Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer for d e f 1. Duration and Convexity Your research department reports continuously compounded interest rates as Maturity (Years) Interest Rate (%) 0.5 1.00

answer for d e f

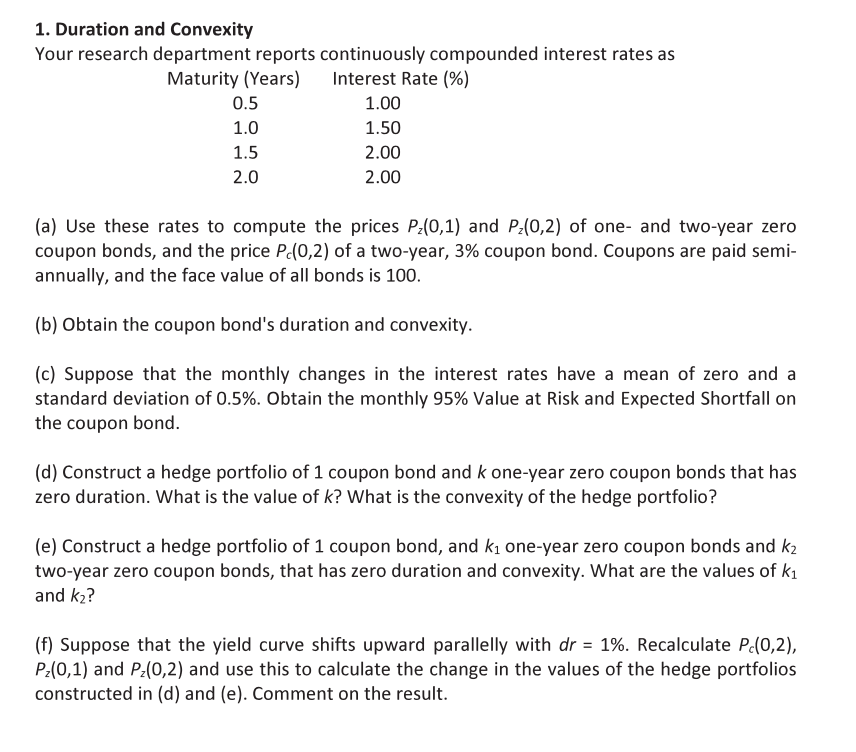

1. Duration and Convexity Your research department reports continuously compounded interest rates as Maturity (Years) Interest Rate (%) 0.5 1.00 1.50 1.5 2.00 2.0 2.00 1.0 (a) Use these rates to compute the prices P2(0,1) and P2(0,2) of one- and two-year zero coupon bonds, and the price Pc(0,2) of a two-year, 3% coupon bond. Coupons are paid semi- annually, and the face value of all bonds is 100. (b) Obtain the coupon bond's duration and convexity. (c) Suppose that the monthly changes in the interest rates have a mean of zero and a standard deviation of 0.5%. Obtain the monthly 95% Value at Risk and Expected Shortfall on the coupon bond. (d) Construct a hedge portfolio of 1 coupon bond and k one-year zero coupon bonds that has zero duration. What is the value of k? What is the convexity of the hedge portfolio? (e) Construct a hedge portfolio of 1 coupon bond, and k1 one-year zero coupon bonds and k2 two-year zero coupon bonds, that has zero duration and convexity. What are the values of k and k2? (f) Suppose that the yield curve shifts upward parallelly with dr = 1%. Recalculate Pc(0,2), P2(0,1) and P2(0,2) and use this to calculate the change in the values of the hedge portfolios constructed in (d) and (e). Comment on the result. 1. Duration and Convexity Your research department reports continuously compounded interest rates as Maturity (Years) Interest Rate (%) 0.5 1.00 1.50 1.5 2.00 2.0 2.00 1.0 (a) Use these rates to compute the prices P2(0,1) and P2(0,2) of one- and two-year zero coupon bonds, and the price Pc(0,2) of a two-year, 3% coupon bond. Coupons are paid semi- annually, and the face value of all bonds is 100. (b) Obtain the coupon bond's duration and convexity. (c) Suppose that the monthly changes in the interest rates have a mean of zero and a standard deviation of 0.5%. Obtain the monthly 95% Value at Risk and Expected Shortfall on the coupon bond. (d) Construct a hedge portfolio of 1 coupon bond and k one-year zero coupon bonds that has zero duration. What is the value of k? What is the convexity of the hedge portfolio? (e) Construct a hedge portfolio of 1 coupon bond, and k1 one-year zero coupon bonds and k2 two-year zero coupon bonds, that has zero duration and convexity. What are the values of k and k2? (f) Suppose that the yield curve shifts upward parallelly with dr = 1%. Recalculate Pc(0,2), P2(0,1) and P2(0,2) and use this to calculate the change in the values of the hedge portfolios constructed in (d) and (e). Comment on the resultStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started