Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer for question 3 Question Two Antonio is buying a house for N$960,000. He has to pay a 10% deposit and can secure a bond

Answer for question 3

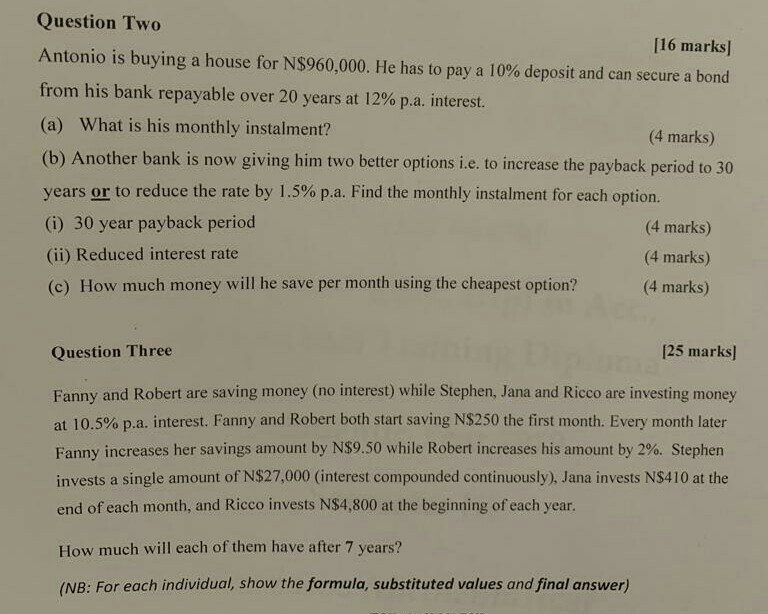

Question Two Antonio is buying a house for N$960,000. He has to pay a 10% deposit and can secure a bond from his bank repayable over 20 years at 12% p.a. interest. (a) What is his monthly instalment? (b) Another bank is now giving him two better options i.e. to increase the payback period to 30 years or to reduce the rate by 1.5% pa. Find the monthly instalment for each option. (0) 30 year payback period (ii) Reduced interest rate (c) How much money will he save per month using the cheapest option? 16 marks (4 marks) (4 marks) (4 marks) (4 marks) [25 marks Question Three Fanny and Robert are saving money (no interest) while Stephen, Jana and Ricco are investing money at 10.5% pa, interest. Fanny and Robert both start saving N$250 the first month. Every month later Fanny increases her savings amount by N$9.50 while Robert increases his amount by 2%. Stephen invests a single amount of N$27,000 (interest compounded continuously), Jana invests N$410 at the end of each month, and Ricco invests N$4,800 at the beginning of each year. How much will each of them have after 7 years? (NB: For each individual, show the formula, substituted values and final answer)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started