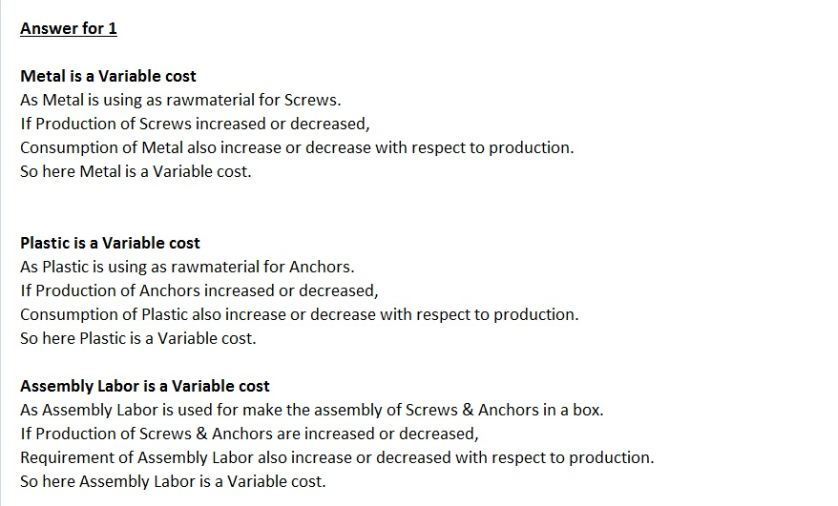

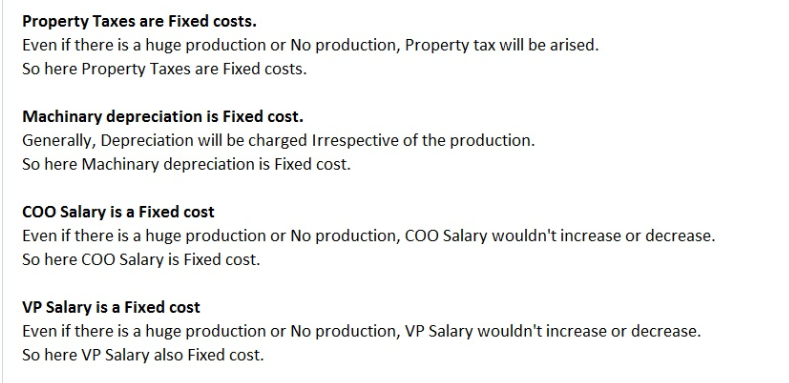

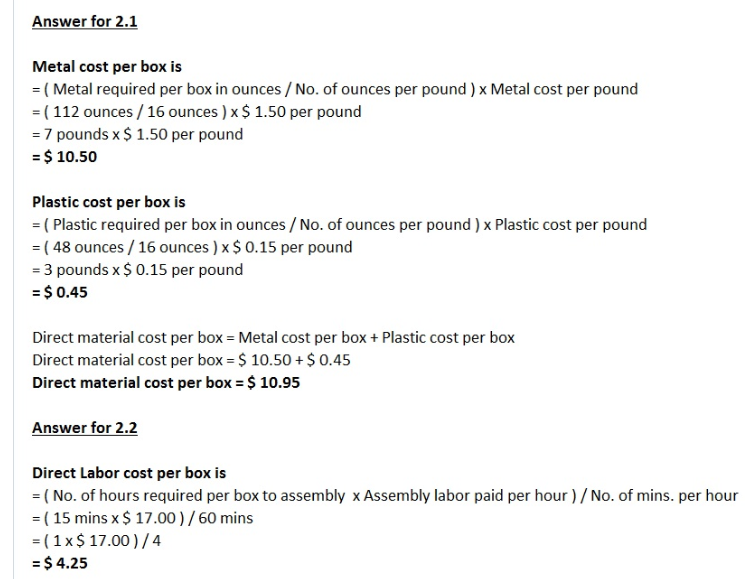

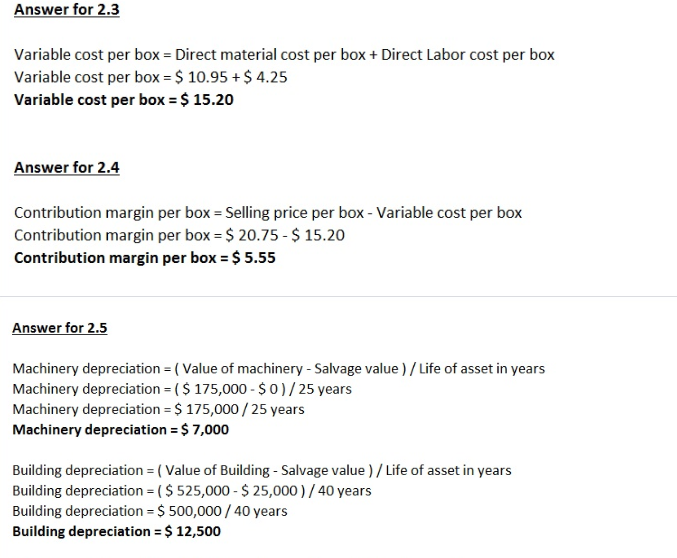

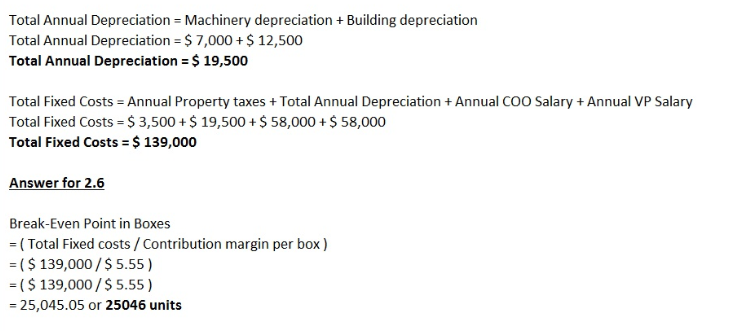

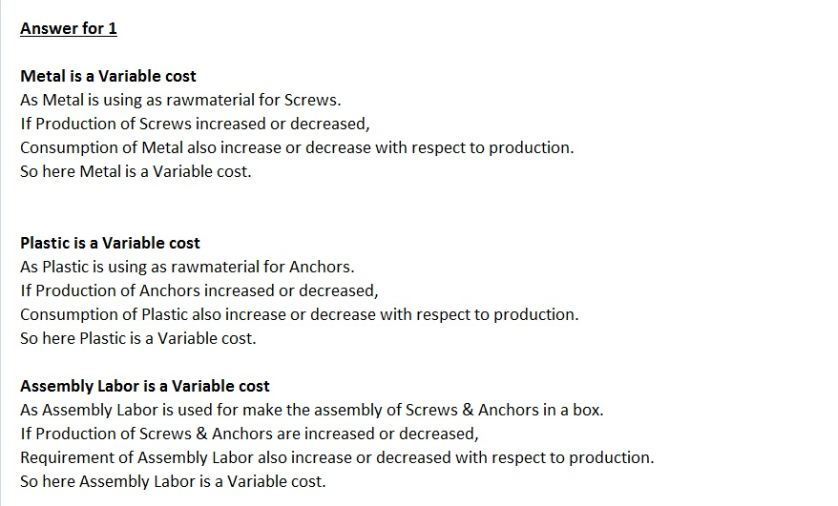

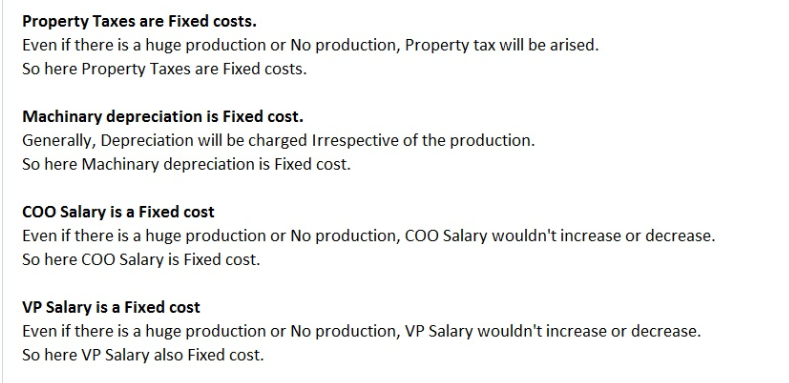

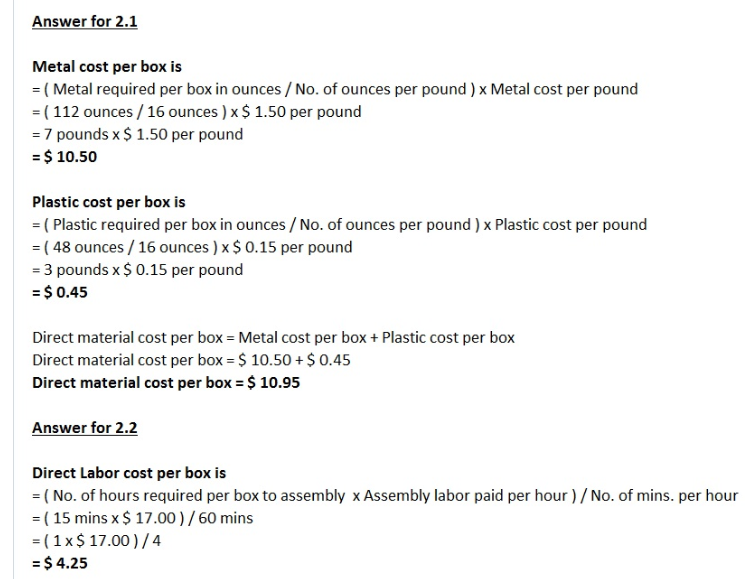

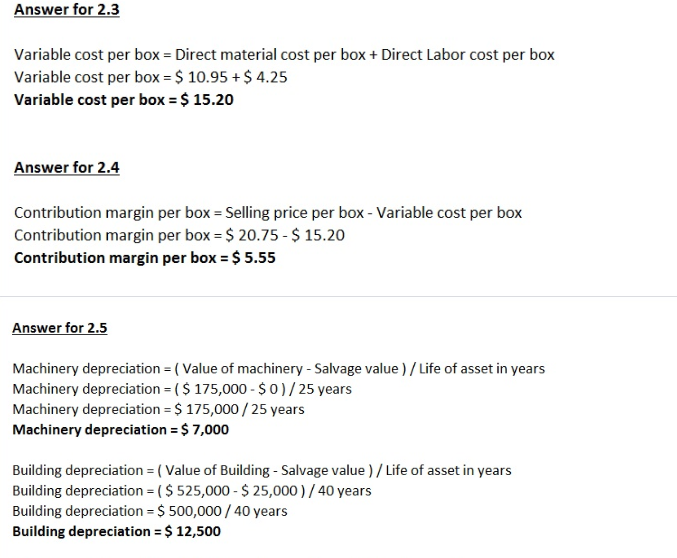

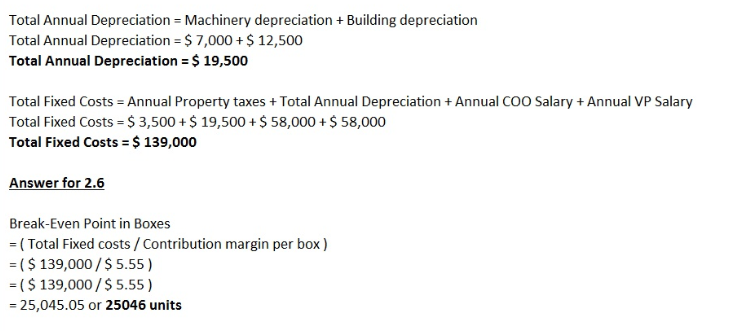

Answer for 1 Metal is a Variable cost As Metal is using as rawmaterial for Screws. If Production of Screws increased or decreased, Consumption of Metal also increase or decrease with respect to production. So here Metal is a Variable cost. Plastic is a Variable cost As Plastic is using as rawmaterial for Anchors. If Production of Anchors increased or decreased, Consumption of Plastic also increase or decrease with respect to production. So here Plastic is a Variable cost. Assembly Labor is a Variable cost As Assembly Labor is used for make the assembly of Screws & Anchors in a box. If Production of Screws & Anchors are increased or decreased, Requirement of Assembly Labor also increase or decreased with respect to production. So here Assembly Labor is a Variable cost. Property Taxes are Fixed costs. Even if there is a huge production or No production, Property tax will be arised. So here Property Taxes are Fixed costs. Machinary depreciation is Fixed cost. Generally, Depreciation will be charged Irrespective of the production. So here Machinary depreciation is Fixed cost. COO Salary is a Fixed cost Even if there is a huge production or No production, COO Salary wouldn't increase or decrease. So here COO Salary is Fixed cost. VP Salary is a Fixed cost Even if there is a huge production or No production, VP Salary wouldn't increase or decrease. So here VP Salary also Fixed cost. Answer for 2.1 