of A (E[rA]) and B (E[/B]). b) Calculate the absolute risk levels of A and B. c) Calculate the relative risk levels of A and B. If you have to invest in one asset which asset would you invest in and why? d) A portfolio is formed with a wa invested in project A and WB invested in project B... Calculate the expected return E[rp]and standard deviation on for the portfolio when Wa=0.5 and WB=0.5. The correlation between A and B is 0.5. e) Assume that there is another possible project C. You decide to create a new portfolio with all three projects A, B, and C. The return for the new portfolio with three assets will be the weighted average of the expected returns of the three assets. A variance of a portfolio with three assets is: 0 = wO + wo + wzoa + 2WAWBOAOBPAB+ 2WAWCA OCPAC + 2wBWCOBOCPB,C where w denotes the weight, o denotes the standard deviation, and p denotes the correlation between two denoted assets of the subscript. The expected return of C is 13% and the variance is 16. The correlation between A and C is 0.7, and the correlation between B and C is -0.1. The correlation between A and B is again 0.5. You allocate 50% of your capital into A, 25% into B, and 25% into C. For the new portfolio with three assets, calculate (1) the expected return and (2) standard deviation. Then briefly discuss the relationship between the risk and the number of holdings in a portfolio based on your findings from this question and from (d) Question 7 (2 points) Assume that a company has two possible investment opportunities that are not correlated, called Project A and Project B. a) Assume that managers of the company are rational and the company's capital allocation is efficient. Why would the managers would want to invest in both Project A and B? Discuss two implications of diversification. b) Now, assume that the company invested in both projects and it turns out the initial NPV calculation for Project A was incorrect (the NPV is found to be negative). Assume the managerial irrationality and discuss how the diversification can harm the business. Questions 6 (10 points) You are given the following information on probabilities of events happening, and rates for return for possible projects A and B. Prob 0. 2 0. 2 0.2 0.2 0.2 A 2 % 9 % 10% 11% 13% B 8% 9% 10% 16% 18% a) Calculate the expected returns of A (E[rA]) and B (E[/B]). b) Calculate the absolute risk levels of A and B. c) Calculate the relative risk levels of A and B. If you have to invest in one asset which asset would you invest in and why? d) A portfolio is formed with a wa invested in project A and WB invested in project B... Calculate the expected return E[rp]and standard deviation on for the portfolio when Wa=0.5 and WB=0.5. The correlation between A and B is 0.5. e) Assume that there is another possible project C. You decide to create a new portfolio with all three projects A, B, and C. The return for the new portfolio with three assets will be the weighted average of the expected returns of the three assets. A variance of a portfolio with three assets is: 0 = wO + wo + wzoa + 2WAWBOAOBPAB+ 2WAWCA OCPAC + 2wBWCOBOCPB,C where w denotes the weight, o denotes the standard deviation, and p denotes the correlation between two denoted assets of the subscript. The expected return of C is 13% and the variance is 16. The correlation between A and C is 0.7, and the correlation between B and C is -0.1. The correlation between A and B is again 0.5. You allocate 50% of your capital into A, 25% into B, and 25% into C. For the new portfolio with three assets, calculate (1) the expected return and (2) standard deviation. Then briefly discuss the relationship between the risk and the number of holdings in a portfolio based on your findings from this question and from (d)