Question: (answer if you can will upvote for you!!!) 1. Assess the culture of RVPT through Scheins model. a. How has it changed over time and

(answer if you can will upvote for you!!!)

1. Assess the culture of RVPT through Scheins model.

a. How has it changed over time and what impact has it had on people?

2. Discuss how RVPTs PT-centric ownership model influences its culture per the Competing Values Framework (Quinn, 1988).

3. What is the relationship between RVPTs culture and the organizations effectiveness?

4. Assess the risks and benefits of the Private Equity offer (people, financials, etc.)

a. How much is at stake?

b. Why is the Private Equity offering so much?

c. How may the Private Equity change RVPTs culture and performance?

5. Outline a recommendation and implementation plan for Horsfield to present to the shareholders.

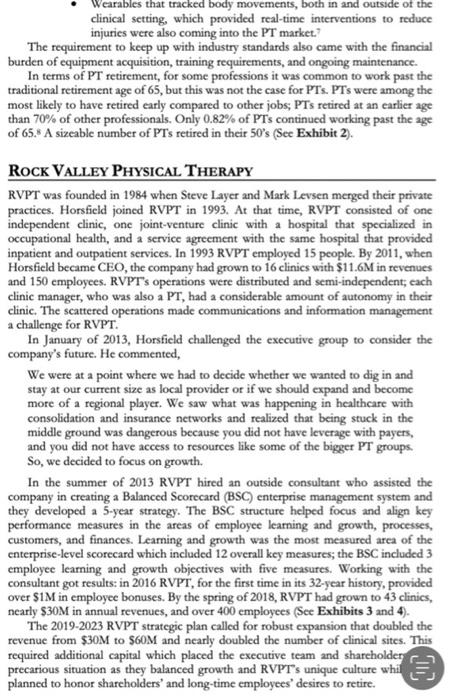

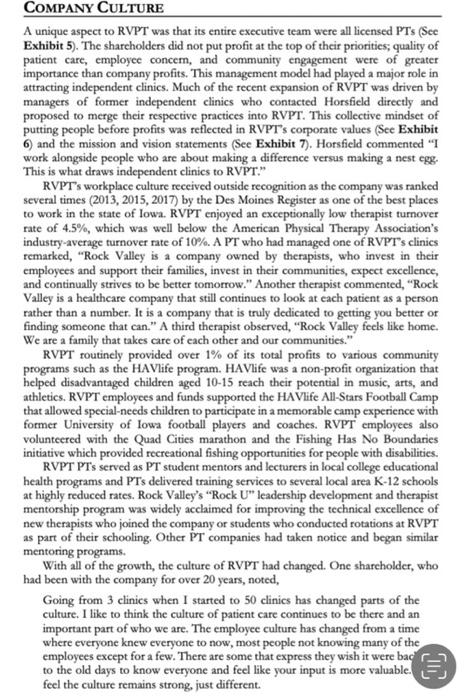

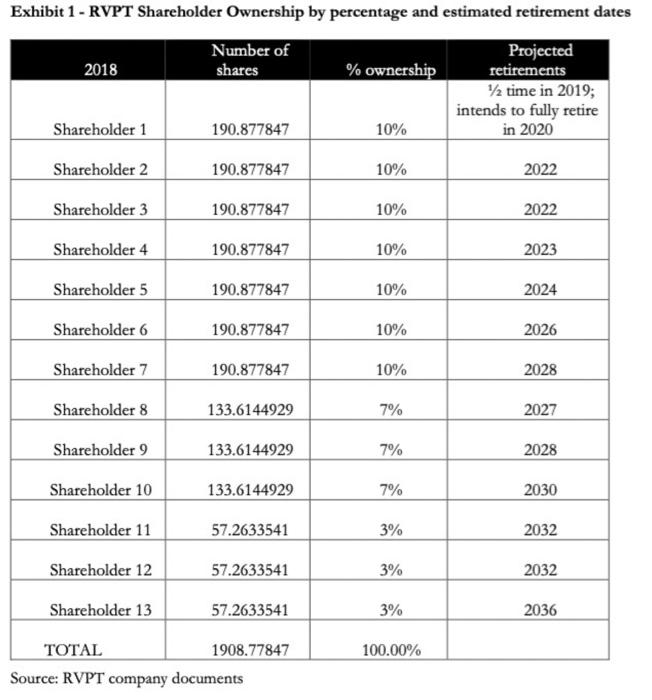

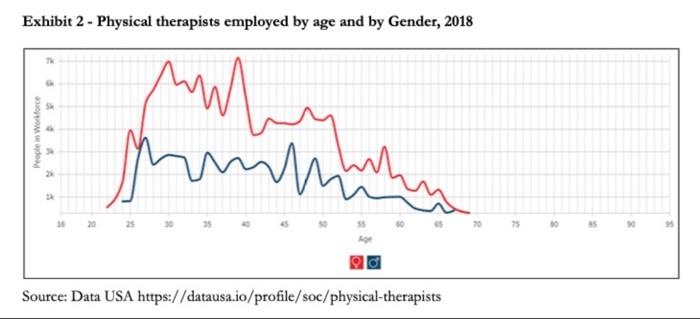

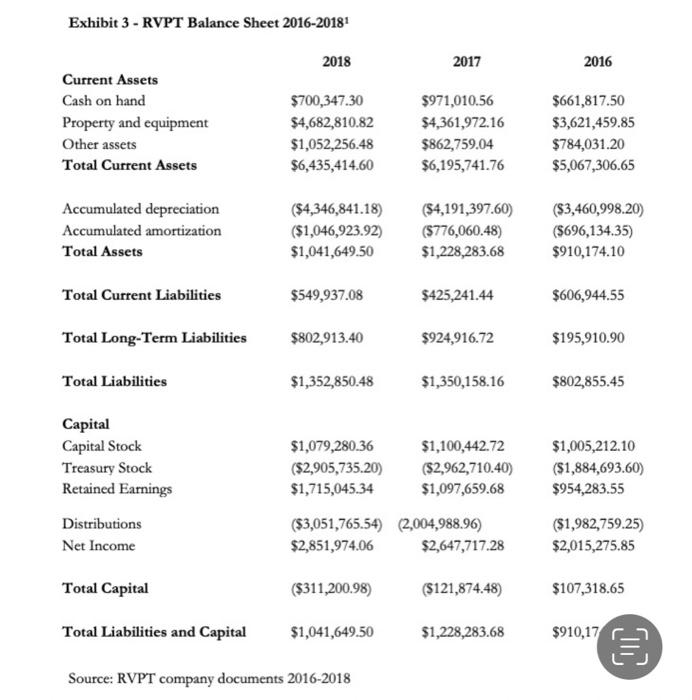

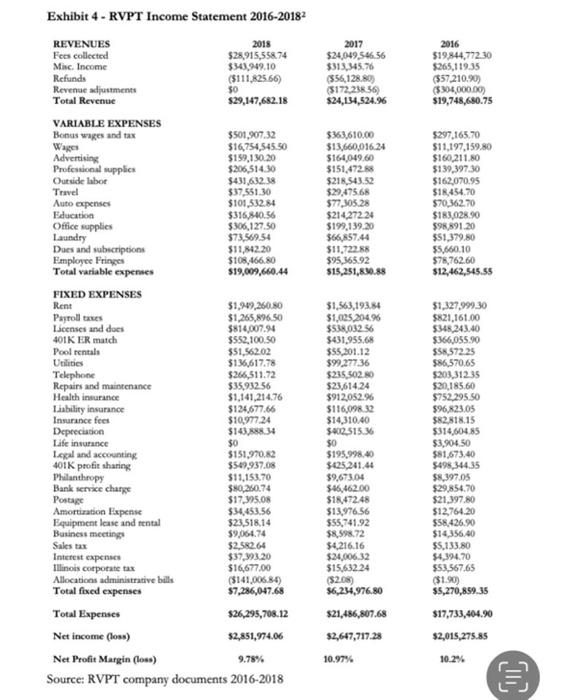

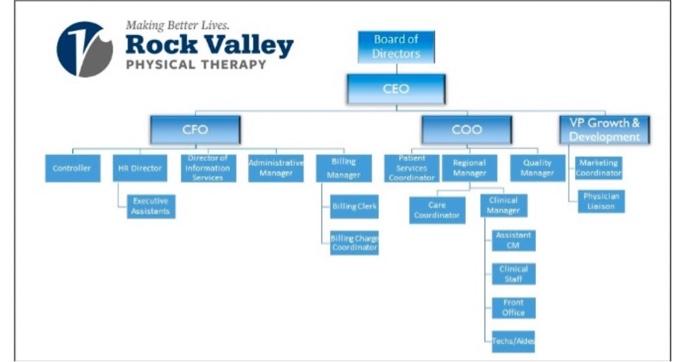

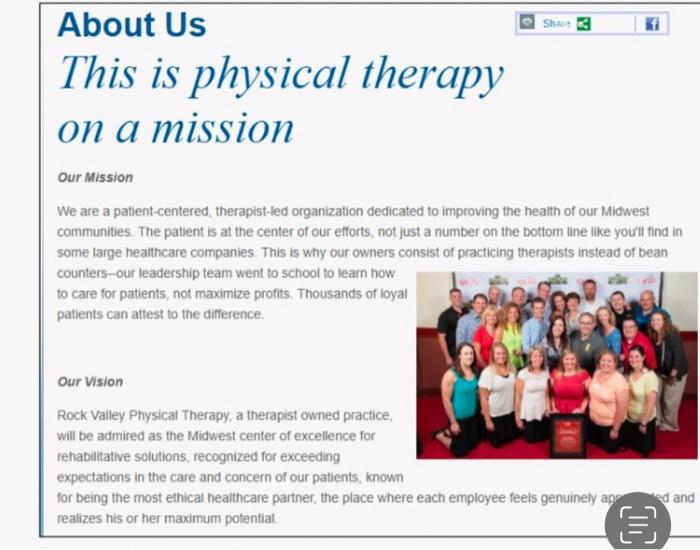

NI RE Rock Valley Physical Therapy: Private Equity and Culture Terry McGovern, University of Wisconsin-Parkside Charles Hilterbrand, University of Mississippi A BIG WIN AND A BIG DECISION It was mid-April of 2018 in Molinc, Illinois. Dr. Mike Horsfield, CEO, MBA, and board-certified specialist in orthopedic physical therapy (PT) of Rock Valley Physical Therapy (RVPT), had come to a fork in the road during his commute home which reminded him of his workplace dilemma. Tomorrow evening, Horsfield had a meeting scheduled with the other 12 RVPT shareholders, all of whom were board-certified and practicing PTs. The group was celebrating a successful year of growth that resulted in RVPT becoming the largest privately held PT group in America and the largest in the Midwest Region of the U.S.. Horsfield had been approached with a tempting buyout offer from a private equity (PE) firm. Horsfield thought to himself, "Things were going well and that was part of the problem." RVPT experienced meteoric growth through acquisitions from 2013 to 2018, more than doubling the number of clinics. The company used bank financing to fund its aggressive growth strategy. Most of the key shareholders and executive officers at RVPT were nearing retirement (See Exhibit 1), which overlapped with their 5-year growth strategy. The line of credit extended by the bank was sufficient to finance RVPT's stated growth strategy, but it was not enough to also cover shareholder buybacks and exit packages for key non-shareholder employees. Horsfield needed to find a way to compensate exiting executives and key staff while continuing the company's growth strategy. The PE offer might accomplish this, but at what cost to RVPT's culture? WORKING AS A PHYSICAL THERAPIST Physical therapists played a key role with recuperation, therapy, and prevention of chronic ailments, discases, or injuries. They assisted patients to regain their movement and manage their pain. PT's offered their services in many different settings including hospitals, outpatient clinics, private practices, sports and fitness facilities, home health programs, work settings, and senior care facilities. Copyright 2020 by the Care Research Jomal and by Terry McGovern and Charles Hilterbrand. The authors developed this field-rescatched case for class discussion rather than to illustrate either effective or ineffective handling of the situation. Contact person: Terry M McGovern, University of Wisconsin-Parkside