answer everything correctly. will like and thumbs up

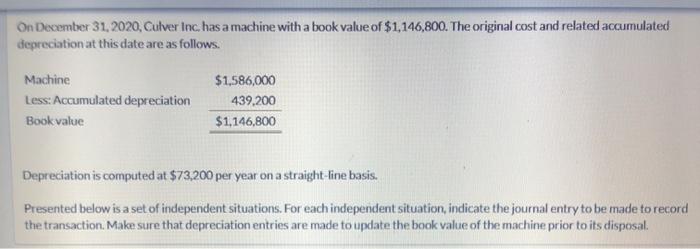

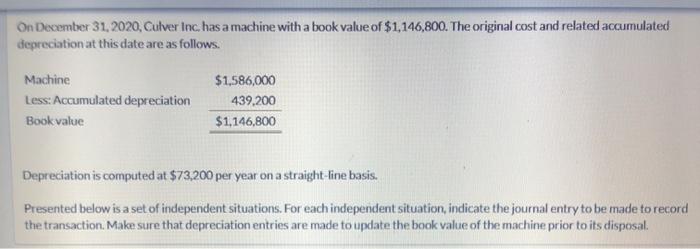

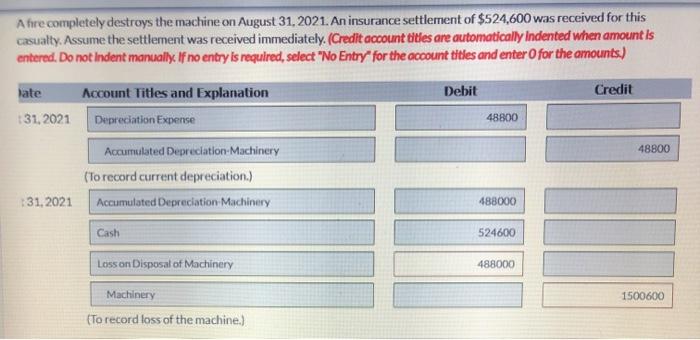

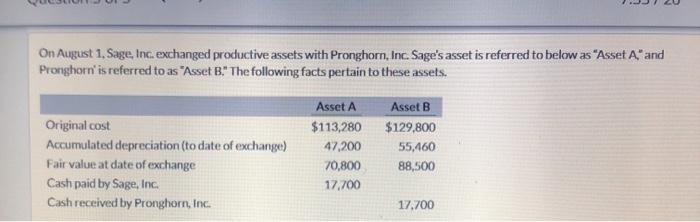

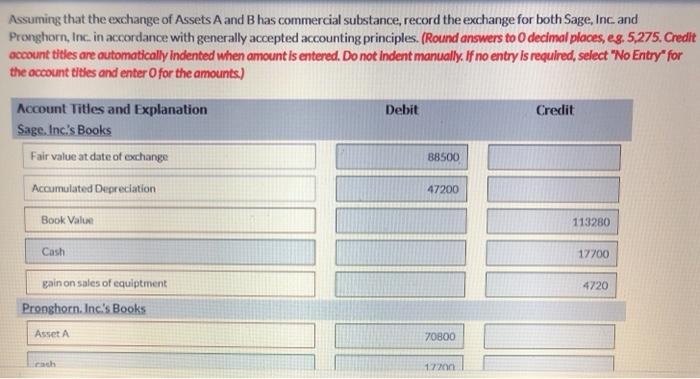

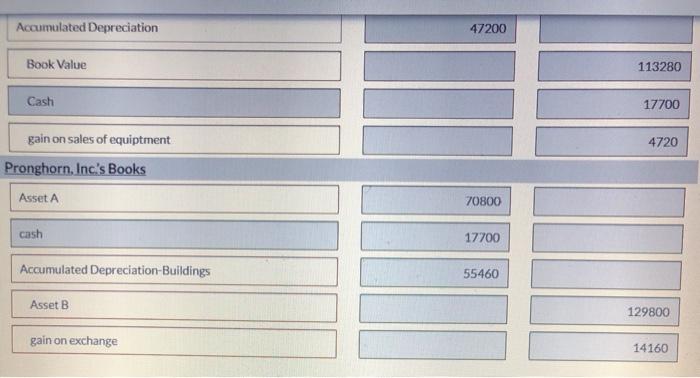

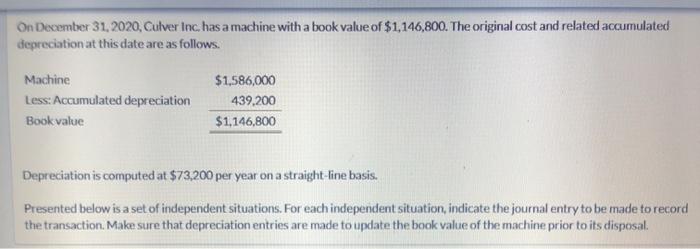

On December 31, 2020, Culver Inc. has a machine with a book value of $1,146,800. The original cost and related accumulated depreciation at this date are as follows. Machine Less: Accumulated depreciation Book value $1,586,000 439,200 $1,146,800 Depreciation is computed at $73,200 per year on a straight-line basis. Presented below is a set of independent situations. For each independent situation, indicate the journal entry to be made to record the transaction. Make sure that depreciation entries are made to update the book value of the machine prior to its disposal. A fre completely destroys the machine on August 31, 2021. An insurance settlement of $524,600 was received for this casualty. Assume the settlement was received immediately. (Credit account titles are automatically Indented when amount is entered. Do not Indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit 48800 late Account Titles and Explanation 31, 2021 Depreciation Expense Accumulated Depreciation Machinery (To record current depreciation.) 31, 2021 Accumulated Depreciation Machinery 48800 488000 Cash 524600 Loss on Disposal of Machinery 488000 1500600 Machinery To record loss of the machine.) On August 1, Sage, Inc. exchanged productive assets with Pronghorn, Inc. Sage's asset is referred to below as "Asset A and Pronghorn' is referred to as "Asset B." The following facts pertain to these assets. Original cost Accumulated depreciation (to date of exchange) Fair value at date of exchange Cash paid by Sage, Inc. Cash received by Pronghorn, Inc. Asset A $113,280 47,200 70,800 17,700 Asset B $129,800 55,460 88,500 17.700 Assuming that the exchange of Assets A and B has commercial substance, record the exchange for both Sage, Inc. and Pronghorn, Inc. in accordance with generally accepted accounting principles. (Round answers to decimal places, eg. 5,275. Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry* for the account titles and enter for the amounts.) Debit Credit Account Titles and Explanation Sage. Inc's Books Fair value at date of change 88500 Accumulated Depreciation 47200 Book Value 113280 Cash 17700 4720 gain on sales of equipment Pronghorn, Inc.'s Books Asset A 70800 17200 Accumulated Depreciation 47200 Book Value 113280 Cash 17700 4720 gain on sales of equiptment Pronghorn, Inc.'s Books Asset A 70800 cash 17700 Accumulated Depreciation-Buildings 55460 Asset B 129800 gain on exchange 14160