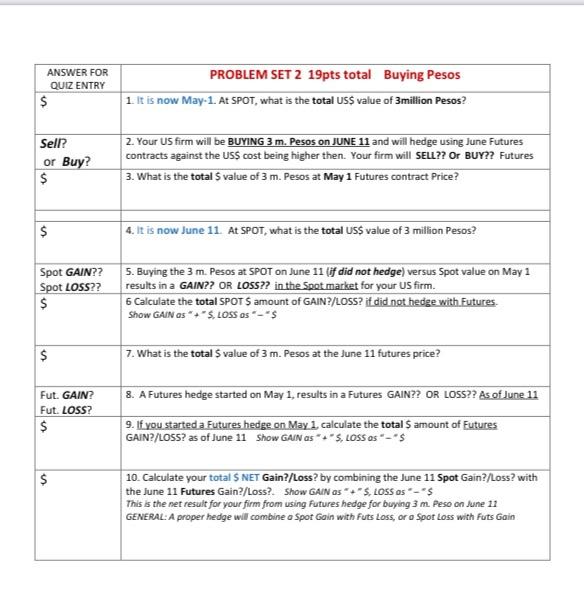

ANSWER FOR QUIZ ENTRY $ PROBLEM SET 2 19pts total Buying Pesos 1. It is now May-1. At SPOT, what is the total US$ value of 3million pesos? Sell? or Buy? $ 2. Your US firm will be BUYING 3 m. Pesos on JUNE 11 and will hedge using June Futures contracts against the US$ cost being higher then. Your firm will SELL?? Or BUY?? Futures 3. What is the total 5 value of 3 m. Pesos at May 1 Futures contract Price? $ 4. It is now June 11 At SPOT, what is the total US$ value of 3 million Pesos? Spot GAIN?? Spot LOSS?? $ 5. Buying the 3 m. Pesos at SPOT on June 11 (if did not hedge) versus Spot value on May 1 results in a GAIN?? OR LOSS?? in the Spot market for your US firm. 6 Calculate the total SPOTS amount of GAIN?/LOSS? it did not hedge with Futures. Show GAIN as 'S, LOSS os "-"$ $ 7. What is the total value of 3 m. Pesos at the June 11 futures price? 8. A Futures hedge started on May 1, results in a futures GAIN?? OR LOSS?? As of June 11 Fut. GAIN? Fut. LOSS? $ 9. If you started a Futures hedge on May 1 calculate the total amount of Futures GAIN?/LOSS? as of June 11 Show GAIN as * .-S. LOSS OS - S $ 10. Calculate your total $ NET Gain?/Loss? by combining the June 11 Spot Gain?/Loss? with the June 11 Futures Gain?/Loss?. Show GAIN as+, LOSS OS -5 This is the net result for your firm from using futures hedge for buying 3 m Peso on June 11 GENERAL: A proper hedge will combine o Spot Gain with Futs Loss, or o Spot Loss with Futs Gain JUNE FUTURES PRICE, S/Peso (BLUE) Daily Peso SPOT Price (RED) DATE $0.0465 . $0.0455 $0.0445 May 1 May 4 Mays May 5 May 7 May 11 May 12 May 13 May 14 May 15 May 18 May 19 May 20 May 21 May 22 May 26 May 22 May 28 May 29 un lun und uns lun. lun JUNE MA PESO Futures Spot Price Price by date $ 0.0402 $ 0.0406 0.00099 0.0415 0.04159 0.0416 0.04095 0.041 0.0413 0.0416 0.04158 0.0418 0.0411 0.041 0.04083 0.0413 0.0414 0.0419 0.04148 0.0412 0.04196 00421 0.04177 0.04223 0.04317 0.04310 0.04346 0.0437 0.04381 0.044 0.04492 0.04504 0.04472 0.04483 0.04499 0.04503 0.04496 0.0451 0.04588 0.0459 0.04586 0.0459 0.04568 0.0456 0.04616 0.0463 0.04629 0.046513 0.0457 00456 0.04575 0.0457 0.04398 001394 0.04473 0.045 50.0435 30.0425 $0.0415 50.0405 $0.0395 10 ||||| 11) Mays May 4 May 15 May 13 May. May 12 May 28 May.27 May 22 May.25 May 20 May 21 May.19 11 12 10 May 1 May May. May 18 May 29