Answered step by step

Verified Expert Solution

Question

1 Approved Answer

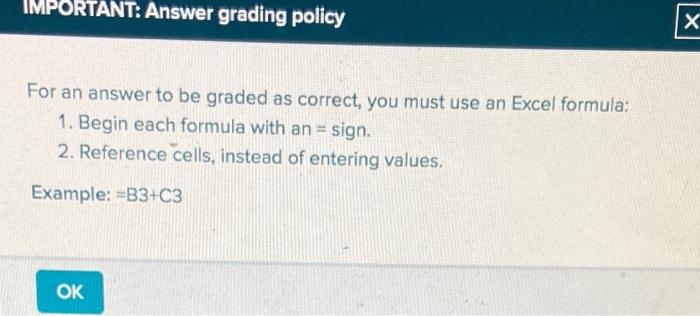

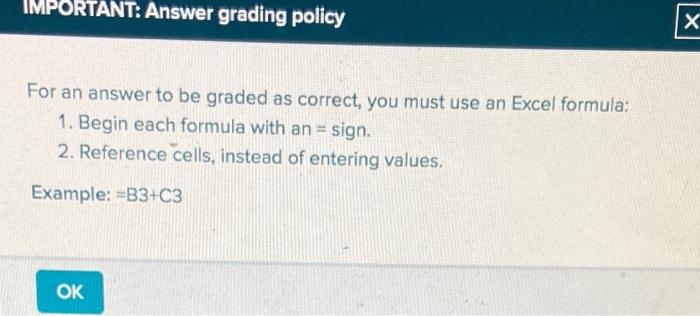

answer fast please ! (common par value is $1) IMPORTANT: Answer grading policy For an answer to be graded as correct, you must use an

answer fast please ! (common par value is $1)

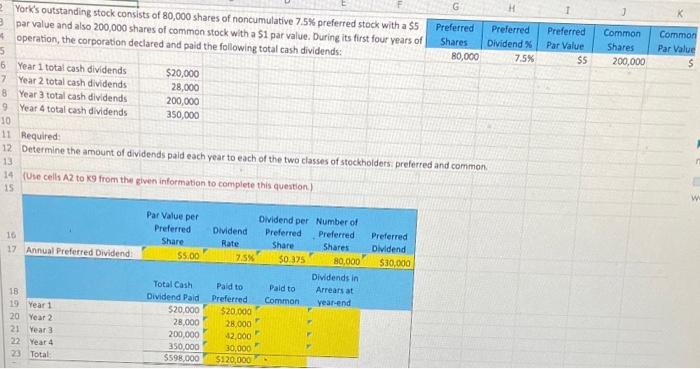

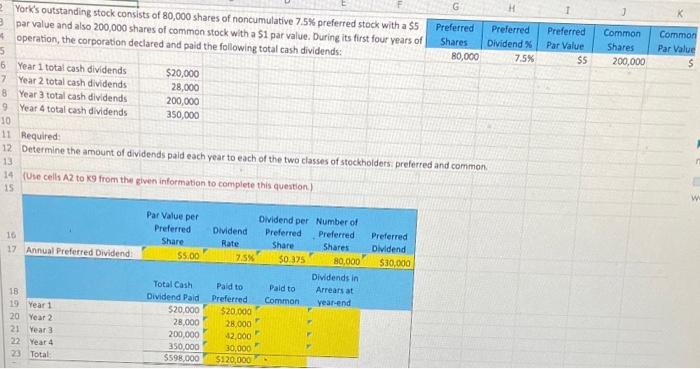

IMPORTANT: Answer grading policy For an answer to be graded as correct, you must use an Excel formula: 1. Begin each formula with an = sign. 2. Reference cells, instead of entering values. Example: -B3+C3 OK 1 York's outstanding stock consists of 80,000 shares of noncumulative 7.5% preferred stock with a $5 par value and also 200,000 shares of common stock with a 51 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends: Preferred Shares 80,000 Preferred Dividend X 7.5% Preferred Par Value S5 Common Shares 200,000 5 Common Par Value $ 6 Year 1 total cash dividends $20,000 7 Year 2 total cash dividends 28,000 8 Year 3 total cash dividends 200,000 9 Year 4 total cash dividends 350,000 10 11 Required 12 Determine the amount of dividends paid each year to each of the two classes of stockholders preferred and common, 13 14 Use cells A2 to 9 from the given information to complete this question) 15 w 16 17 Annual Preferred Dividend: Par Value per Preferred Share $5.00 Preferred Dividend $30,000 18 Dividend per Number of Dividend Preferred Preferred Rate Share Shares 75% $0325 80,000 Dividends in Paid to Pald to Arrears at Preferred Common yearend $20.000 28.000 42.000 30,000 $120,000 Total Cash Dividend Paid $20.000 28.000 200,000 350,000 $598.000 19 Year 1 20 Year 2 21 Year 3 22 Year 4 23 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started