ANSWER FORM BELOW:

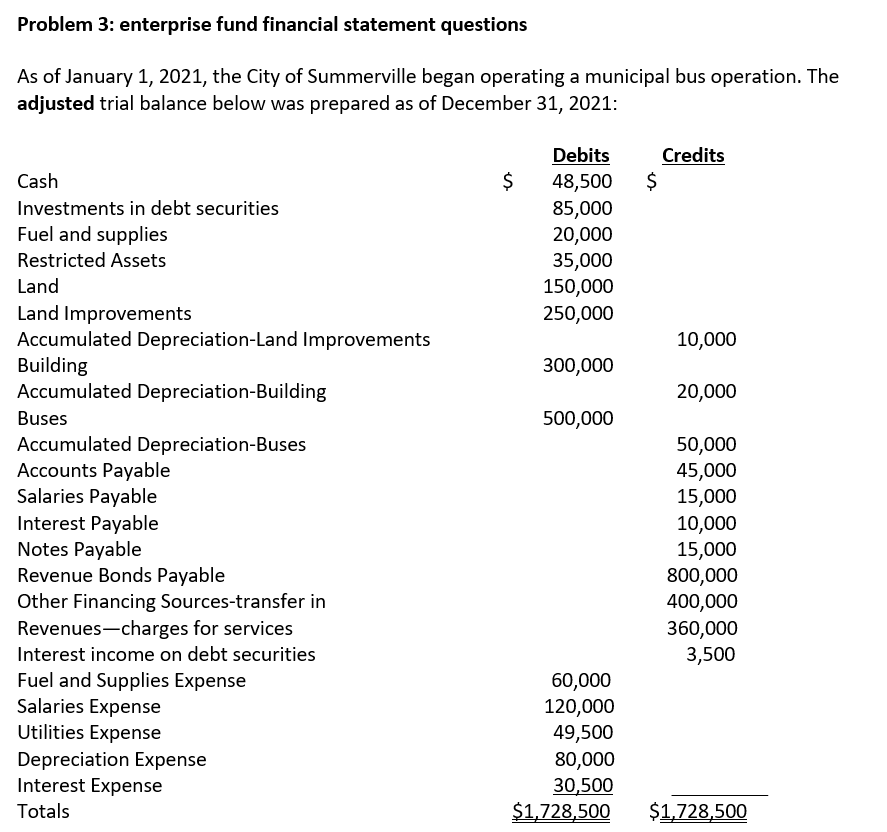

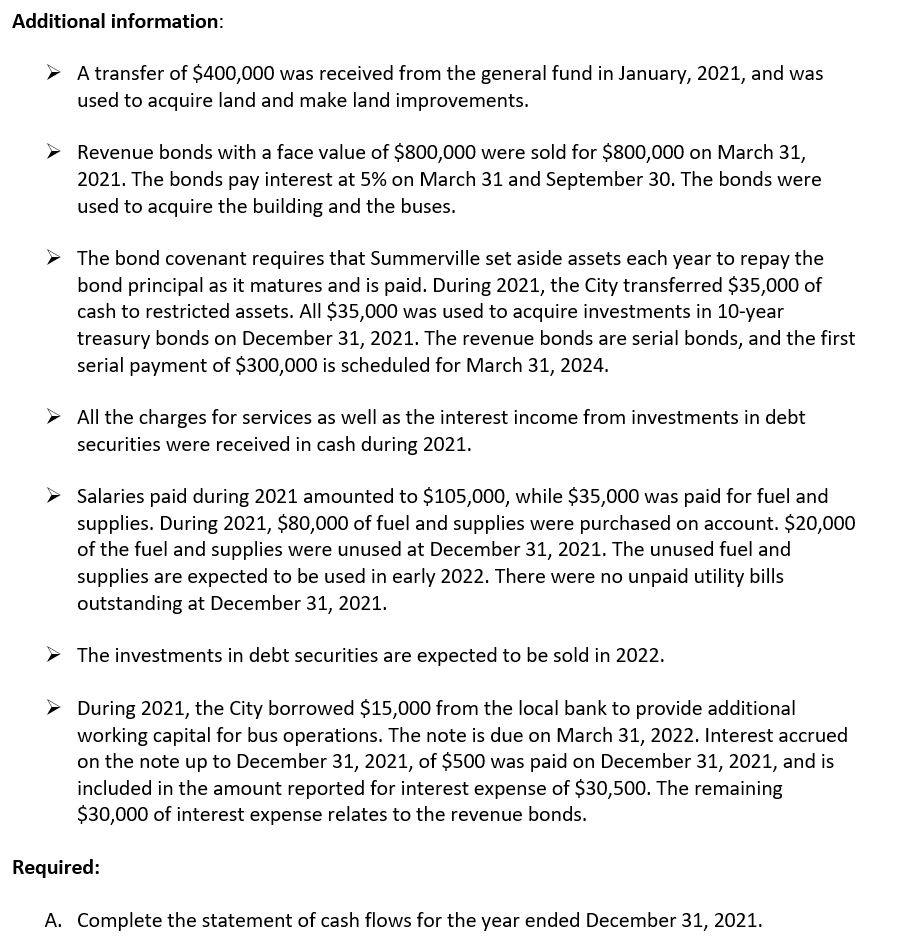

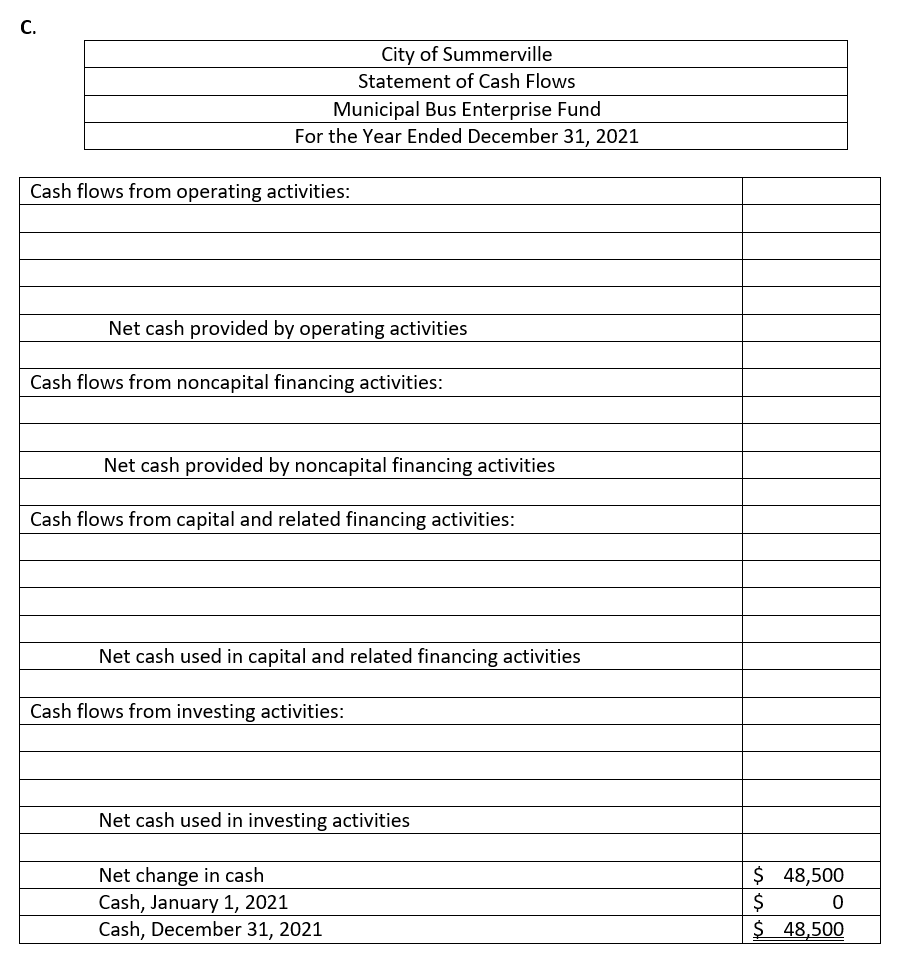

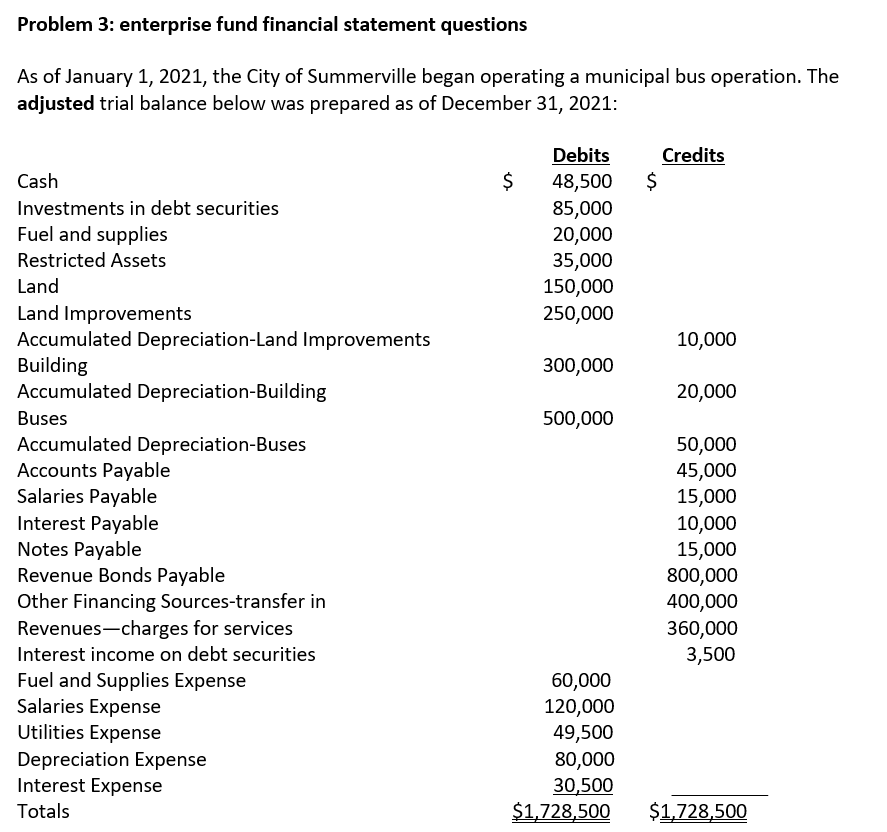

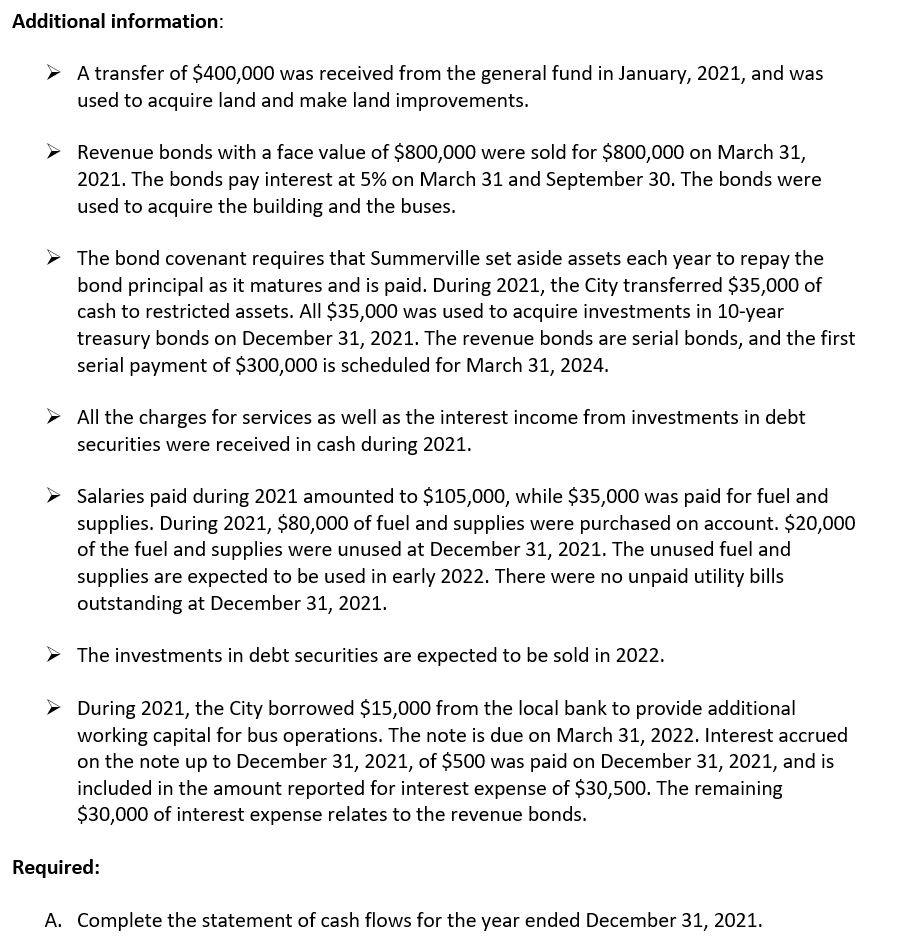

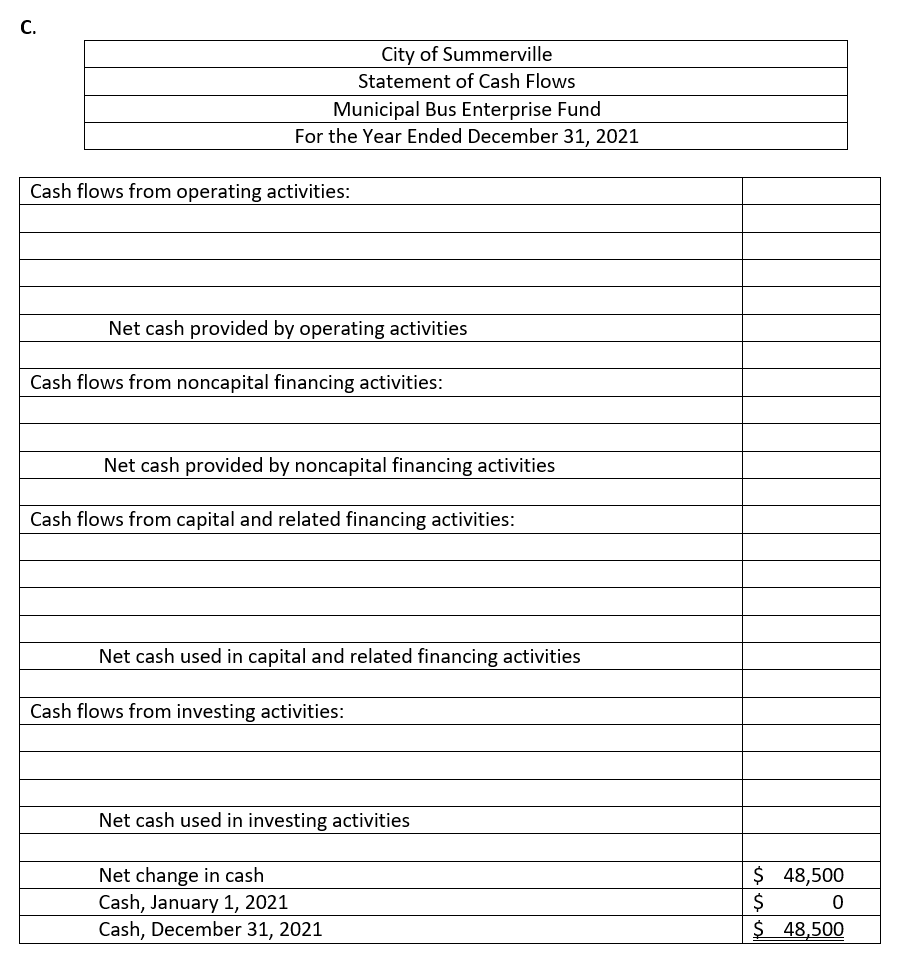

Problem 3: enterprise fund financial statement questions As of January 1, 2021, the City of Summerville began operating a municipal bus operation. The adjusted trial balance below was prepared as of December 31, 2021: Credits $ $ Debits 48,500 85,000 20,000 35,000 150,000 250,000 10,000 300,000 20,000 500,000 Cash Investments in debt securities Fuel and supplies Restricted Assets Land Land Improvements Accumulated Depreciation-Land Improvements Building Accumulated Depreciation-Building Buses Accumulated Depreciation-Buses Accounts Payable Salaries Payable Interest Payable Notes Payable Revenue Bonds Payable Other Financing Sources-transfer in Revenues-charges for services Interest income on debt securities Fuel and Supplies Expense Salaries Expense Utilities Expense Depreciation Expense Interest Expense Totals 50,000 45,000 15,000 10,000 15,000 800,000 400,000 360,000 3,500 60,000 120,000 49,500 80,000 30,500 $1,728,500 $1,728,500 Additional information: A transfer of $400,000 was received from the general fund in January, 2021, and was used to acquire land and make land improvements. > Revenue