ANSWER CORRECTLY AND WITH FULL ANSWER

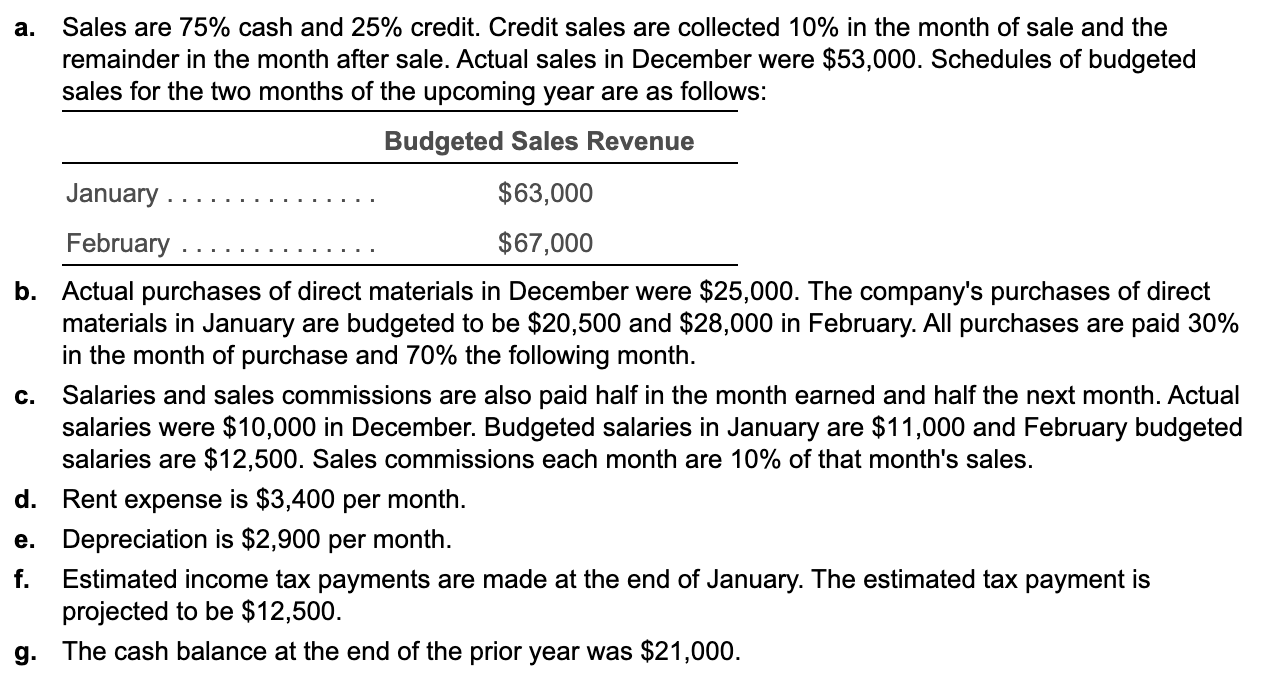

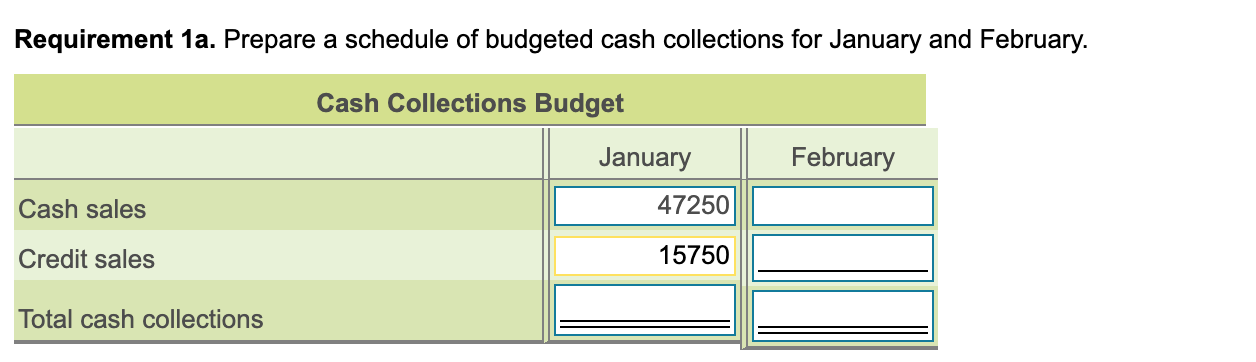

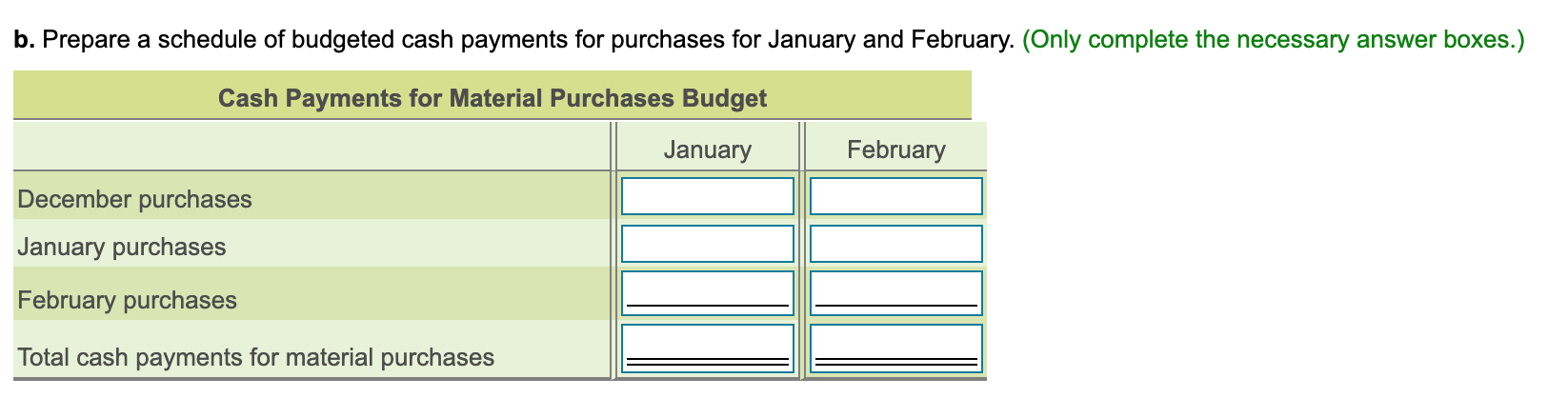

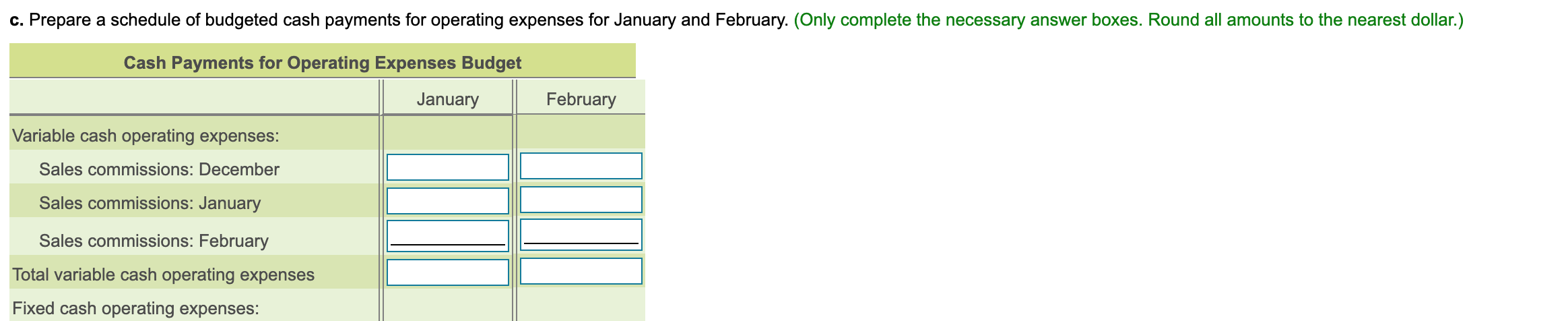

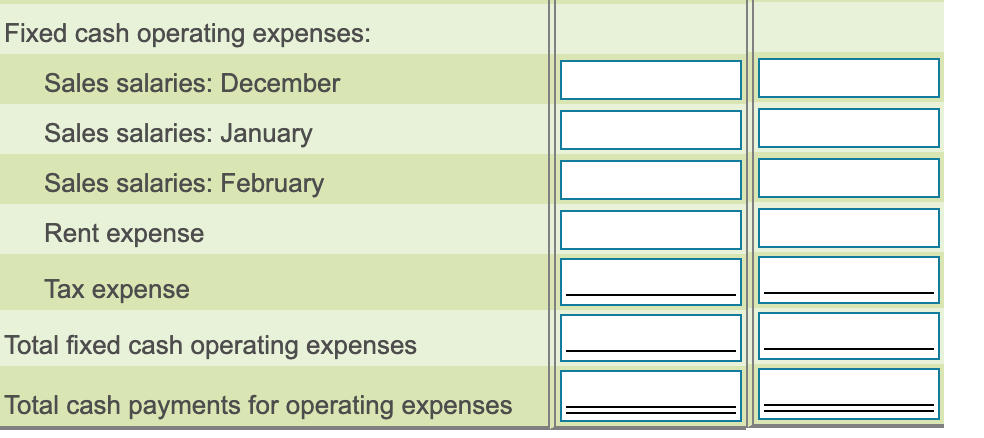

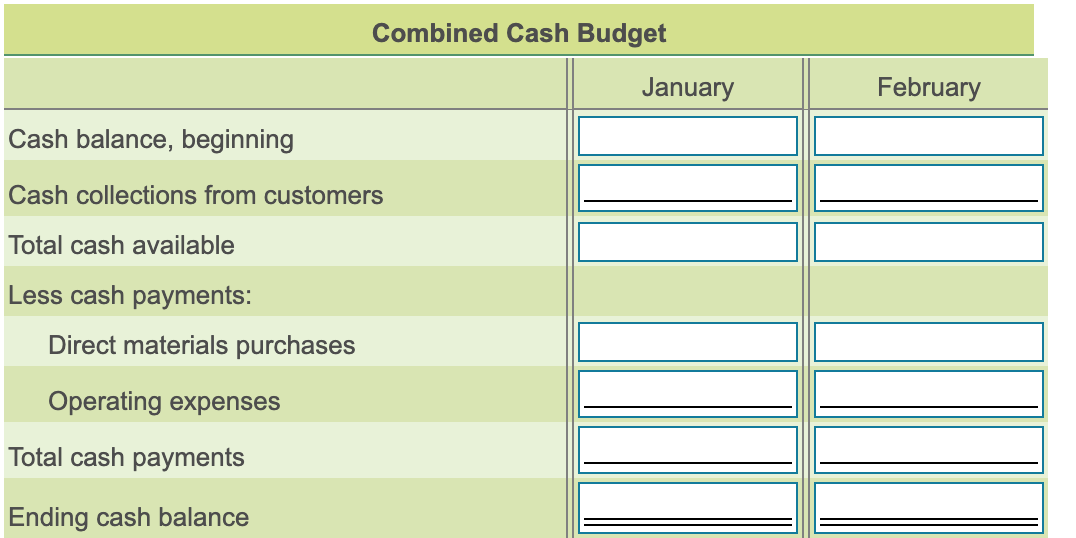

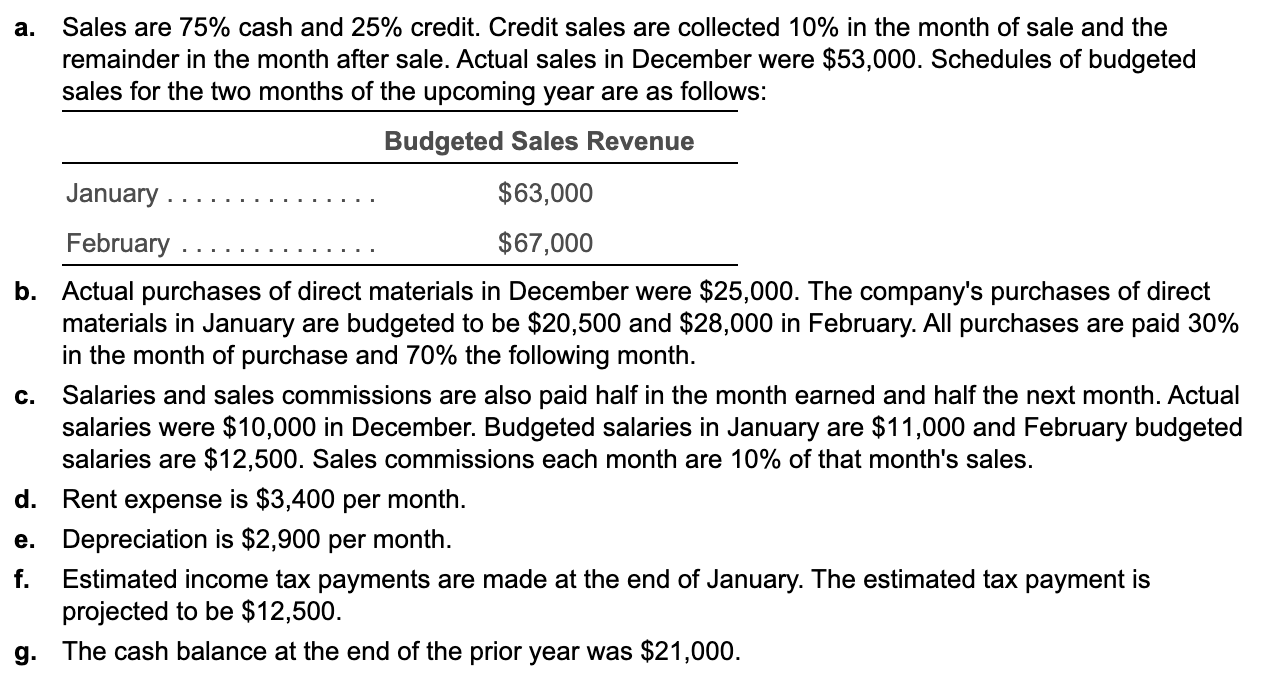

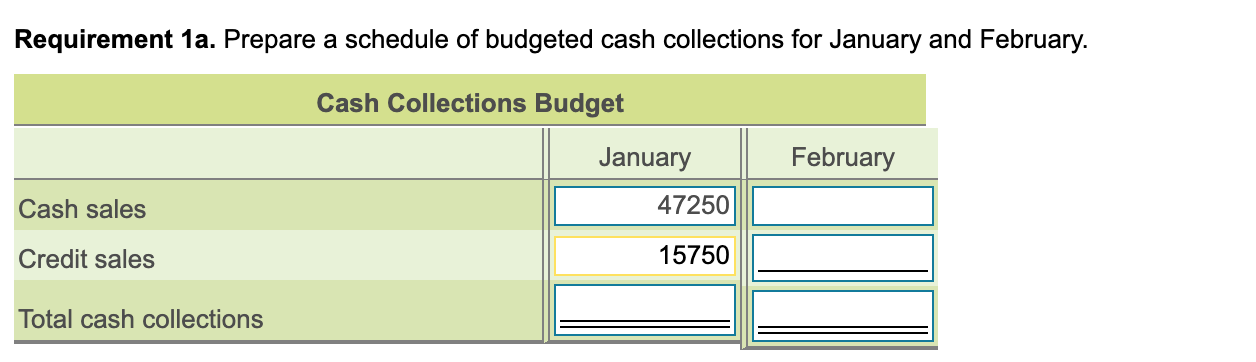

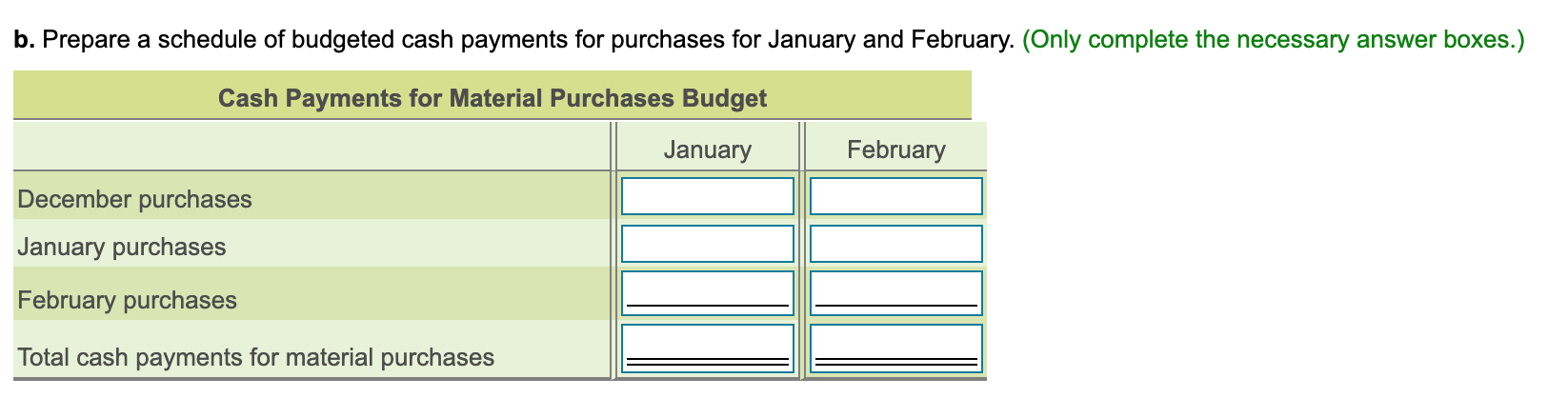

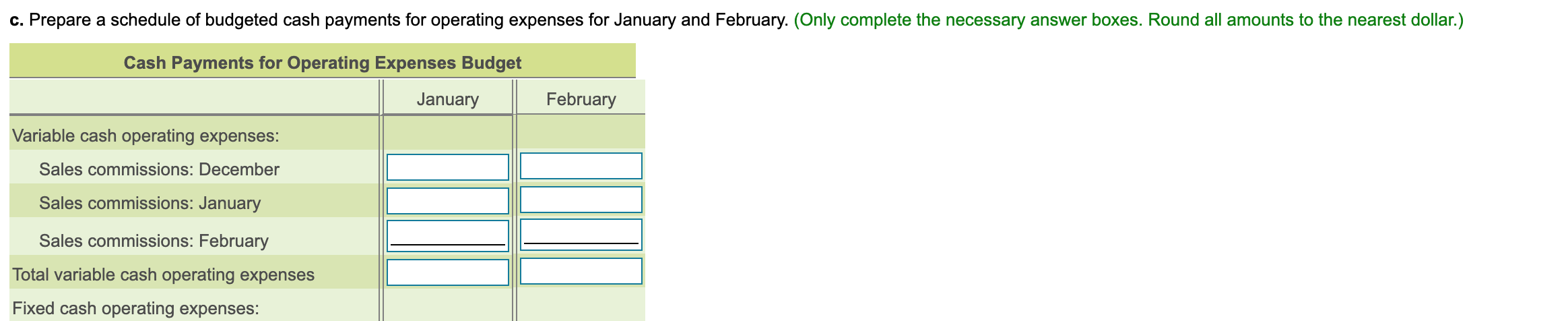

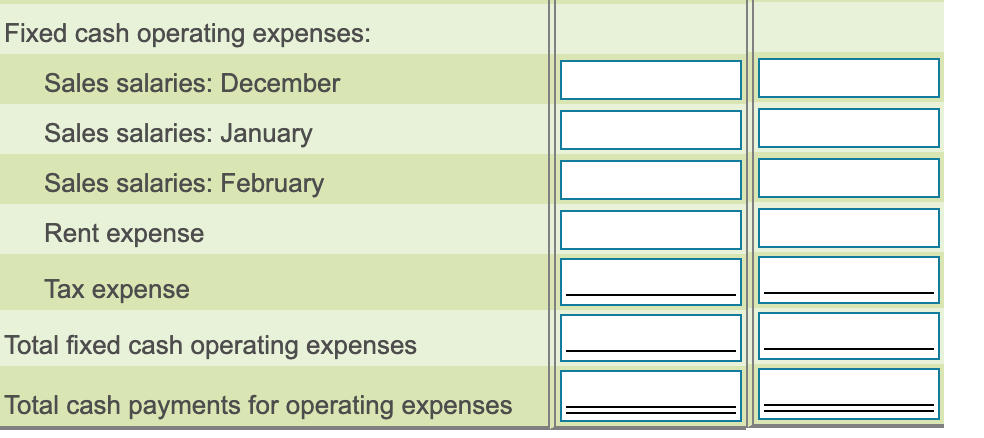

