Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer each one and make sure to show your work. 1 Federal Reserve Bank (FED) lowered the target for federal funds rate from 5.25% in

answer each one and make sure to show your work.

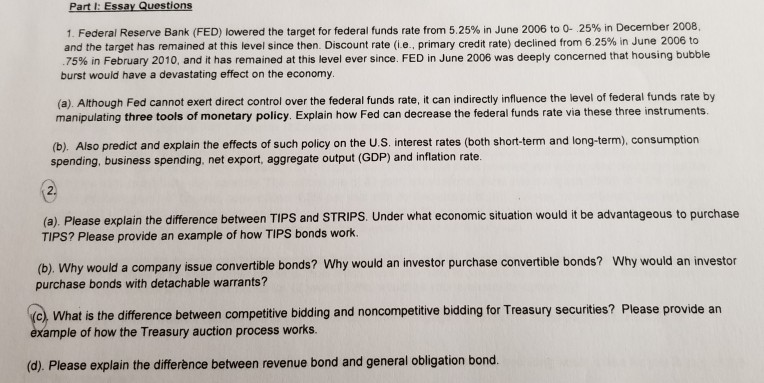

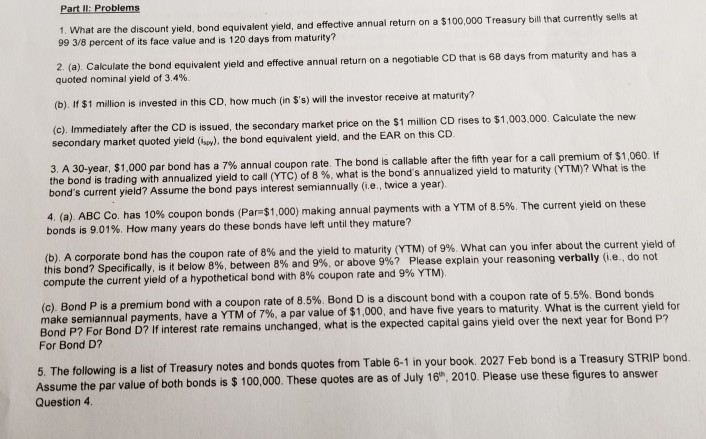

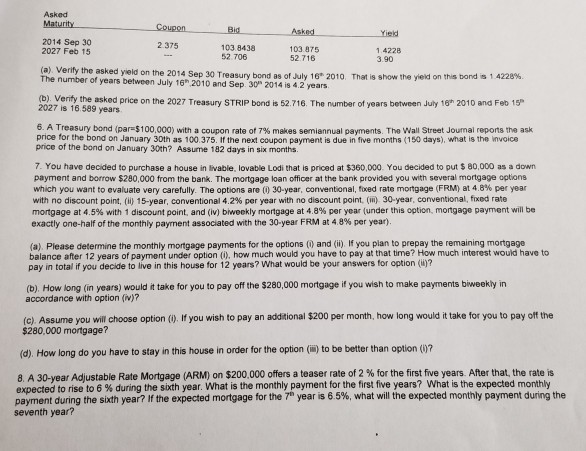

1 Federal Reserve Bank (FED) lowered the target for federal funds rate from 5.25% in June 2006 to 0-25% in December 2008. and the target has remained at this level since then. Discount rate (ie , primary credit rate) declined from 6 25% in June 2006 to 75% in February 2010, and it has remained at this level ever since. FED in June 2006 was deeply concerned that housing bubble burst would have a devastating effect on the economy. (a). Although Fed cannot exert direct control over the federal funds rate, it can indirectly influence the level of federal funds rate by manipulating three tools of monetary policy. Explain how Fed can decrease the federal funds rate via these three instruments (b). Also predict and explain the effects of such policy on the U.S. interest rates (both short-term and long-term), consumption spending, business spending, net export, aggregate output (GDP) and inflation rate. 2. (a). Please explain the difference between TIPS and STRIPS. Under what economic situation would it be advantageous to purchase TIPS? Please provide an example of how TIPS bonds work. (b). Why would a company issue convertible bonds? Why would an investor purchase convertible bonds? Why would an investor purchase bonds with detachable warrants? c) What is the difference between competitive bidding and noncompetitive bidding for Treasury securities? Please provide an xample of how the Treasury auction process works. (d) Please explain the difference between revenue bond and general obligation bond. Part Il: Problems 1. What 99 3/8 percent of its face value and is 120 days from maturity? are the discount yield, bond equivalent yield, and effective annual return on a $100,000 Treasury bill that currently sells at al return on a negotiable CD that is 68 days from maturity and hasa quoted nominal yield of 34% (b). If $1 million is invested in this CD, how much (in 5's) will the investor receive at matunty? (c). Immediately after the CD is issued, the secondary market p secondary market quoted yield (sy), the bond equivalent yield, and the EAR on this CD ice on the $1 million CD rises to $1,003.000. Calculate the new 3, A 30-year, $1,000 par bond has a 7% annual coupon rate The b the bond is trading with annualized yield to call ( bond's current yield? Assume the bond pays interest semiannually (i.e, twice a year). 4. (a) ABC Co. bonds is 9.01% How many years do these bonds have left until they mature? ond is callable afterthe th year for a cal pre um of S1 060 YTC) of 8 %, what is the bond's annualized yield to maturity (YTM)? What is the has 10% coupon bonds (Par $1,000) making annual payments with a YTM of 8 5%. The current yield on these b) A corporate bond has the coupon rate of 8% and the yield to maturity (YTM) of 9% What can you infer about the current yield of this bond? Specifically, is itbelow 8%, between 8% and 9%, or above 9%? Please explan trea current yeda compute the current yield of a hypothetical bond with 8% coupon rate and 9% YTM) bond with a coupon rate of 8.5% Bond D is a discount bond with a coupon rate of 5.5%. Bond bonds make semiannual payments, have a YTM of 7%, a par value of $1,000, and have five years to matur What is the current yield for make semiannuat pa remains unchanged, what is the expected capital gains yield over the next year for Bond Bond P? For Bond D? If interest rate the expected capitalg For Bond D? t of Treasury notes and bonds quotes from Table 6-1 in your book. 2027 Feb bond is a Treasury STRIP bond th bonds is $ 100,000. These quotes are as of July 16", 2010. Please use these figures to answer Question 4 Asked Asked Yieid 2014 Sep 30 2027 Feb 15 2 375 103 8438 52 706 103.875 52 716 3.90 the asked yield on the 2014 Sep 30 Treasury bond as or July 16, 2010. That is show the yied on this bond 4228% number of years between July 16h 2010 and Sep 30 2014 is 4.2 years (b). Verity the asked price on the 2027 Treasury STRIP