Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer each of the following questions below: i. Who is liable to pay Fringe Benefits Tax? (1 mark) ii. What is the rate at which

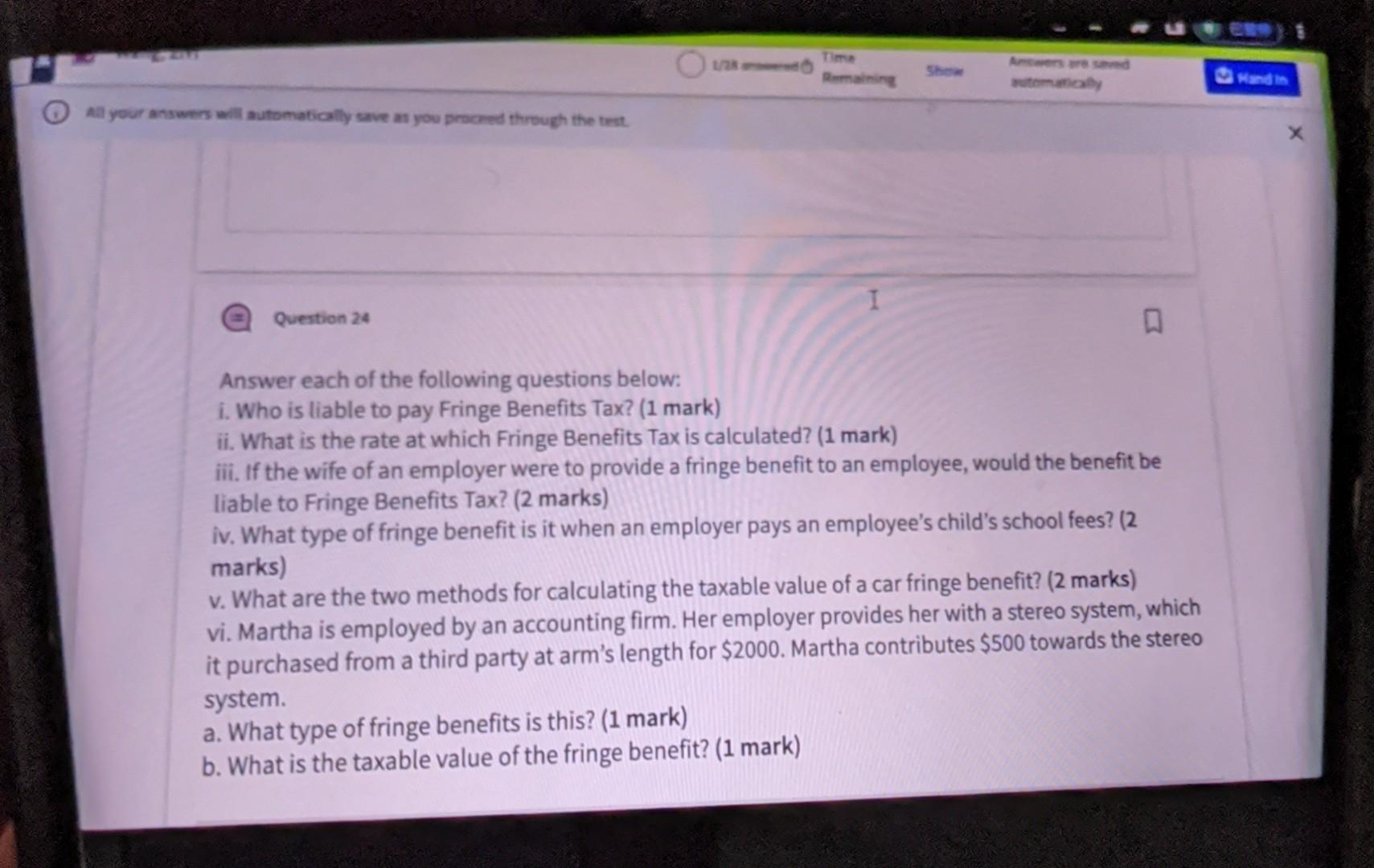

Answer each of the following questions below: i. Who is liable to pay Fringe Benefits Tax? (1 mark) ii. What is the rate at which Fringe Benefits Tax is calculated? (1 mark) iii. If the wife of an employer were to provide a fringe benefit to an employee, would the benefit be liable to Fringe Benefits Tax? (2 marks) iv. What type of fringe benefit is it when an employer pays an employee's child's school fees? (2 marks) v. What are the two methods for calculating the taxable value of a car fringe benefit? (2 marks) vi. Martha is employed by an accounting firm. Her employer provides her with a stereo system, which it purchased from a third party at arm's length for $2000. Martha contributes $500 towards the stereo system. a. What type of fringe benefits is this? (1 mark) b. What is the taxable value of the fringe benefit? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started