megovert@wp.edu. The company, case characters and situation are real however, financial figures have been disguised at the request of the company, Physical therapists treated a broad range of patients with different demographic backgrounds. This included senior citizens recovering from stroke to young athletes rehabilitating sports injuries. There were also a wide range of specializations among PTS. RVPT included specialized expertise in occupational health and wellness, fitness services, corporate wellness, orthopedics, sports, specialized hand therapies, neurological rehabilitative treatments, sports performance, and women's health.2 THE PHYSICAL THERAPY INDUSTRY As of 2018, the PT industry in the U.S. consisted of 113,178 mostly independent clinics earning $35.2B in revenue, $4.7B in profits. There were no major players in the PT industry. The largest three PT practices accounted for only 8.4% of the industry revenue; no one PT firm earned more than 5% of the total industry revenue. Wages were the primary costs for PT clinics accounting for 56% of a typical PT clinic's operation based on national averages.+ Projecting future wage costs depended on the forecasted supply and demand for PT's. The demand for PTs was expected to grow 28% from 2016-2026; this was much faster than the 7% rate forecasted for all industries. PT job growth was due to a large and aging baby boomer population consisting of seniors who stayed active but were also vulnerable to age-related health conditions such as strokes, which often required PT due to loss of movement. Additionally, PT job growth was also tied to mobility problems created by chronic conditions such as obesity and diabetes. Like many industries, technology played a significant role with PT diagnosis, treatment, and patient engagement. These innovations included: Smartphone apps that provided medical glossaries, video demonstrations of exercises, diagnostic tools, clinical tests, and ability to do 360-degree anatomy scans. PTGenie (https://mypugenic.com/ was an example of a PT apps Exoskeleton suits made of aluminum or titanium that patients wore to help with a range of biomechanical alignments and movements. Ekso Suit was an example of this technology: Rehab robots that assisted PTs with exercises reduced the recovery time for patients dcaling with brain injuries. Robots increased the number of exercise repetitions performed by a patient. Lokomat, a robotic treadmill that promoted task-specific repetitive movement was an example of a rehabilitative robot; Video game platforms that used motion-sensor movements, such as Nintendo's Wii, improved patient engagement with their recovery and allowed patients to rchab at home; Virtual reality (VR) allowed for the use of immersive, interactive therapies in a VR environment. VR had been used in PT for over 10 years, but a recent technology called CAREN (Computer Assisted Rehabilitation Environment) provided new possibilities for patient diagnosis and treatment; Telemedicine, which used pre-existing technology like the Microsoft Xbox Kinect, allowed for web-based therapy programs that incorporated instructional videos, coaching, monitoring, ey and educational material. Jintronix and Reflexion Health such products, and Wearables that tracked body movements, both in and outside of the clinical setting, which provided real-time interventions to reduce injuries were also coming into the PT market. The requirement to keep up with industry standards also came with the financial burden of equipment acquisition, training requirements, and ongoing maintenance. In terms of PT retirement, for some professions it was common to work past the