Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer each of the following questions for Target 2 0 2 0 annual report Consolidated Statements of Financial Position table [ [ ( millions

Answer each of the following questions for Target annual report Consolidated Statements of Financial Position

tablemillions except footnotestableanuary tableFebruary AssetsCash and cash equivalents,$ $InventoryOther current assets,,Total current assets,,Property and equipmentLandBuildings and improvements,,Fixtures and equipment,,Computer hardware and software,,Constructioninprogress,,Accumulated depreciation,,Property and equipment, net,,Operating lease assets,,Other noncurrent assets,,Total assets,$$Liabilities and shareholders' investmentAccounts payable,$$Accrued and other current liabilities,,Current portion of longterm debt and other borrowings,,Total current liabilities,,Longterm debt and other borrowings,,Noncurrent operating lease liabilities,,Deferred income taxes,,Other noncurrent liabilities,,Total noncurrent liabilities,,Shareholders investmentCommon stock,,Additional paidin capital,,Retained earnings,,Accumulated other comprehensive loss,,Total shareholders' investment,,Total liabilities and shareholders' investment,$ $

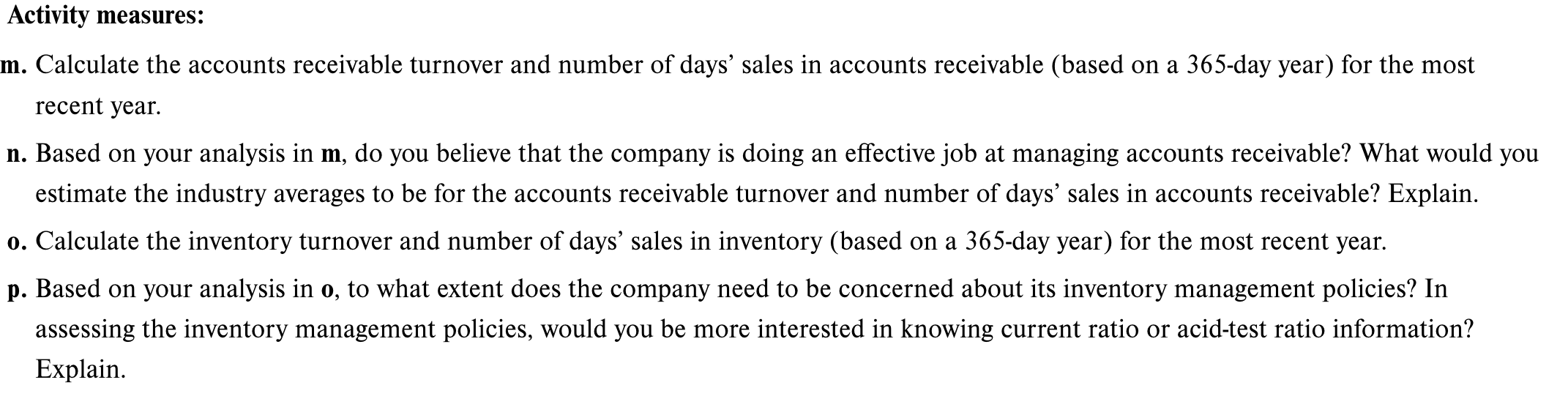

Activity measures:

m Calculate the accounts receivable turnover and number of days' sales in accounts receivable based on a day year for the most

recent year.

n Based on your analysis in do you believe that the company is doing an effective job at managing accounts receivable? What would you

estimate the industry averages to be for the accounts receivable turnover and number of days' sales in accounts receivable? Explain.

o Calculate the inventory turnover and number of days' sales in inventory based on a day year for the most recent year.

p Based on your analysis in to what extent does the company need to be concerned about its inventory management policies? In

assessing the inventory management policies, would you be more interested in knowing current ratio or acidtest ratio information?

Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started