Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer correclty for upvote and feedback . its just one long question Ute yahoo finance to find information for the common stock of Walt Disney

Answer correclty for upvote and feedback . its just one long question

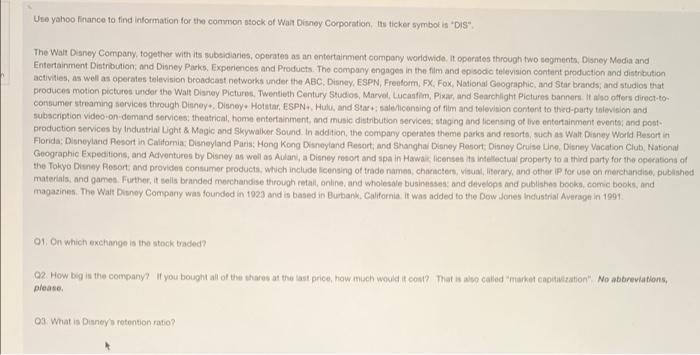

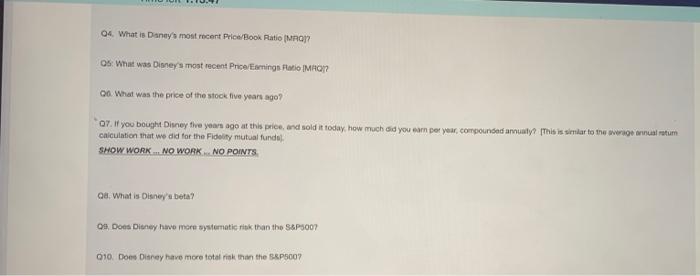

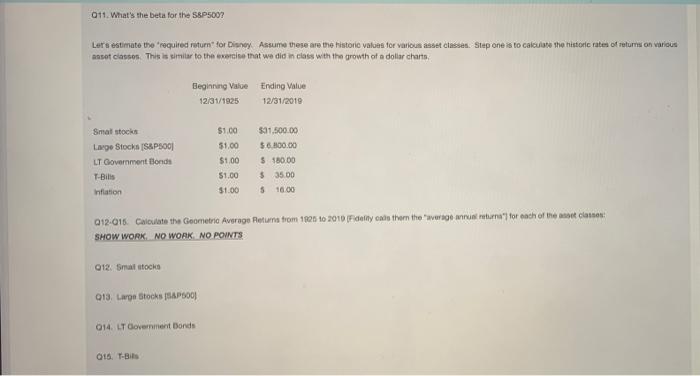

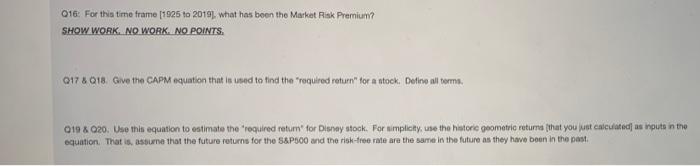

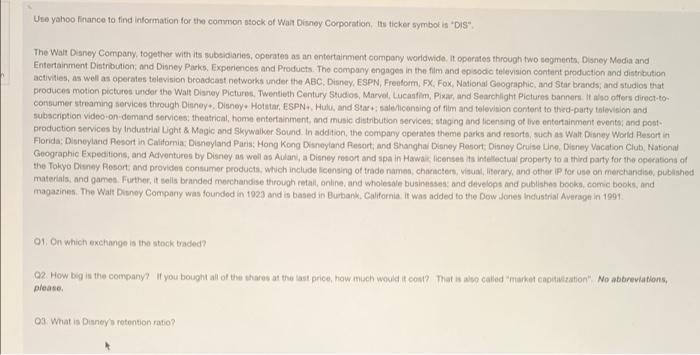

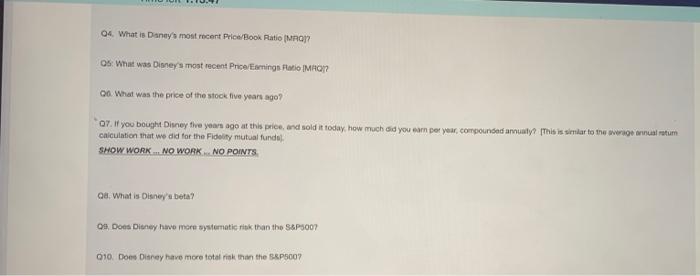

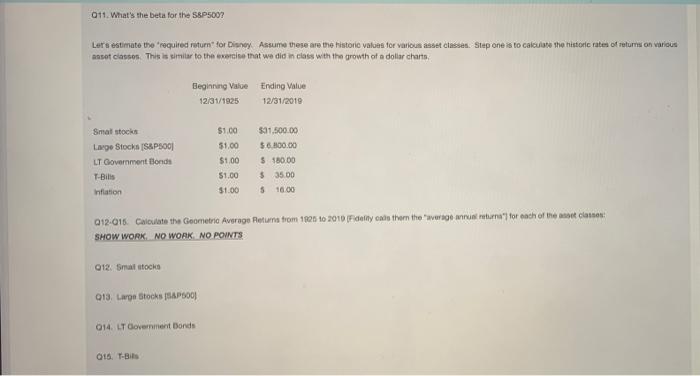

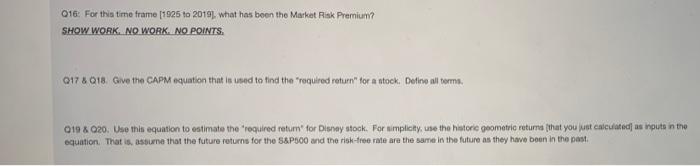

Ute yahoo finance to find information for the common stock of Walt Disney Corporation. Its ticker symbol is 'Dis", The Walt Disney Company, together with its subsidiaries, operates as an entertainment company worldwide. It operates through two segments, Disney Media and Entertainment Distribution and Disney Parks. Experiences and Products. The company engages in the film and episodio television content production and distribution activities, as well as operates television broadcast networks under the ABC, Disney, ESPN, Freeform, FX Fox, National Geographic, and Star brands and studios that produces motion pictures under the Walt Disney Pictures, Twentieth Century Studios, Marvel Lucanim, Pixar, and Searchlight Pictures banners. It to offers direct to consumer streaming services through Disney Disney Hotstar, ESPNHulu, and Staal licensing of film and television content to thed-party tolevision and subscription video on demand services, theatrical, home entertainment, and music distribution services staging and licensing of live entertainment events and post- production services by Industrial Light & Magic and Skywalker Sound. In addition, the company operates theme parks and resorto, such as Walt Disney World Resort in Florida: Disneyland Resort in California Disneyland Paris Hong Kong Disneyland Resort and Shanghai Daney Resort Disney Cruise Uno, Disney Vacation Club, National Geographic Expeditions, and Adventures by Disney as well as Aulani, a Disney resort and spa in Hawa loose its intellectual property to a third party for the operations of the Tokyo Disney Resort and provides consumer products, which include licensing of trade namen, characters, Vit, terwy, and other for use on merchandise published materials and games. Further, it sells branded merchandise through retail, online, and wholesale businesses and develops and publish books, comic books, and magazines. The Walt Disney Company was founded in 1923 and is based in Burbank. California. It was added to the Dow Jones Industrial Average in 1991 01 on which exchange is the stock traded? 02. How big is the company? If you bought all of the shares at the last price, how much would com? That is also called market cotization" No abbreviations, please 03 What is Duneyrotention ratio? 