traditional retirement age of 65, but this was not the case for PTs. PTs were among the most likely to have retired early compared to other jobs; PTs retired at an earlier age than 70% of other professionals . Only 0.82% of PTs continued working past the age of 65. A sizeable number of PTs retired in their 50's (See Exhibit 2). Rock VALLEY PHYSICAL THERAPY RVPT was founded in 1984 when Steve Layer and Mark Levsen merged their private practices. Horsfield joined RVPT in 1993. At that time, RVPT consisted of one independent clinic, one joint-venture clinic with a hospital that specialized in occupational health, and a service agreement with the same hospital that provided inpatient and outpatient services. In 1993 RVPT employed 15 people. By 2011, when Horsfield became CEO, the company had grown to 16 clinics with $11.6M in revenues and 150 employees. RVPT's operations were distributed and semi-independent, each clinic manager, who was also a PT, had a considerable amount of autonomy in their clinic. The scattered operations made communications and information management a challenge for RVPT. In January of 2013, Horsfield challenged the executive group to consider the company's future. He commented, We were at a point where we had to decide whether we wanted to dig in and stay at our current size as local provider or if we should expand and become more of a regional player. We saw what was happening in healthcare with consolidation and insurance networks and realized that being stuck in the middle ground was dangerous because you did not have leverage with payers, and you did not have access to resources like some of the bigger PT groups. So, we decided to focus on growth. In the summer of 2013 RVPT hired an outside consultant who assisted the company in creating a Balanced Scorecard (BSC) enterprise management system and they developed a 5-year strategy. The BSC structure helped focus and align key performance measures in the areas of employee learning and growth, processes, customers, and finances. Learning and growth was the most measured arca of the enterprise-level scorecard which included 12 overall key measures; the BSC included 3 employee learning and growth objectives with five measures. Working with the consultant got results: in 2016 RVPT, for the first time in its 32-year history, provided over $1M in employee bonuses. By the spring of 2018, RVPT had grown to 43 clinics, nearly $30M in annual revenues, and over 400 employees (See Exhibits 3 and 4). The 2019-2023 RVPT strategic plan called for robust expansion that doubled the revenue from $30M to $60M and nearly doubled the number of clinical sites. This required additional capital which placed the executive team and shareholder precarious situation as they balanced growth and RVPT's unique culture whil planned to honor shareholders' and long-time employees' desires to retire. COMPANY CULTURE A unique aspect to RVPT was that its entire executive team were all licensed PT's (See Exhibit 5). The sharcholders did not put profit at the top of their priorities, quality of patient care, employee concem, and community engagement were of greater importance than company profits. This management model had played a major role in attracting independent clinics. Much of the recent expansion of RVPT was driven by managers of former independent clinics who contacted Horsfield directly and proposed to merge their respective practices into RVPT. This collective mindset of putting people before profits was reflected in RVPT's corporate values (See Exhibit 6) and the mission and vision statements (See Exhibit 7). Horsfield commented "I work alongside people who are