answer everything correctly pls. i will thumbs up and like

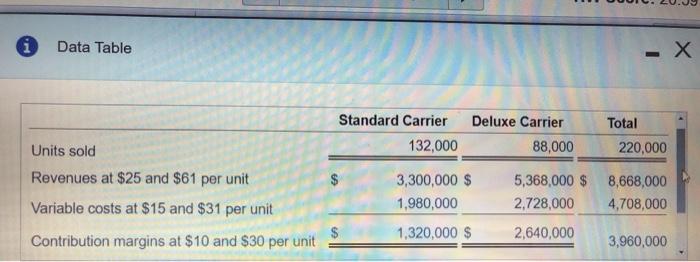

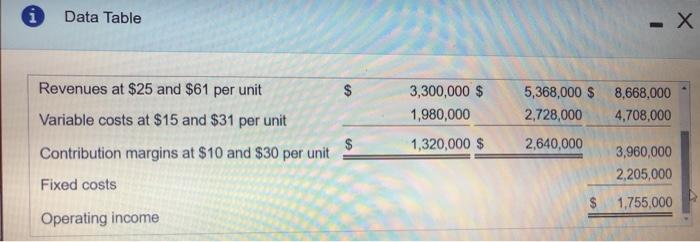

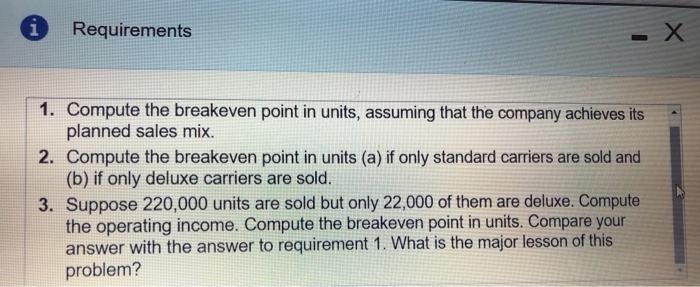

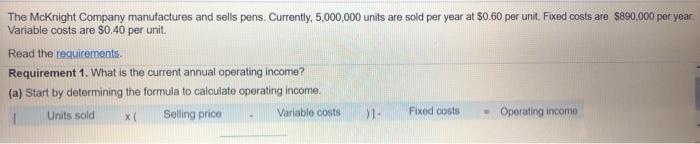

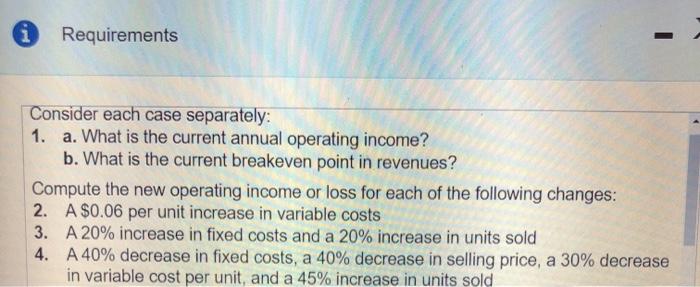

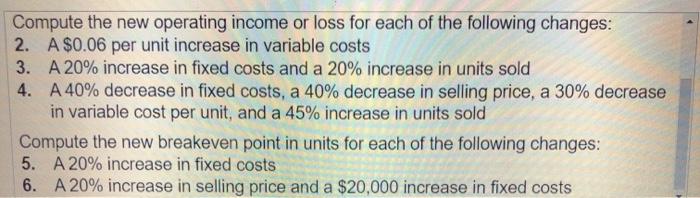

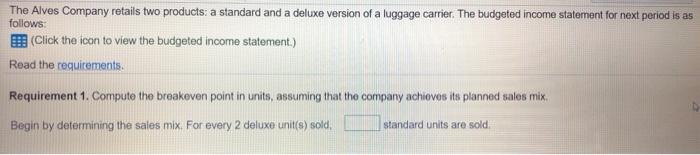

The Alves Company retails two products: a standard and a deluxe version of a luggage carrier. The budgeted income statement for next period is as follows: (Click the icon to view the budgeted income statement.) Read the requirements Requirement 1. Compute the breakeven point in units, assuming that the company achieves its planned sales mix Begin by determining the sales mix. For every 2 deluxe unit(s) sold, standard units are sold i Data Table - X Deluxe Carrier Standard Carrier 132,000 Total 220,000 Units sold 88,000 $ Revenues at $25 and $61 per unit Variable costs at $15 and $31 per unit 3,300,000 $ 1,980,000 5,368,000 $ 2,728,000 2,640,000 8,668,000 4,708,000 $ 1,320,000 $ Contribution margins at $10 and $30 per unit 3,960,000 Data Table -X Revenues at $25 and $61 per unit 3,300,000 $ 1,980,000 Variable costs at $15 and $31 per unit Contribution margins at $10 and $30 per unit 5,368,000 $ 8,668,000 2,728,000 4,708,000 2,640,000 3,960,000 2,205,000 1,320,000 $ Fixed costs 1,755,000 Operating income i Requirements 1. Compute the breakeven point in units, assuming that the company achieves its planned sales mix. 2. Compute the breakeven point in units (a) if only standard carriers are sold and (b) if only deluxe carriers are sold. 3. Suppose 220,000 units are sold but only 22,000 of them are deluxe. Compute the operating income. Compute the breakeven point in units. Compare your answer with the answer to requirement 1. What is the major lesson of this problem? The McKnight Company manufactures and sells pens. Currently, 5,000,000 units are sold per year at $0.60 per unit. Fixed costs are $890,000 per year Variable costs are $0,40 per unit. Read the requirements Requirement 1. What is the current annual operating income? (a) Start by determining the formula to calculate operating income Units sold X Selling price Variable costs > Fixed costs - Operating incomo (a) Start by determining the formula to calculate operating income. Units sold x Selling price Variable costs > Fixed costs = Operating income The current annual operating income is $ 25000000 Requirements Consider each case separately: 1. a. What is the current annual operating income? b. What is the current breakeven point in revenues? Compute the new operating income or loss for each of the following changes: 2. A$0.06 per unit increase in variable costs 3. A 20% increase in fixed costs and a 20% increase in units sold 4. A 40% decrease in fixed costs, a 40% decrease in selling price, a 30% decrease in variable cost per unit, and a 45% increase in units sold Compute the new operating income or loss for each of the following changes: 2. A $0.06 per unit increase in variable costs 3. A 20% increase in fixed costs and a 20% increase in units sold 4. A 40% decrease in fixed costs, a 40% decrease in selling price, a 30% decrease in variable cost per unit, and a 45% increase in units sold Compute the new breakeven point in units for each of the following changes: 5. A 20% increase in fixed costs 6. A 20% increase in selling price and a $20,000 increase in fixed costs