04. What is Danay's most recent ProBook Ratio (MRON osWhat was Disney's most recent Price Earnings Ratio Mon 00. What was the price of the stock five years ago? 07. # you bought Disney the years ago at this price and sold it today, how much did you earn per year, compounidad amusly? This is similar to the average wnual ratum calculation that we did for the Fidelity mutual funds SHOW WORK... NO WORK.NO POINTS 08. What is Disney'a bota? Os, Dots Disney have more systematic risk than the S&P5007 010. Don Disney have more total risk than the S&P5007 011. What's the beta for the S&P500? Lars estimate the required return for Disney Assume these are the historic values for various asset classes. Step ones to calculate the historic rates of returns on various nosot Clason This is similar to the exercise that we did in class with the growth of a dollar charts Beginning Value Ending Value 12/31/1925 12/31/2010 $1.00 31.00 Smal stocks Large Stocks S&P500 LT Government Blonde T-Bilis Inflation $1.00 $1.00 $1.00 $11.500.00 56.800.00 $180.00 $ 35.00 5 16.00 012-016. Calculate the Geometric Average Return trom 1925 to 2010 Fidelnycal them the "wwage anrus returne" tor each of the weet clainen: SHOW WORK NO WORK NO POINTS 012. Smal stock Q13. Laron Stock APO 014. LT Government Bords 015. T-Bits 016: For this time frame (1925 to 2019), what has been the Market Risk Premium? SHOW WORK. NO WORK. NO POINTS. 0178018. Give the CAPM equation that is used to find the required return" tor a stock. Detine all terms, 019 & 020. Use this equation to estimate the required return for Disney stock. For ampliaty, use the historie geometric returns that you just calculated as put in the equation. That is, assume that the future returns for the S&P500 and the risk-free rate are the same in the future as they have been in the past Ute yahoo finance to find information for the common stock of Walt Disney Corporation. Its ticker symbol is 'Dis", The Walt Disney Company, together with its subsidiaries, operates as an entertainment company worldwide. It operates through two segments, Disney Media and Entertainment Distribution and Disney Parks. Experiences and Products. The company engages in the film and episodio television content production and distribution activities, as well as operates television broadcast networks under the ABC, Disney, ESPN, Freeform, FX Fox, National Geographic, and Star brands and studios that produces motion pictures under the Walt Disney Pictures, Twentieth Century Studios, Marvel Lucanim, Pixar, and Searchlight Pictures banners. It to offers direct to consumer streaming services through Disney Disney Hotstar, ESPNHulu, and Staal licensing of film and television content to thed-party tolevision and subscription video on demand services, theatrical, home entertainment, and music distribution services staging and licensing of live entertainment events and post- production services by Industrial Light & Magic and Skywalker Sound. In addition, the company operates theme parks and resorto, such as