about making a difference versus making a nest egg. This is what draws independent clinics to RVPT." RVPT's workplace culture received outside recognition as the company was ranked several times (2013, 2015, 2017) by the Des Moines Register as one of the best places to work in the state of lowa. RVPT enjoyed an exceptionally low therapist turnover rate of 4.5%, which was well below the American Physical Therapy Association's industry-average turnover rate of 10%. A PT who had managed one of RVPT's clinics remarked, "Rock Valley is a company owned by therapists, who invest in their employees and support their families, invest in their communities, expect excellence, and continually strives to be better tomorrow." Another therapist commented, "Rock Valley is a healthcare company that still continues to look at each patient as a person rather than a number. It is a company that is truly dedicated to getting you better or finding someone that can." A third therapist observed, "Rock Valley feels like home. We are a family that takes care of each other and our communities." RVPT routinely provided over 1% of its total profits to various community programs such as the HAVlife program. HAVlife was a non-profit organization that helped disadvantaged children aged 10-15 reach their potential in music, arts, and athletics. RVPT employees and funds supported the HAVlife All-Stars Football Camp that allowed special needs children to participate in a memorable camp experience with former University of lowa football players and coaches. RVPT employees also volunteered with the Quad Cities marathon and the Fishing Has No Boundaries initiative which provided recreational fishing opportunities for people with disabilities. RVPT PT's served as PT student mentors and lecturers in local college educational health programs and PT's delivered training services to several local area K-12 schools at highly reduced rates. Rock Valley's "Rock U" leadership development and therapist mentorship program was widely acclaimed for improving the technical excellence of new therapists who joined the company or students who conducted rotations at RVPT as part of their schooling, Other PT companies had taken notice and began similar mentoring programs. With all of the growth, the culture of RVPT had changed. One shareholder, who had been with the company for over 20 years, noted, Going from 3 clinics when I started to 50 clinics has changed parts of the culture. I like to think the culture of patient care continues to be there and an important part of who we are. The employee culture has changed from a time where everyone knew everyone to now, most people not knowing many of the employees except for a few. There are some that express they wish it were back to the old days to know everyone and feel like your input is more valuable. feel the culture remains strong, just different Another sharcholder, who had played a key role in developing the growth strategy, commented, Yes, the culture has changed. We have brought on new talent with skills that have allowed us to grow while maintaining our core values. We have developed formal processes to ensure our clinician development and mentoring produces the results we value. We have a leadership training program that allows us to respond to opportunities for growth rather than passing because we did not have the right person at the time. So, I would definitely say the growth has been for the better. The only downside is not knowing everyone's name at company gatherings, right now anyway. THE BUSINESS OF HEALTH CARE Horsfield, who received his MBA in 2001, was the only PT and shareholder with formal