Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer for a, b and c also..as it is under 1 question Question 4 You are a fixed-income portfolio manager of an investment company. Currently,

answer for a, b and c also..as it is under 1 question

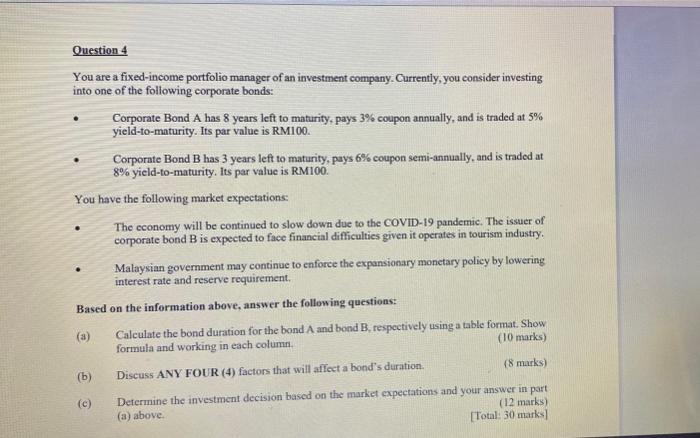

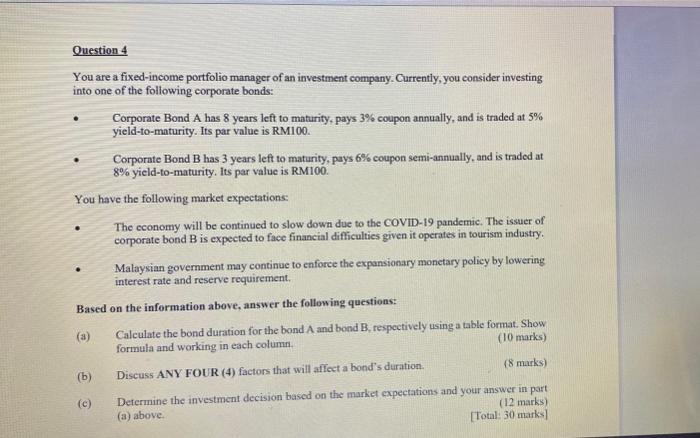

Question 4 You are a fixed-income portfolio manager of an investment company. Currently, you consider investing into one of the following corporate bonds: Corporate Bond A has 8 years left to maturity, pays 3% coupon annually, and is traded at 5% yield-to-maturity. Its par value is RM100. Corporate Bond B has 3 years left to maturity, pays 6% coupon semi-annually, and is traded at 8% yield-to-maturity. Its par value is RM100. You have the following market expectations The economy will be continued to slow down due to the COVID-19 pandemic. The issuer of corporate bond B is expected to face financial difficulties given it operates in tourism industry. Malaysian government may continue to enforce the expansionary monetary policy by lowering interest rate and reserve requirement Based on the information above, answer the following questions: (3) Calculate the bond duration for the bond A and bond B, respectively using a table format. Show formula and working in each column. (10 marks) (b) Discuss ANY FOUR (4) factors that will affect a bond's duration (8 marks) (c) Determine the investment decision based on the market expectations and your answer in part (a) above (12 marks) [Total: 30 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started