Answered step by step

Verified Expert Solution

Question

1 Approved Answer

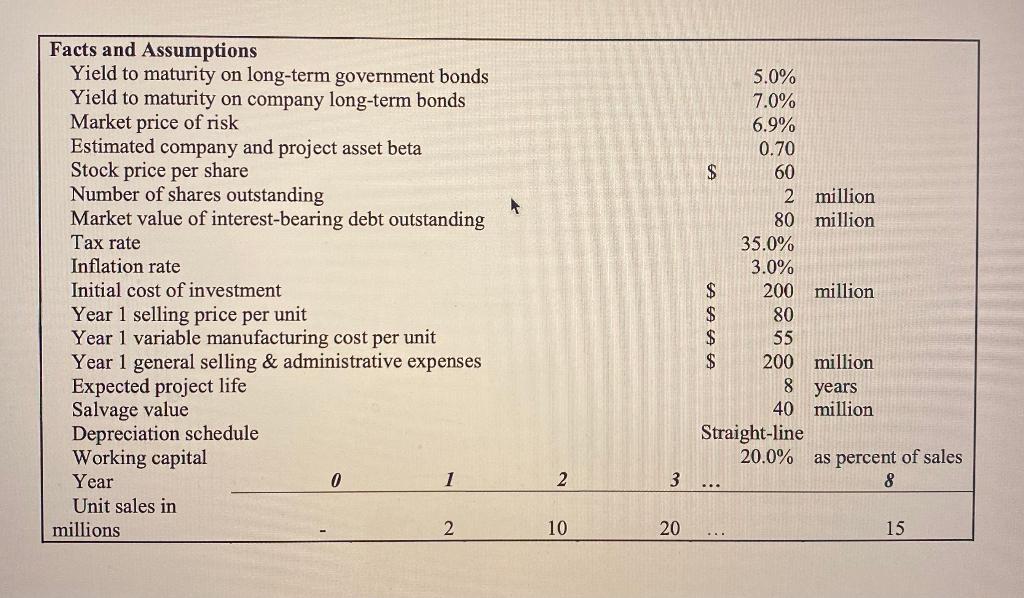

Estimate the projects third year (t=3) change in net working capital (in $ millions, from year 2 to 3)? Hint: working capital is an accounting

Estimate the projects third year (t=3) change in net working capital (in $ millions, from year 2 to 3)? Hint: working capital is an accounting number which is nominal.

A. 160

B. 175

C. 339

D. 320

E. -90

Solution:

Year 1 2 3

Working capital (increases with inflation) 32 165 339

Change in working capital 32 133 175

Note: The sales inflate with inflation over time.

The answer to this question is 175, but I don't understand where the numbers 32, 165, and 339 came from, thus I don't understand how we got to the answer 175. Can someone please explain?

$ Facts and Assumptions Yield to maturity on long-term government bonds Yield to maturity on company long-term bonds Market price of risk Estimated company and project asset beta Stock price per share Number of shares outstanding Market value of interest-bearing debt outstanding Tax rate Inflation rate Initial cost of investment Year 1 selling price per unit Year 1 variable manufacturing cost per unit Year 1 general selling & administrative expenses Expected project life Salvage value Depreciation schedule Working capital Year 0 1 Unit sales in millions 2 5.0% 7.0% 6.9% 0.70 60 2 million 80 million 35.0% 3.0% 200 million 80 55 200 million $ $ $ $ 8 years 40 million Straight-line 20.0% as percent of sales 8 2 3 ... 10 20 15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started