Metal cost per box is = ( Metal required per box in ounces / No. of ounces per pound ) x Metal cost per pound -(112 ounces /16 ounces ) x $1.50 per pound 7 pounds x $ 1.50 per pound -$10.50 Plastic cost per box is -( Plastic required per box in ounces / No. of ounces per pound) x Plastic cost per pound (48 ounces/16 ounces ) x$ 0.15 per pound 3 pounds x $ 0.15 per pound $0.45 Direct material cost per box - Metal cost per box Plastic cost per box Direct material cost per box $ 10.50$0.45 Direct material cost per box $ 10.95 Answer for 2.2 Direct Labor cost per box is -(No. of hours required per box to assembly x Assembly labor paid per hour) /No. of mins. per hour (15 mins x$ 17.00)/60 mins (1 x$ 17.00)/4 $4.25 Answer for 2.3 Variable cost per box - Direct material cost per box Variable cost per box $ 10.95$ 4.25 Variable cost per box $ 15.20 Direct Labor cost per box Answer for 2.4 Contribution margin per box - Selling price per box - Variable cost per box Contribution margin per box $ 20.75 $15.20 Contribution margin per box- $5.55 Answer for 2.5 Machinery depreciation-(Value of machinery -Salvage value)/Life of asset in years Machinery depreciation (S 175,000 $0)/25 years Machinery depreciation 175,000/25 years Machinery depreciation $ 7,000 Building depreciation (Value of Building - Salvage value)/Life of asset in years Building depreciation (S 525,000 $ 25,000)/40 years Building depreciation S 500,000/40 years Building depreciation 12,500 Total Annual Depreciation Machinery depreciation Building depreciation Total Annual Depreciation $ 7,000+$ 12,500 Total Annual Depreciation = $ 19,500 Total Fixed Costs Annual Property taxes Total Annual Depreciation Annual COO SalaryAnnual VP Salary Total Fixed Costs S 3,500$19,500S58,000 S 58,000 Total Fixed Costs = $ 139,000 Answer for 2.6 Break-Even Point in