bond is 52.716. The number of years between July 16 2010 and Feb 15 2027 is 16 589 years 6 A Treasury bond par-$100,000) with a coupon rate of 7% makes semiannual payments. The Wall Street Journal reports the ask pice for the bond on January 30th as 100.375. If the next coupon payment is due in five months (150 days), what is the invoice price of the bond on January 30th? Assume 182 days in six months 7. You have decided to purchase a house in Iivable, lovable Lodi that is priced at $360,000. You decided to put $ 80,000 as a down payment and borrow $280,000 from the bank. The mortgage loan officer at the bank provided you with several mortgage options which you want to evaluate very carefully. The options are (1) 30-year conventional, ted rate mortgage (FRM) at 4 8% per year with no discount point, (ii) 15-year, conventional 4.2% per year with no discount point (in) 30-year conventional, fixed rate mortgage at 4.5% with 1 discount point, and (iv) bweekly mortgage at 4.8% per year (under this option, mortgage payment will be exactly one-half ofthe monthly payment associated with the 30-year FRM at 48% per year) (a). Piease determine the monthly mortgage payments for the options (0 and (ii). If you plan to prepay the remaining mortgage balance after 12 years of payment under option (i), how much would you have to pay at that time? How much interest would have to pay in total if you decide to live in this house for 12 years? What would be your answers for option ()? (b). How long (in years) would it take for you to pay off the $280,000 mortgage if you wish to make payments biweekly in accordance with option (w)? (c). Assume you will choose option (). If you wish to pay an additional $200 per month, how long would it take for you to pay off the $280,000 mortgage? (d). How long do you have to stay in this house in order for the option (i)to be better than option (? 8. A 30-year A ustable Rate Mortgage ARM on $200,000 offer a teaser ate of 2% for the first five years. After that, the ate expected to rise to 6 % during the sixth year. What is the monthly payment for the first five years? What is the expected monthly payment during the sixth year? If the expected mortgage for the 7" year is 6 5%, what will the expected monthly payment during the seventh year? 1 Federal Reserve Bank (FED) lowered the target for federal funds rate from 5.25% in June 2006 to 0-25% in December 2008. and the target has remained at this level since then. Discount rate (ie , primary credit rate) declined from 6 25% in June 2006 to 75% in February 2010, and it has remained at this level ever since. FED in June 2006 was deeply concerned that housing bubble burst would have a devastating effect on the economy. (a). Although Fed cannot exert direct control over the federal funds rate, it can indirectly influence the level of federal funds rate by manipulating three tools of monetary policy. Explain how Fed can decrease the federal funds rate via these three instruments (b). Also predict and explain the effects of such policy on the U.S. interest rates (both short-term and long-term), consumption spending, business spending, net export, aggregate output (GDP) and inflation rate. 2. (a). Please explain the difference between TIPS and STRIPS. Under what economic situation would it be advantageous to purchase TIPS? Please provide an example of how TIPS bonds work. (b). Why would a company issue convertible bonds? Why would an investor purchase convertible bonds? Why would an investor purchase bonds with detachable warrants? c) What is the difference between competitive bidding and noncompetitive bidding for Treasury securities? Please provide an xample of how the Treasury auction process works. (d) Please explain the difference between revenue bond and general obligation bond. Part Il: Problems 1. What 99 3/8 percent of its face value and is 120 days from maturity? are the discount yield, bond equivalent yield, and effective annual return on a $100,000 Treasury bill that currently sells at al return on a negotiable CD that is 68 days from maturity and hasa quoted nominal yield of 34% (b). If $1 million is invested in this CD, how much (in 5's) will the investor receive at matunty? (c). Immediately after the CD is issued, the secondary market p secondary market quoted yield (sy), the bond equivalent yield, and the EAR on this CD ice on the $1 million CD rises to $1,003.000. Calculate the new 3, A 30-year, $1,000 par bond has a 7% annual coupon rate The b the bond is trading with annualized yield to call ( bond's current yield? Assume the bond pays interest semiannually (i.e, twice a year). 