business training. He was a shareholder who served as CEO and was the one that the others looked to for advice on the future of RVPT as a business. Horsfield presented the company financials along with areas that where he believed improvements were necessary to maximize RVPT's profits and maintain its commercial viability. Horsfield was certain that RVPT could perform better. Other PT shareholders however, had disagreed with how Horsfield viewed the practice as a business. They felt that RVPT had excelled because of great patient care. One shareholder echoed the sentiments of most of the clinicians, saying "I am still a firm believer that "Great care is good business so ensuring RVPT can continue to practice in the best interest of the patient and be paid fairly for the services provided will lead to long term business success." Horsfield understood the importance of the patient, but he also felt a well-managed business and a needed growth strategy ensured RVPT's long-term survival. PE firms had access to business experts, professional managers, and a large amount of money that could be used to expand RVPT and allow shareholders to exit when they wanted to retire. He remarked, The private equity people we talked to think we should be making 20% profit based on EBITDA instead of our 12%, but I don't think that would be consistent with who we are; we could go from 12% to 15% though. I wish we'd have had somebody as a shareholder or at a board meeting sometimes say "hey, how come we're not making more money? If we hit all the targets on our scorecard, we would easily be at that 15% number-we just need to find the right buttons to push to get there. PRIVATE EQUITY PE investments were referred to as "private" because the ownership interest was not publicly traded (6.c., stock was not sold on public stock market). PE firms served as a banker for private investors. The PE firm identified profitable companies that sought investment. PE's provided a business plan or prospectus of the future for the targeted company after acquisition from a PE firm, raised money for private investors that had an interest in investing in a stated target company, and structured an acquisitio paired the targeted company with the private investors. A single PE firm might : numerous funds simultaneously. These private investors included a range of stakeholders university endowments, qualified pension plans, insurance companies, banks, charities, corporate entities that looked to diversify their investment portfolios, and extremely wealthy individuals. The investment structure involved the use of a limited partnership to hold a newly established investment fund. The investors who contributed capital received an ownership interest as limited partners in a newly created fund and received a percentage interest in that fund based on the amount of their capital contribution. The PE firm served as the general partner. The general partner then directed the fund to acquire the targeted company and take control of the new company with the intent of tuming a profit. After acquisition of the target company, the PE fimm was tasked with providing a return to its investor clients. The newly formed company, under the direction of the PE firm, was instructed to perform its daily functions in a manner consistent with hitting profitability margins. PE was enticing to investors for the following reasons 1. Taking companies private was profitable - The PE firm owns the entire company. The PE firm retained all profits from the company and had complete control over capital allocation including cash flow. 2. Equity returns in short time frames - PE firms had full benefits of ownership (profits), and then resold the companies at a future date. PE firms often have the intent to sell off the company within a stated number of years or upon meeting certain metrics. 