Boxes (Total Fixed costs/Contribution margin per box) = ( $ 139,000 / $ 5.55 ) -( $ 139,000 / $ 5.55 ) -25,045.05 or 25046 units Required: Answer the questions above. Prepare a variable costing format income statement assuming that the company makes and sells the maximum possible number of units. If the income is negative, what is the reason? Your friend asks you for advice on how to increase the company income. Give him at least two possible solutions to the problem. Which solution did you recommend to your friend? Why did you choose this particular solution? Prepare a memo addressed to your friend/client explaining your options and your recommendation. This memo should be no more than one page long. What is the new break-even point after implementing your solution? What is the maximum income the company can make after implementing your solution? Is this enough profit to justify going into business? Why or why not? Prepare both an absorption costing income statement and a variable costing income statement to reflect your solution. State your assumptions about the number of units produced and the number sold. Answer for 1 Metal is a Variable cost As Metal is using as rawmaterial for Screws. If Production of Screws increased or decreased, Consumption of Metal also increase or decrease with respect to production. So here Metal is a Variable cost. Plastic is a Variable cost As Plastic is using as rawmaterial for Anchors. If Production of Anchors increased or decreased, Consumption of Plastic also increase or decrease with respect to production. So here Plastic is a Variable cost. Assembly Labor is a Variable cost As Assembly Labor is used for make the assembly of Screws & Anchors in a box. If Production of Screws & Anchors are increased or decreased, Requirement of Assembly Labor also increase or decreased