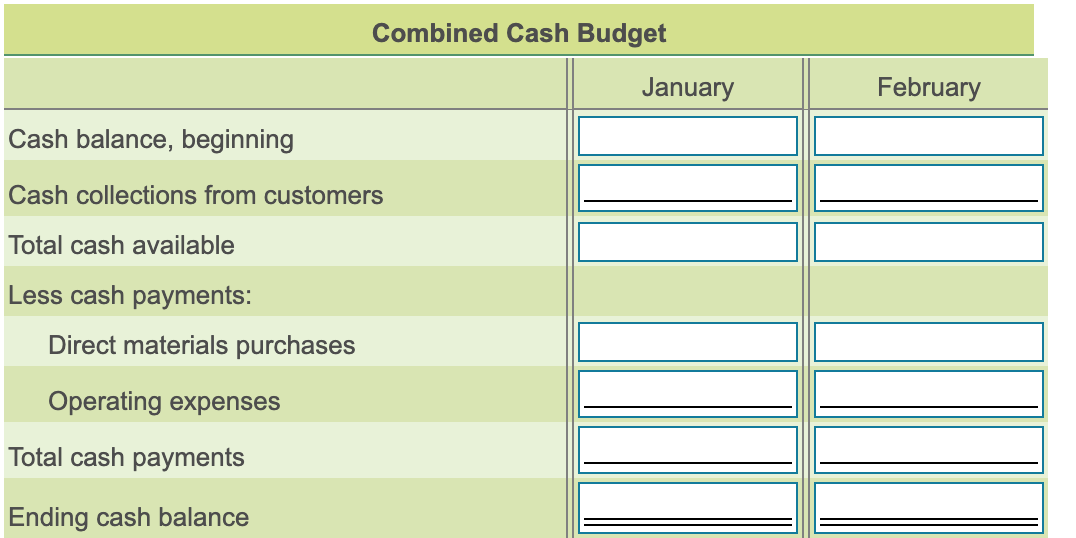

Sales are 75% cash and 25% credit. Credit sales are collected 10% in the month of sale and the remainder in the month after sale. Actual sales in December were $53,000. Schedules of budgeted sales for the two months of the upcoming year are as follows: Budgeted Sales Revenue January ...... $63,000 February .............. $67,000 b. Actual purchases of direct materials in December were $25,000. The company's purchases of direct materials in January are