3. Leverage - PE funds took money from investors and then may leverage it with bank loans and bond issues from their newly acquired companies to boost returns for their investors. 4. Exits - PE funds were usually designed to exist only for a period spanning less than a decade. When the fund reached the end of its designed life, it'exited' its holdings by selling them. A common exit was to sell a PE position to a competing firm, or to list private companies in its portfolio on the public markets through an initial public offering (IPO) PE firms earned their money by charging a management fee to their investors. The management fee often involved a 'hurdle rate and a profit split agreement. The hurdle rate was the minimum amount of return promised to the investors by the PE firm. Once the PE-owned company made profits that exceeded the hurdle amount, the PE company received a split of the profits.30 The shareholders in the targeted firm would be paid in exchange for their shares. The executives were normally retained for a contractually stated period, but they could also be replaced by professional managers acquired through the PE's hiring processes. Typically, the PE firm guided the future direction of the company regardless of the PE's ownership percentage. Exceptions could be negotiated but each exception reduced the amount the PE would pay for each owner's share. The PE firm's goal was to maximize profit through efficiency gains, standardized processes, and enterprise growth to sell the company at a profit, providing an attractive return to its investors. Although PE had a reputation for negatively impacting a company's culture due to efficiency efforts such as reducing the workforce and putting profits before people, academic studies found no empirical evidence that proved PE negatively impacted culture on a consistent basis. Although 'strip it and flip it may have been the PEm in the carly days, it was no longer the case according to one PE investor.' Aneca PE was described as either a devil (firing employees and destroying company or an angel (revitalizing companies, and creating / saving jobs) but the multifaco.ca effects on employees post-buyout and the large amount of variation between types of PE buyouts such as industry type, private or public company, or timing, had made it impossible to pinpoint PE's impact on culture. 12 13 14 PE AND HEALTHCARE PE investment in healthcare had risen in the past twenty years. There was less than $5B of PE capital invested in healthcare in 2000, and it grew to $100B in 2018.15 In 2004 there were fewer than 600 PE arrangements in healthcare, and in 2018 there were more than 1,500. PE firms offered medical groups like RVPT stability in the dynamic healthcare industry, economies of scale given the PE may own multiple healthcare entities, high EBITDA multiples well above what any young PT could have offered, and a viable exit strategy to support shareholder retirement. A common criticism of the acquisition of healthcare practices by PE firms was misaligned priorities. The new PE ownership and staff of the acquired company often had similar operational goals, but different overall priorities. A survey at the 2018 Health Care Services PE Symposium provided an example of the dichotomy between the priorities of PE owners and healthcare front line employees. The survey found that 46% of PE executives and 31% of PE management teams believed vision and ability to deal with change were the top characteristics of CEOs in healthcare. Only 8% of the PE professionals believed knowledge of the healthcare industry was an important attribute of effective CEOs. There was evidence that nursing homes experienced greater increases in efficiencies after PE buyouts, however, there was strong evidence of declines in patient health and lower compliance with quality of care standards. 