with respect to production. So here Assembly Labor is a Variable cost. Property Taxes are Fixed costs. Even if there is a huge production or No production, Property tax will be arised. So here Property Taxes are Fixed costs. Machinary depreciation is Fixed cost. Generally, Depreciation will be charged Irrespective of the production. So here Machinary depreciation is Fixed cost. COO Salary is a Fixed cost Even if there is a huge production or No production, COO Salary wouldn't increase or decrease. So here COO Salary is Fixed cost. VP Salary is a Fixed cost Even if there is a huge production or No production, VP Salary wouldn't increase or decrease. So here VP Salary also Fixed cost. Answer for 2.1 Metal cost per box is = ( Metal required per box in ounces / No. of ounces per pound ) x Metal cost per pound -(112 ounces /16 ounces ) x $1.50 per pound 7 pounds x $ 1.50 per pound -$10.50 Plastic cost per box is -( Plastic required per box in ounces / No. of ounces per pound) x Plastic cost per pound (48 ounces/16 ounces ) x$ 0.15 per pound 3 pounds x $ 0.15 per pound $0.45 Direct material cost per box - Metal cost per box Plastic cost per box Direct material cost per box $ 10.50$0.45 Direct material cost per box $ 10.95 Answer for 2.2 Direct Labor cost per box is -(No. of hours required per box to assembly x Assembly labor paid per hour) /No. of mins. per hour (15 mins x$ 17.00)/60 mins (1 x$ 17.00)/4 $4.25 Answer for 2.3 Variable cost per box - Direct material cost per box Variable cost per box $ 10.95$ 4.25 Variable cost per box $ 15.20 Direct Labor cost per box Answer for 2.4 Contribution margin per box - Selling price per box - Variable cost per box Contribution margin per box $ 20.75 $15.20 Contribution margin per box- $5.55 Answer for 2.5 Machinery depreciation-(Value of machinery -Salvage value)/Life