answer d & e please. i got $548,358.17 and it wad incorrect.

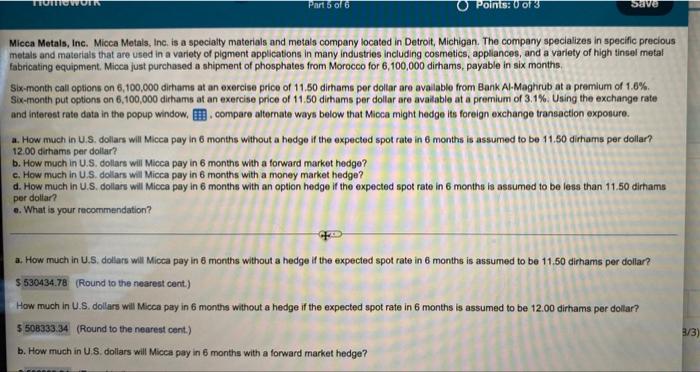

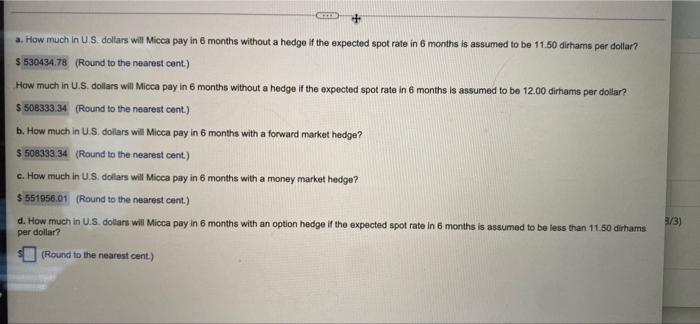

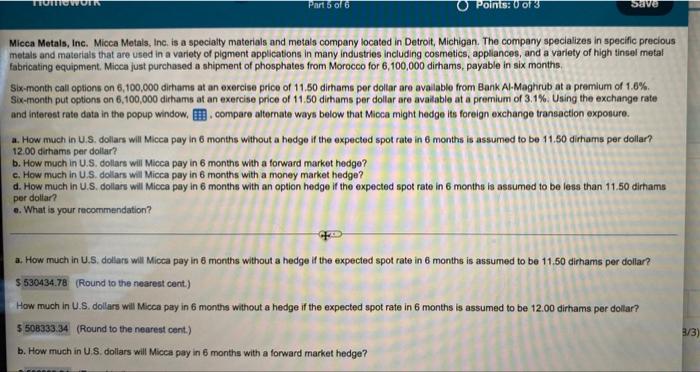

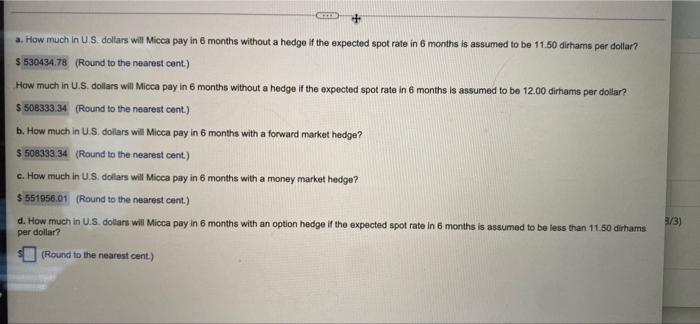

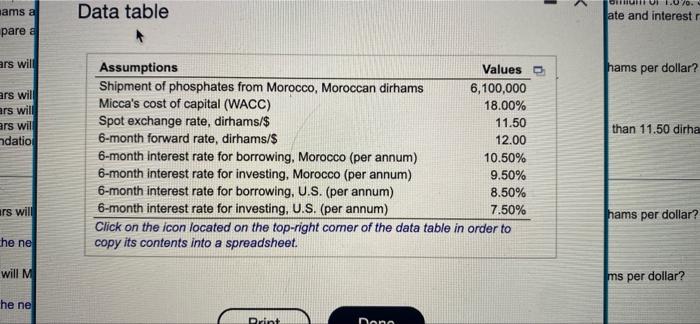

Part 5 of 6 Points: 0 of 3 Save Micca Metals, Inc. Micca Metals, Inc. is a specialty materials and metals company located in Detroit, Michigan. The company specializes in specific precious metals and materials that are used in a variety of pigment applications in many industries including cosmetics, appliances, and a variety of high tinsel metal fabricating equipment. Micca just purchased a shipment of phosphates from Morocco for 6,100,000 dirhams, payable in six months. Six-month call options on 6,100,000 dirhams at an exercise price of 11.50 dirhams per dollar are available from Bank Al-Maghrub at a premium of 1.6%. Six-month put options on 6,100,000 dirhams at an exercise price of 11.50 dirhams per dollar are available at a premium of 3.1%. Using the exchange rate and interest rate data in the popup window, . compare alternate ways below that Micca might hedge its foreign exchange transaction exposure. a. How much in U.S. dollars will Micca pay in 6 months without a hedge if the expected spot rate in 6 months is assumed to be 11.50 dirhams per dollar? 12.00 dirhams per dollar? b. How much in U.S. dollars will Micca pay in 6 months with a forward market hedge? c. How much in U.S. dollars will Micca pay in 6 months with a money market hedge? d. How much in U.S. dollars will Micca pay in 6 months with an option hedge if the expected spot rate in 6 months is assumed to be less than 11.50 dirhams per dollar? e. What is your recommendation? a. How much in U.S. dollars will Micca pay in 6 months without a hedge if the expected spot rate in 6 months is assumed to be 11.50 dirhams per dollar? $530434.78 (Round to the nearest cent.) How much in U.S. dollars will Micca pay in 6 months without a hedge if the expected spot rate in 6 months is assumed to be 12.00 dirhams per dollar? $ 508333.34 (Round to the nearest cent.) b. How much in U.S. dollars will Micca pay in 6 months with a forward market hedge? 3/3) Comb + a. How much in U.S. dollars will Micca pay in 6 months without a hedge if the expected spot rate in 6 months is assumed to be 11.50 dirhams per dollar? $530434.78 (Round to the nearest cent.) How much in U.S. dollars will Micca pay in 6 months without a hedge if the expected spot rate in 6 months is assumed to be 12.00 dirhams per dollar? $508333.34 (Round to the nearest cent.) b. How much in U.S. dollars will Micca pay in 6 months with a forward market hedge? $508333.34 (Round to the nearest cent.) c. How much in U.S. dollars will Micca pay in 6 months with a money market hedge? $551956.01 (Round to the nearest cent.) d. How much in U.S. dollars will Micca pay in 6 months with an option hedge if the expected spot rate in 6 months is assumed to be less than 11.50 dirhams per dollar? (Round to the nearest cent.) 3/3) ams a pare a ars will ars will ars will ars will ndation ars will he ne will M he ne Data table Assumptions Shipment of phosphates from Morocco, Moroccan dirhams Micca's cost of capital (WACC) Spot exchange rate, dirhams/$ 6-month forward rate, dirhams/$ 6-month interest rate for borrowing, Morocco (per annum) 6-month interest rate for investing, Morocco (per annum) 6-month interest rate for borrowing, U.S. (per annum) 6-month interest rate for investing, U.S. (per annum) 10.50% 9.50% 8.50% 7.50% Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Print Values 6,100,000 18.00% 11.50 12.00 Dono 101 1.070. ate and interest r hams per dollar? than 11.50 dirha hams per dollar? ms per dollar