general transactions

T account

multi- steps income statement

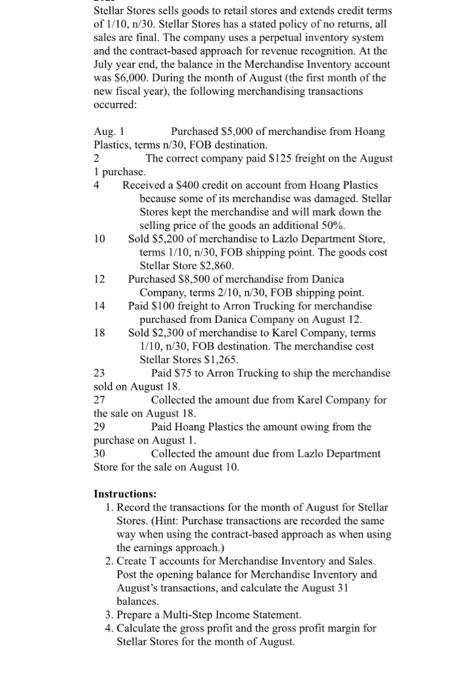

Stellar Stores sells goods to retail stores and extends credit terms of 1/10,n/30. Stellar Stores has a stated policy of no returns, all sales are final. The company uses a perpetual inventory system and the contract-based approach for revenue recognition. At the July year end, the balance in the Merchandise Inventory account was $6,000. During the month of August (the first month of the new fiscal year), the following merchandising transactions occurred: Aug. 1 Purchased $5,000 of merchandise from Hoang Plastics, terms n/30, FOB destination. 2 The correct company paid $125 freight on the August I purchase. 4 Received a $400 credit on account from Hoang Plastics because some of its merchandise was damaged. Stellar Stores kept the merchandise and will mark down the selling price of the goods an additional 50%. 10 Sold \$5,200 of merchandise to Lazlo Department Store, terms 1/10,n/30,FOB shipping point. The goods cost Stellar Store $2,860. 12 Purchased $8,500 of merchandise from Danica Company, terms 2/10,n/30, FOB shipping point. 14 Paid $100 freight to Arron Trucking for merchandise purchased from Danica Company on August 12. 18 Sold \$2,300 of merchandise to Karel Company, terms 1/10,n/30, FOB destination. The merchandise cost Stellar Stores \$1,265. 23 Paid $75 to Arron Trucking to ship the merchandise sold on August 18. 27 Collected the amount due from Karel Company for the sale on August 18. 29 Paid Hoang Plastics the amount owing from the purchase on August 1. 30 Collected the amount due from Lazlo Department Store for the sale on August 10. Instructions: 1. Record the transactions for the month of August for Stellar Stores. (Hint: Purchase transactions are recorded the same way when using the contract-based approach as when using the earnings approach.) 2. Create T accounts for Merchandise Inventory and Sales. Post the opening balance for Merchandise Inventory and August's transactions, and calculate the August 31 balances. 3. Prepare a Multi-Step Income Statement. 4. Calculate the gross profit and the gross profit margin for Stellar Stores for the month of August. Stellar Stores sells goods to retail stores and extends credit terms of 1/10,n/30. Stellar Stores has a stated policy of no returns, all sales are final. The company uses a perpetual inventory system and the contract-based approach for revenue recognition. At the July year end, the balance in the Merchandise Inventory account was $6,000. During the month of August (the first month of the new fiscal year), the following merchandising transactions occurred: Aug. 1 Purchased $5,000 of merchandise from Hoang Plastics, terms n 30,FOB destination. 2 The correct company paid $125 freight on the August 1 purchase. 4 Received a $400 credit on account from Hoang Plastics because some of its merchandise was damaged. Stellar Stores kept the merchandise and will mark down the selling price of the goods an additional 50%. 10 Sold 55,200 of merchandise to Lazlo Department Store, terms 1/10,n/30,FOB shipping point. The goods cost Stellar Store $2,860. 12 Purchased $8,500 of merchandise from Danica Company, terms 2/10,n/30,FOB shipping point. 14 Paid $100 freight to Arron Trucking for merchandise purchased from Danica Company on August 12. 18 Sold $2,300 of merchandise to Karel Company, terms 1/10,n/30,FOB destination. The merchandise cost Stellar Stores $1,265. 23 Paid $75 to Arron Trucking to ship the merchandise sold on August 18. 27 Collected the amount due from Karel Company for the sale on August 18. 29 Paid Hoang Plastics the amount owing from the purchase on August 1. 30 Collected the amount due from Lazlo Department Store for the sale on August 10. Instructions: 1. Record the transactions for the month of August for Stellar Stores. (Hint: Purchase transactions are recorded the same way when using the contract-based approach as when using the earnings approach.) 2. Create T accounts for Merchandise Inventory and Sales. Post the opening balance for Merchandise Inventory and August's transactions, and calculate the August 31 balances. 3. Prepare a Multi-Step Income Statement. 