bonds with a face value of $800,000 were sold for $800,000 on March 31, 2021. The bonds pay interest at 5% on March 31 and September 30. The bonds were used to acquire the building and the buses. The bond covenant requires that Summerville set aside assets each year to repay the bond principal as it matures and is paid. During 2021, the City transferred $35,000 of cash to restricted assets. All $35,000 was used to acquire investments in 10-year treasury bonds on December 31, 2021. The revenue bonds are serial bonds, and the first serial payment of $300,000 is scheduled for March 31, 2024. All the charges for services as well as the interest income from investments in debt securities were received in cash during 2021. Salaries paid during 2021 amounted to $105,000, while $35,000 was paid for fuel and supplies. During 2021, $80,000 of fuel and supplies were purchased on account. $20,000 of the fuel and supplies were unused at December 31, 2021. The unused fuel and supplies are expected to be used in early 2022. There were no unpaid utility bills outstanding at December 31, 2021. The investments in debt securities are expected to be sold in 2022. > During 2021, the City borrowed $15,000 from the local bank to provide additional working capital for bus operations. The note is due on March 31, 2022. Interest accrued on the note up to December 31, 2021, of $500 was paid on December 31, 2021, and is included in the amount reported for interest expense of $30,500. The remaining $30,000 of interest expense relates to the revenue bonds. Required: A. Complete the statement of cash flows for the year ended December 31, 2021. C. City of Summerville Statement of Cash Flows Municipal Bus Enterprise Fund For the Year Ended December 31, 2021 Cash flows from operating activities: Net cash provided by operating activities Cash flows from noncapital financing activities: Net cash provided by noncapital financing activities Cash flows from capital and related financing activities: Net cash used in capital and related financing activities Cash flows from investing activities: Net cash used in investing activities Net change in cash Cash, January 1, 2021 Cash, December 31, 2021 $ 48,500 $ 0 $ 48,500 Problem 3: enterprise fund financial statement questions As of January 1, 2021, the City of Summerville began operating a municipal bus operation. The adjusted trial balance below was prepared as of December 31, 2021: Credits $ $ Debits 48,500 85,000 20,000 35,000 150,000 250,000 10,000 300,000 20,000 500,000 Cash Investments in debt securities Fuel and supplies Restricted Assets Land Land Improvements Accumulated Depreciation-Land Improvements Building Accumulated Depreciation-Building Buses Accumulated Depreciation-Buses Accounts Payable Salaries