Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer first three questions Analysis of the Bankruptcy of GM Groups of four (4) students maximum - no Individual Submissions Due: 11:59 pm on the

answer first three questions

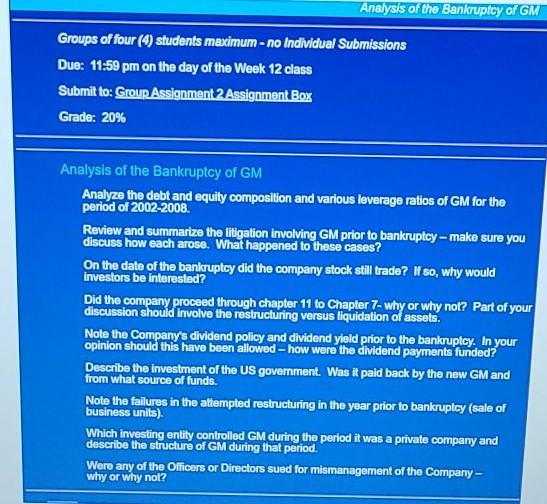

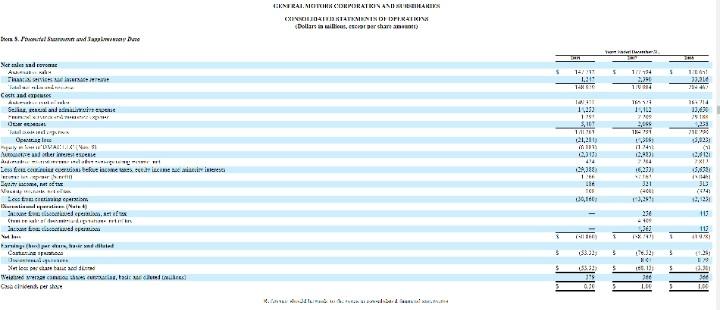

Analysis of the Bankruptcy of GM Groups of four (4) students maximum - no Individual Submissions Due: 11:59 pm on the day of the Week 12 class Submit to: Group Assignment 2 Assignment Box Grade: 20% Analysis of the Bankruptcy of GM Analyze the debt and equity composition and various leverage ratios of GM for the period of 2002-2008 Review and summarize the litigation involving GM prior to bankruptcy - make sure you discuss how each arose. What happened to these cases? On the date of the bankruptcy did the company stock still trade? If so, why would investors be interested? Did the company proceed through chapter 11 to Chapter 7- why or why not? Part of your discussion should involve the restructuring versus liquidation of assets. Note the Company's dividend policy and dividend yield prior to the bankruptcy. In your opinion should this have been allowed - how were the dividend payments funded? Describe the investment of the US government. Was it paid back by the new GM and from what source of funds. Note the failures in the attempted restructuring in the year prior to bankruptcy (sale of business units). Which investing entity controlled GM during the period it was a private company and describe the structure of GM during that period. Were any of the Officers or Directors sued for mismanagement of the Company - why or why not? TEKN RAINCTEIX CARRATIIN AND MANIS CIRCHITOKTATKINNIX DE OFTEN Dollars a willies crashan Do '. Sada De TR TH 1217 11111 11! 33.3 332 TANTE 1 6114 la 1,352 195 SU TIN 1,13 151 1151 Nerance and ht Fetele Copes Abu Sellissandinn OR. 'S OR OVALO Neudorfer wees escene S.HU Les ice cu = hts AES SEriuture as airtir instan Se, etc Vackr Cesta N. Sisse, fx (with 21,210 . 19 1993 (11 2.1 T! 1) 118 24,339 21 165 30 321 21231 23 -104 10 1 1 3 3 imperdiet JWA et les para bang We starts Coachender 5 5 553) 395 03 1.13 701 LE Analysis of the Bankruptcy of GM Groups of four (4) students maximum - no Individual Submissions Due: 11:59 pm on the day of the Week 12 class Submit to: Group Assignment 2 Assignment Box Grade: 20% Analysis of the Bankruptcy of GM Analyze the debt and equity composition and various leverage ratios of GM for the period of 2002-2008 Review and summarize the litigation involving GM prior to bankruptcy - make sure you discuss how each arose. What happened to these cases? On the date of the bankruptcy did the company stock still trade? If so, why would investors be interested? Did the company proceed through chapter 11 to Chapter 7- why or why not? Part of your discussion should involve the restructuring versus liquidation of assets. Note the Company's dividend policy and dividend yield prior to the bankruptcy. In your opinion should this have been allowed - how were the dividend payments funded? Describe the investment of the US government. Was it paid back by the new GM and from what source of funds. Note the failures in the attempted restructuring in the year prior to bankruptcy (sale of business units). Which investing entity controlled GM during the period it was a private company and describe the structure of GM during that period. Were any of the Officers or Directors sued for mismanagement of the Company - why or why not? TEKN RAINCTEIX CARRATIIN AND MANIS CIRCHITOKTATKINNIX DE OFTEN Dollars a willies crashan Do '. Sada De TR TH 1217 11111 11! 33.3 332 TANTE 1 6114 la 1,352 195 SU TIN 1,13 151 1151 Nerance and ht Fetele Copes Abu Sellissandinn OR. 'S OR OVALO Neudorfer wees escene S.HU Les ice cu = hts AES SEriuture as airtir instan Se, etc Vackr Cesta N. Sisse, fx (with 21,210 . 19 1993 (11 2.1 T! 1) 118 24,339 21 165 30 321 21231 23 -104 10 1 1 3 3 imperdiet JWA et les para bang We starts Coachender 5 5 553) 395 03 1.13 701 LEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started