Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer for this and solving for the last question thank you Which of the following is true? 2 points * If the entity elects Cost

answer for this and solving for the last question thank you

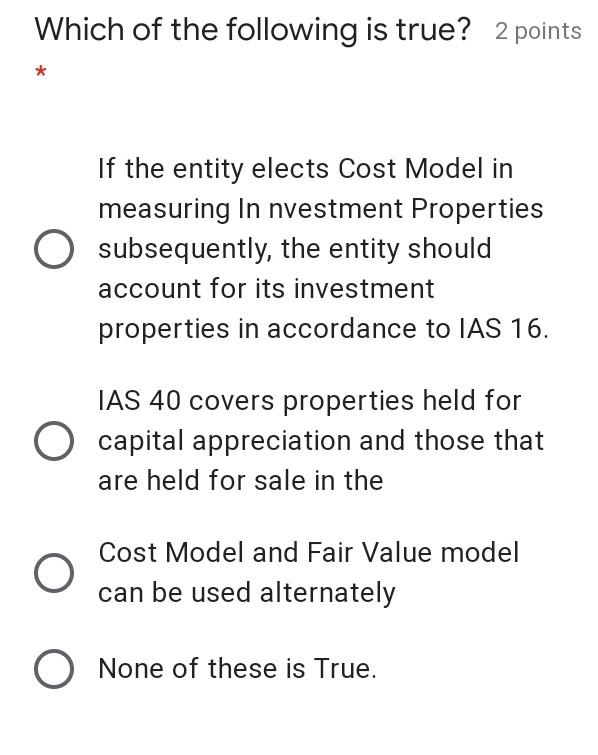

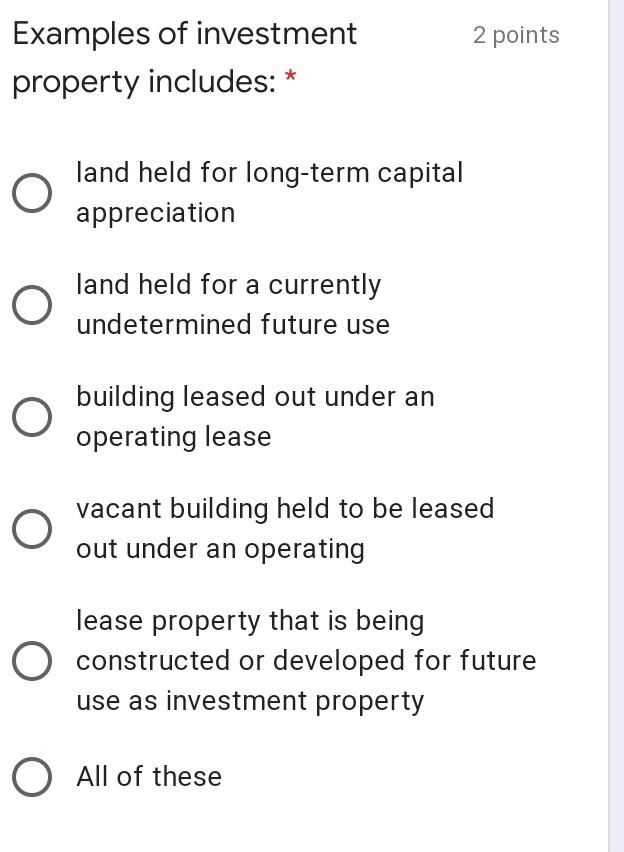

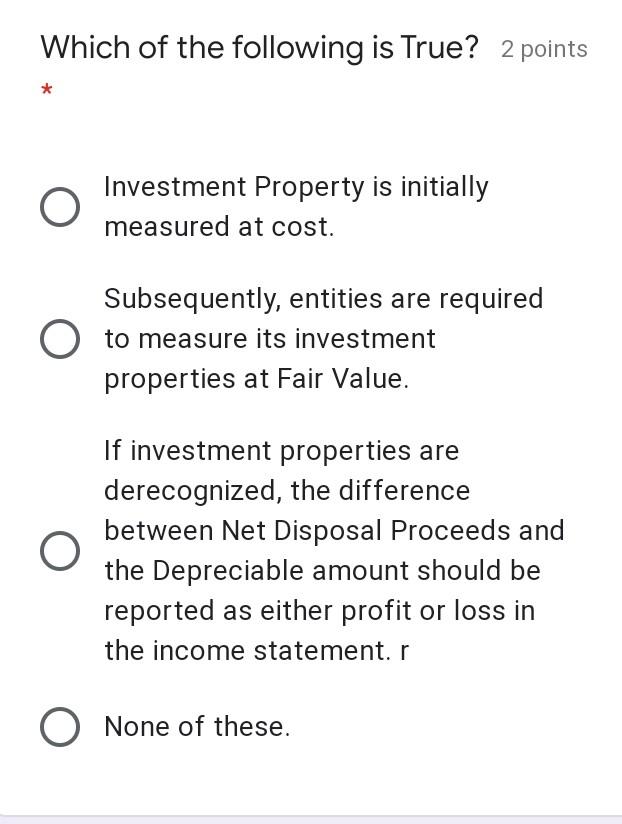

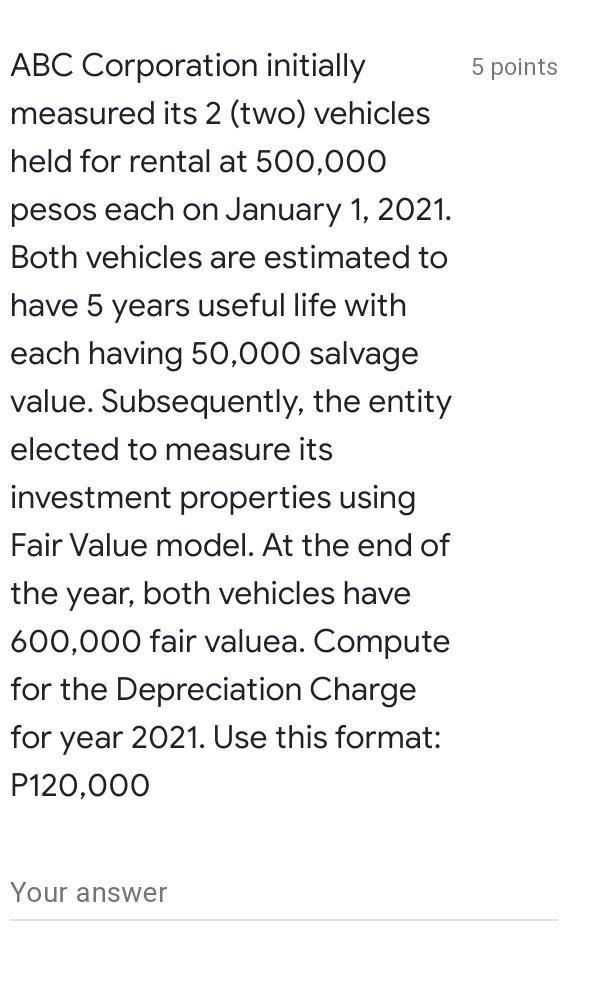

Which of the following is true? 2 points * If the entity elects Cost Model in measuring In nvestment Properties subsequently, the entity should account for its investment properties in accordance to IAS 16. IAS 40 covers properties held for capital appreciation and those that are held for sale in the Cost Model and Fair Value model can be used alternately O None of these is True. . 2 points Examples of investment property includes: * land held for long-term capital appreciation O land held for a currently undetermined future use building leased out under an operating lease O vacant building held to be leased out under an operating lease property that is being O constructed or developed for future use as investment property O All of these Which of the following is True? 2 points Investment Property is initially measured at cost. Subsequently, entities are required O to measure its investment properties at Fair Value. O If investment properties are derecognized, the difference between Net Disposal Proceeds and the Depreciable amount should be reported as either profit or loss in the income statement. r O None of these. 5 points ABC Corporation initially measured its 2 (two) vehicles held for rental at 500,000 pesos each on January 1, 2021. Both vehicles are estimated to have 5 years useful life with each having 50,000 salvage value. Subsequently, the entity elected to measure its investment properties using Fair Value model. At the end of the year, both vehicles have 600,000 fair valuea. Compute for the Depreciation Charge for year 2021. Use this format: P120,000 YourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started