Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer for p2q2 only please PROBLEM 2. DCF VALUATION (15 pts). You are an equity research analyst for Galvin & Gannaway LLC (G2), a successful

answer for p2q2 only please

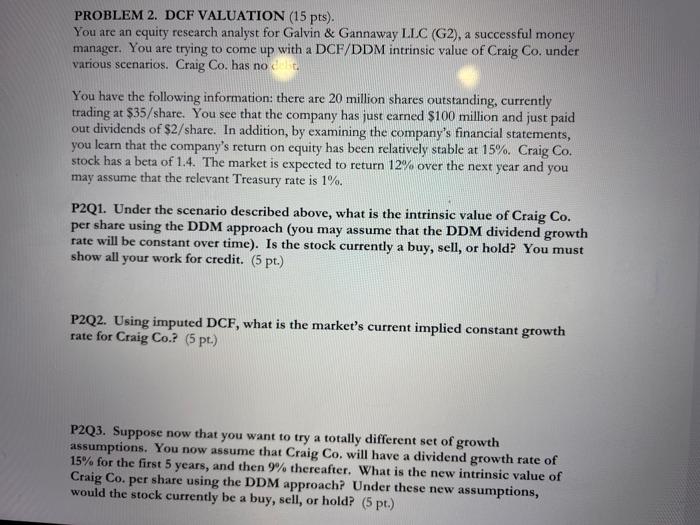

PROBLEM 2. DCF VALUATION (15 pts). You are an equity research analyst for Galvin & Gannaway LLC (G2), a successful money manager. You are trying to come up with a DCF/DDM intrinsic value of Craig Co. under various scenarios. Craig Co. has not You have the following information: there are 20 million shares outstanding, currently trading at $35/share. You see that the company has just earned $100 million and just paid out dividends of $2/share. In addition, by examining the company's financial statements, you learn that the company's return on equity has been relatively stable at 15%. Craig Co. stock has a beta of 1.4. The market is expected to return 12% over the next year and you may assume that the relevant Treasury rate is 1%. P2Q1. Under the scenario described above, what is the intrinsic value of Craig Co. per share using the DDM approach (you may assume that the DDM dividend growth rate will be constant over time). Is the stock currently a buy, sell, or hold? You must show all your work for credit. (5 pt.) P2Q2. Using imputed DCF, what is the market's current implied constant growth rate for Craig Co.? (5 pr.) P2Q3. Suppose now that you want to try a totally different set of growth assumptions. You now assume that Craig Co. will have a dividend growth rate of 15% for the first 5 years, and then 9% thereafter. What is the new intrinsic value of Craig Co. per share using the DDM approach? Under these new assumptions, would the stock currently be a buy, sell, or hold? (5 pt.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started