budgeted to be $20,500 and $28,000 in February. All purchases are paid 30% in the month of purchase and 70% the following month. Salaries and sales commissions are also paid half in the month earned and half the next month. Actual salaries were $10,000 in December. Budgeted salaries in January are $11,000 and February budgeted salaries are $12,500. Sales commissions each month are 10% of that month's sales. d. Rent expense is $3,400 per month. e. Depreciation is $2,900 per month. f. Estimated income tax payments are made at the end of January. The estimated tax payment is projected to be $12,500. g. The cash balance at the end of the prior year was $21,000. Requirement 1a. Prepare a schedule of budgeted cash collections for January and February. Cash Collections Budget January February Cash sales 47250 Credit sales 15750 Total cash collections b. Prepare a schedule of budgeted cash payments for purchases for January and February. (Only complete the necessary answer boxes.) Cash Payments for Material Purchases Budget January February December purchases January purchases February purchases Total cash payments for material purchases c. Prepare a schedule of budgeted cash payments for operating expenses for January and February. (Only complete the necessary answer boxes. Round all amounts to the nearest dollar.) Cash Payments for Operating Expenses Budget January February Variable cash operating expenses: Sales commissions: December Sales commissions: January Sales commissions: February Total variable cash operating expenses Fixed cash operating expenses: Fixed cash operating expenses: Sales salaries: December Sales salaries: January Sales salaries: February Rent expense Tax expense Total fixed cash operating expenses Total cash payments for operating expenses Combined Cash Budget January February Cash balance, beginning Cash collections from customers Total cash available Less cash payments: Direct materials purchases Operating expenses Total cash payments Ending cash balance