17 Because of the potential conflicts of interest between patient care and profit motives, the Corporate Practice of Medicine (CPOM) doctrine was created. The CPOM doctrine was developed due to state medical practice laws and public policy concerns. CPOM prevented corporations from practicing medicine or retaining a physician to provide professional medical services. 's The CPOM doctrine addressed many concerns, however, the key concerns included: 1) The allowance of businesses to practice medicine or employ physicians that could result in the commercialization of healthcare; 2) A firm's obligation to its shareholders may be misaligned with a physician's duties to his or her patient; and 3) Employment of a physician by a business may hinder the doctor's independent medical opinion. PE firms worked around the CPOM doctrine by forming management services organizations (MSOs) and a professional medical corporation (PMO). The MSO provided costs savings to the medical group's practice through traditional business practices such as centralizing support services and leveraging economies of scale. The MSO may also purchase the non-medical assets such as office buildings and equipment for cash or cquity. The PMC was physician-owned, and it employed the doctors and non-physician practitioners. The MSO and PMC had contractual agreements where the PMC agreed to provide professional expertise and the MSO agreed to provide administrative and management services for a fixed fee or a percentage of the mele group's revenue. PE AND RVPT In building the 2019-2023 strategic plan, the RVPT executive team decided to focus on doubling their revenue. Horsfield noted, "We were starting to see larger PT companies consolidating and expanding. Some were approaching our markets. We felt it was important for RVPT to continue growing and to establish moats around our markets before it was too late. Nearly all of our acquisitions consisted of independent clinics who wanted to join us after they leamed PTs were running the company." While the rapid growth was needed, it was not without tradeoffs. Horsfield observed "The culture of RVPT, which is our strength, was changing with the expansion Manager meetings that once consisted of just a dozen people now involved over 50 managers." Not only had the culture changed, but RVPT also had to consider potential changes to its executive team. Horsfield stated, "We'll see roughly twenty percent of our non-shareholders and seventy percent of our shareholders retiring between 2020-2028. These were the people who built RVPT. We needed to think about how we will provide for them financially and the future of RVPT." RVPT's position as the largest privately held PT group in the Midwest drew much interest from PE investors. Horsfield usually had 4-5 calls each week from PE firms. Most offers were 8 to 10 times EBITDA, but Horsfield had a recent offer for 12 times EBITDA from a Los Angeles-based PE firm. The PE firm had excess funds available for a limited time and it wanted to avoid returning this uninvested capital to its investors. The excess funds prompted the PE firm to make a higher initial offer to RVPT. The PE viewed RVPT's aggressive growth and performance orientation as an ideal match for the