Question

Answer: i 6.4.5 The effective annual yield on a one-year zero coupon bond is 8% and the effective annual interest rate on a two-year zero

Answer:

Answer:

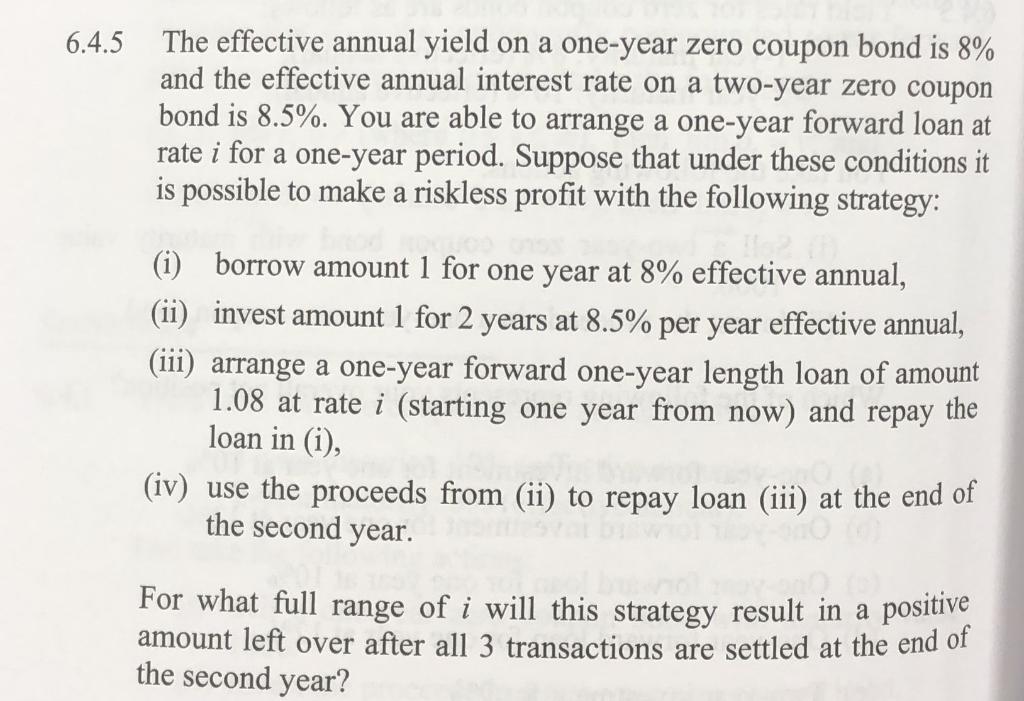

i 6.4.5 The effective annual yield on a one-year zero coupon bond is 8% and the effective annual interest rate on a two-year zero coupon bond is 8.5%. You are able to arrange a one-year forward loan at rate i for a one-year period. Suppose that under these conditions it is possible to make a riskless profit with the following strategy: (i) borrow amount 1 for one year at 8% effective annual, (ii) invest amount 1 for 2 years at 8.5% per year effective annual, (iii) arrange a one-year forward one-year length loan of amount 1.08 at rate i (starting one year from now) and repay the loan in (i), (iv) use the proceeds from (ii) to repay loan (iii) at the end of the second year. For what full range of i will this strategy result in a positive amount left over after all 3 transactions are settled at the end of the second year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started