4. Calculate the gross profit and the gross profit margin for Stellar Stores for the month of August. Stellar Stores sells goods to retail stores and extends credit terms of 1/10,n/30. Stellar Stores has a stated policy of no returns, all sales are final. The company uses a perpetual inventory system and the contract-based approach for revenue recognition. At the July year end, the balance in the Merchandise Inventory account was $6,000. During the month of August (the first month of the new fiscal year), the following merchandising transactions occurred: Aug. 1 Purchased $5,000 of merchandise from Hoang Plastics, terms n/30, FOB destination. 2 The correct company paid $125 freight on the August I purchase. 4 Received a $400 credit on account from Hoang Plastics because some of its merchandise was damaged. Stellar Stores kept the merchandise and will mark down the selling price of the goods an additional 50%. 10 Sold \$5,200 of merchandise to Lazlo Department Store, terms 1/10,n/30,FOB shipping point. The goods cost Stellar Store $2,860. 12 Purchased $8,500 of merchandise from Danica Company, terms 2/10,n/30, FOB shipping point. 14 Paid $100 freight to Arron Trucking for merchandise purchased from Danica Company on August 12. 18 Sold \$2,300 of merchandise to Karel Company, terms 1/10,n/30, FOB destination. The merchandise cost Stellar Stores \$1,265. 23 Paid $75 to Arron Trucking to ship the merchandise sold on August 18. 27 Collected the amount due from Karel Company for the sale on August 18. 29 Paid Hoang Plastics the amount owing from the purchase on August 1. 30 Collected the amount due from Lazlo Department Store for the sale on August 10. Instructions: 1. Record the transactions for the month of August for Stellar Stores. (Hint: Purchase transactions are recorded the same way when using the contract-based approach as when using the earnings approach.) 2. Create T accounts for Merchandise Inventory and Sales. Post the opening balance for Merchandise Inventory and August's transactions, and calculate the August 31 balances. 3. Prepare a Multi-Step Income Statement. 4. Calculate the gross profit and the gross profit margin for Stellar Stores for the month of August. Stellar Stores sells goods to retail stores and extends credit terms of 1/10,n/30. Stellar Stores has a stated policy of no returns, all sales are final. The company uses a perpetual inventory system and the contract-based approach for revenue recognition. At the July year end, the balance in the Merchandise Inventory account was $6,000. During the month of August (the first month of the new fiscal year), the following merchandising transactions occurred: Aug. 1 Purchased $5,000 of merchandise from Hoang Plastics, terms n 30,FOB destination. 2 The correct company paid $125 freight on the August 1 purchase. 4 Received a $400 credit on account from Hoang Plastics because some of its merchandise was damaged. Stellar Stores kept the merchandise and will mark down the selling price of the goods an additional 50%. 10 Sold 55,200 of merchandise to Lazlo Department Store, terms 1/10,n/30,FOB shipping point. The goods cost Stellar Store $2,860. 12 Purchased $8,500 of merchandise from Danica Company, terms 2/10,n/30,FOB shipping point. 14 Paid $100 freight to Arron Trucking for merchandise purchased from Danica Company on August 12. 18 Sold $2,300 of merchandise to Karel Company, terms 1/10,n/30,FOB destination. The merchandise cost Stellar Stores $1,265. 23 Paid $75 to Arron Trucking to ship the merchandise sold on August 18. 27 Collected the amount due from Karel Company for the sale on August 18. 29 Paid Hoang Plastics the amount owing from the purchase on August 1. 30 Collected the amount due from Lazlo Department Store for the sale on August 10. Instructions: 1. Record the transactions for the month of August for Stellar Stores. (Hint: Purchase transactions are recorded the same way when using the contract-based approach as when using the earnings approach.) 2. Create T accounts for Merchandise Inventory and Sales. Post the opening balance for Merchandise Inventory and August's transactions, and calculate the August 31 balances. 3. Prepare a Multi-Step Income Statement. 4. Calculate the gross profit and the gross profit margin for Stellar Stores for the month of August