Payable Interest Payable Notes Payable Revenue Bonds Payable Other Financing Sources-transfer in Revenues-charges for services Interest income on debt securities Fuel and Supplies Expense Salaries Expense Utilities Expense Depreciation Expense Interest Expense Totals 50,000 45,000 15,000 10,000 15,000 800,000 400,000 360,000 3,500 60,000 120,000 49,500 80,000 30,500 $1,728,500 $1,728,500 Additional information: A transfer of $400,000 was received from the general fund in January, 2021, and was used to acquire land and make land improvements. > Revenue bonds with a face value of $800,000 were sold for $800,000 on March 31, 2021. The bonds pay interest at 5% on March 31 and September 30. The bonds were used to acquire the building and the buses. The bond covenant requires that Summerville set aside assets each year to repay the bond principal as it matures and is paid. During 2021, the City transferred $35,000 of cash to restricted assets. All $35,000 was used to acquire investments in 10-year treasury bonds on December 31, 2021. The revenue bonds are serial bonds, and the first serial payment of $300,000 is scheduled for March 31, 2024. All the charges for services as well as the interest income from investments in debt securities were received in cash during 2021. Salaries paid during 2021 amounted to $105,000, while $35,000 was paid for fuel and supplies. During 2021, $80,000 of fuel and supplies were purchased on account. $20,000 of the fuel and supplies were unused at December 31, 2021. The unused fuel and supplies are expected to be used in early 2022. There were no unpaid utility bills outstanding at December 31, 2021. The investments in debt securities are expected to be sold in 2022. > During 2021, the City borrowed $15,000 from the local bank to provide additional working capital for bus operations. The note is due on March 31, 2022. Interest accrued on the note up to December 31, 2021, of $500 was paid on December 31, 2021, and is included in the amount reported for interest expense of $30,500. The remaining $30,000 of interest expense relates to the revenue bonds. Required: A. Complete the statement of cash flows for the year ended December 31, 2021. C. City of Summerville Statement of Cash Flows Municipal Bus Enterprise Fund For the Year Ended December 31, 2021 Cash flows from operating activities: Net cash provided by operating activities Cash flows from noncapital financing activities: Net cash provided by noncapital financing activities Cash flows from capital and related financing activities: Net cash used in capital and related financing activities Cash flows from investing activities: Net cash used in investing activities Net change in cash Cash, January 1, 2021 Cash, December 31, 2021 $ 48,500 $ 0 $ 48,500