4. (a) ABC Co. bonds is 9.01% How many years do these bonds have left until they mature? ond is callable afterthe th year for a cal pre um of S1 060 YTC) of 8 %, what is the bond's annualized yield to maturity (YTM)? What is the has 10% coupon bonds (Par $1,000) making annual payments with a YTM of 8 5%. The current yield on these b) A corporate bond has the coupon rate of 8% and the yield to maturity (YTM) of 9% What can you infer about the current yield of this bond? Specifically, is itbelow 8%, between 8% and 9%, or above 9%? Please explan trea current yeda compute the current yield of a hypothetical bond with 8% coupon rate and 9% YTM) bond with a coupon rate of 8.5% Bond D is a discount bond with a coupon rate of 5.5%. Bond bonds make semiannual payments, have a YTM of 7%, a par value of $1,000, and have five years to matur What is the current yield for make semiannuat pa remains unchanged, what is the expected capital gains yield over the next year for Bond Bond P? For Bond D? If interest rate the expected capitalg For Bond D? t of Treasury notes and bonds quotes from Table 6-1 in your book. 2027 Feb bond is a Treasury STRIP bond th bonds is $ 100,000. These quotes are as of July 16", 2010. Please use these figures to answer Question 4 Asked Asked Yieid 2014 Sep 30 2027 Feb 15 2 375 103 8438 52 706 103.875 52 716 3.90 the asked yield on the 2014 Sep 30 Treasury bond as or July 16, 2010. That is show the yied on this bond 4228% number of years between July 16h 2010 and Sep 30 2014 is 4.2 years (b). Verity the asked price on the 2027 Treasury STRIP bond is 52.716. The number of years between July 16 2010 and Feb 15 2027 is 16 589 years 6 A Treasury bond par-$100,000) with a coupon rate of 7% makes semiannual payments. The Wall Street Journal reports the ask pice for the bond on January 30th as 100.375. If the next coupon payment is due in five months (150 days), what is the invoice price of the bond on January 30th? Assume 182 days in six months 7. You have decided to purchase a house in Iivable, lovable Lodi that is priced at $360,000. You decided to put $ 80,000 as a down payment and borrow $280,000 from the bank. The mortgage loan officer at the bank provided you with several mortgage options which you want to evaluate very carefully. The options are (1) 30-year conventional, ted rate mortgage (FRM) at 4 8% per year with no discount point, (ii) 15-year, conventional 4.2% per year with no discount point (in) 30-year conventional, fixed rate mortgage at 4.5% with 1 discount point, and (iv) bweekly mortgage at 4.8% per year (under this option, mortgage payment will be exactly one-half ofthe monthly payment associated with the 30-year FRM at 48% per year) (a). Piease determine the monthly mortgage payments for the options (0 and (ii). If you plan to prepay the remaining mortgage balance after 12 years of payment under option (i), how much would you have to pay at that time? How much interest would have to pay in total if you decide to live in this house for 12 years? What would be your answers for option ()? (b). How long (in years) would it take for you to pay off the $280,000 mortgage if you wish to make payments biweekly in accordance with option (w)? (c). Assume you will choose option (). If you wish to pay an additional $200 per month, how long would it take for you to pay off the $280,000 mortgage? (d). How long do you have to stay in this house in order for the option (i)to be better than option (? 8. A 30-year A ustable Rate Mortgage ARM on $200,000 offer a teaser ate of 2% for the first five years. After that, the ate expected to rise to 6 % during the sixth year. What is the monthly payment for the first five years? What is the expected monthly payment during the sixth year? If the expected mortgage for the 7" year is 6 5%, what will the expected monthly payment during the seventh yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started