Answered step by step

Verified Expert Solution

Question

1 Approved Answer

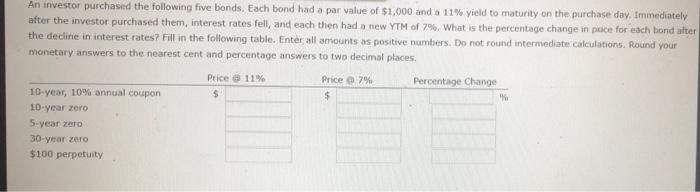

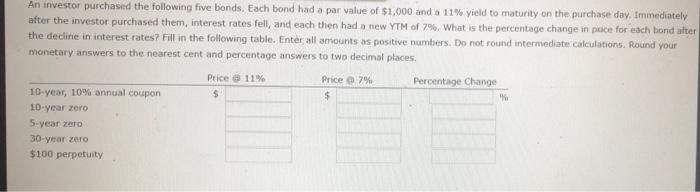

Answer correctyl and quickly for thumbs up! Thanks An investor purchased the following five bonds. Each bond had a par value of $1,000 and a

Answer correctyl and quickly for thumbs up! Thanks

An investor purchased the following five bonds. Each bond had a par value of $1,000 and a 11% yield to maturity on the purchase day. Immediately after the investor purchased them, interest rates fell, and each then had a new YTM of 7%. What is the percentage change in pace for each bondatter the decline in interest rates? Fill in the following table. Enter all amounts as positive numbers. Do not round intermediate calculations. Round your monetary answers to the nearest cent and percentage answers to two decimal places. Price 11% $ Price 7% $ Percentage Change 10 year, 10% annual coupon 10-year zero 5-year zero 30-year zero $100 perpetuity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started