Walt Disney World Resort in Florida: Disneyland Resort in California Disneyland Paris Hong Kong Disneyland Resort and Shanghai Daney Resort Disney Cruise Uno, Disney Vacation Club, National Geographic Expeditions, and Adventures by Disney as well as Aulani, a Disney resort and spa in Hawa loose its intellectual property to a third party for the operations of the Tokyo Disney Resort and provides consumer products, which include licensing of trade namen, characters, Vit, terwy, and other for use on merchandise published materials and games. Further, it sells branded merchandise through retail, online, and wholesale businesses and develops and publish books, comic books, and magazines. The Walt Disney Company was founded in 1923 and is based in Burbank. California. It was added to the Dow Jones Industrial Average in 1991 01 on which exchange is the stock traded? 02. How big is the company? If you bought all of the shares at the last price, how much would com? That is also called market cotization" No abbreviations, please 03 What is Duneyrotention ratio? 04. What is Danay's most recent ProBook Ratio (MRON osWhat was Disney's most recent Price Earnings Ratio Mon 00. What was the price of the stock five years ago? 07. # you bought Disney the years ago at this price and sold it today, how much did you earn per year, compounidad amusly? This is similar to the average wnual ratum calculation that we did for the Fidelity mutual funds SHOW WORK... NO WORK.NO POINTS 08. What is Disney'a bota? Os, Dots Disney have more systematic risk than the S&P5007 010. Don Disney have more total risk than the S&P5007 011. What's the beta for the S&P500? Lars estimate the required return for Disney Assume these are the historic values for various asset classes. Step ones to calculate the historic rates of returns on various nosot Clason This is similar to the exercise that we did in class with the growth of a dollar charts Beginning Value Ending Value 12/31/1925 12/31/2010 $1.00 31.00 Smal stocks Large Stocks S&P500 LT Government Blonde T-Bilis Inflation $1.00 $1.00 $1.00 $11.500.00 56.800.00 $180.00 $ 35.00 5 16.00 012-016. Calculate the Geometric Average Return trom 1925 to 2010 Fidelnycal them the "wwage anrus returne" tor each of the weet clainen: SHOW WORK NO WORK NO POINTS 012. Smal stock Q13. Laron Stock APO 014. LT Government Bords 015. T-Bits 016: For this time frame (1925 to 2019), what has been the Market Risk Premium? SHOW WORK. NO WORK. NO POINTS. 0178018. Give the CAPM equation that is used to find the required return" tor a stock. Detine all terms, 019 & 020. Use this equation to estimate the required return for Disney stock. For ampliaty, use the historie geometric returns that you just calculated as put in the equation. That is, assume that the future returns for the S&P500 and the risk-free rate are the same in the future as they have been in the past

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started