of asset in years Machinery depreciation (S 175,000 $0)/25 years Machinery depreciation 175,000/25 years Machinery depreciation $ 7,000 Building depreciation (Value of Building - Salvage value)/Life of asset in years Building depreciation (S 525,000 $ 25,000)/40 years Building depreciation S 500,000/40 years Building depreciation 12,500 Total Annual Depreciation Machinery depreciation Building depreciation Total Annual Depreciation $ 7,000+$ 12,500 Total Annual Depreciation = $ 19,500 Total Fixed Costs Annual Property taxes Total Annual Depreciation Annual COO SalaryAnnual VP Salary Total Fixed Costs S 3,500$19,500S58,000 S 58,000 Total Fixed Costs = $ 139,000 Answer for 2.6 Break-Even Point in Boxes (Total Fixed costs/Contribution margin per box) = ( $ 139,000 / $ 5.55 ) -( $ 139,000 / $ 5.55 ) -25,045.05 or 25046 units Required: Answer the questions above. Prepare a variable costing format income statement assuming that the company makes and sells the maximum possible number of units. If the income is negative, what is the reason? Your friend asks you for advice on how to increase the company income. Give him at least two possible solutions to the problem. Which solution did you recommend to your friend? Why did you choose this particular solution? Prepare a memo addressed to your friend/client explaining your options and your recommendation. This memo should be no more than one page long. What is the new break-even point after implementing your solution? What is the maximum income the company can make after implementing your solution? Is this enough profit to justify going into business? Why or why not? Prepare both an absorption costing income statement and a variable costing income statement to reflect your solution. State your assumptions about the number of units produced and the number sold