PE's philosophy of buying companies with solid business fundamentals and rapidly building the future value of that company for a future exit. This strategy was called a buy and build approach. Business success as measured by performance metrics would have been the top priority for the PE MSO, followed by the provision of quality care, and the continued maintenance of a positive image within the communities that were served by the practice. If all of the fiscal goals were met within the timeline set by the PE, it was anticipated that RVPT would be merged into a similar physical therapy group or issued as a public offering so the PE firm could turn a profit on its investment. At that point, the remaining employees would have to adapt to yet another ownership structure The PE had alternative investments and a limited time frame, so it had given Horsfield a two-week period to decide on the offer. Horsfield knew that he was obliged to report the offer to the other shareholders, and he intended to do so the next evening However, he had not decided whether he should advocate for pursuing the PE offer or push against it. As the only MBA among the RVPT sharcholders, Horsfield knew his opinion on the PE offer would be highly valued by his colleagues. CONTEMPLATION In the final minutes of his commute, Horsfield thought about how the quick access to capital and strong valuation offer made the PE proposal tempting Horsfield knew that PE investment would allow RVPT to provide a sizeable bonus to reward long time shareholders and employees who were critical to building the company and facing retirement in the coming years. On the other hand, Horsfield knew some PT clinics that sold to PE. He recalled that every PT he had spoken with that had done a PE deal, told him how great it was for about the first year or two working for the PE and then a change sent most of them off into retirement soon thereafter. Either they had been pushed aside or they could not handle the culture change. Horsfield recalled another conversation with a CEO from a PT group from the Northeast region of the U.S. who told him you are nuts to even think about it. Just sell it to a PE and walk away!" Horsfield acknowledged the PE would continue to expand RVPT, hire professional managers, and make needed changes to ensure that RVPT was more efficient; all actions that were vital for RVPT to remain viable in the competitive PT industry. Bringing PE into the practice, however, risked destroying RVPT's therapist- centric management model. Horsfield also realized that PE also risked changing RVPI's strong patient-centric culture which also played a key role in attracting and retaining valuable talent. The PE manager who contacted Horsfield with the offer noted, "Culture is a huge factor in healthcare. Why change a strong culture? We would want to leave it as it is. Our goal would be to preserve the legacy of the shareholders and support the leadership team the shareholders have groomed to take over. Horsfield recognized the culture of RVPT had already changed due to the rapid growth and the implementation of more standardized processes and performance metrics. He felt compelled to decide on a position related to the PE offer before the next day's meeting with the other shareholders, not only because of the PE timeline, but because of the upcoming retirements. RVPT had people who wanted to retire, but RVPT lacked the resources available to support buyouts. Horsfield knew he had other potential options such as an employee owned stock option or a partnership model, but these would not be nearly as lucrative as the PE valuation. As Horsfield arrives and parked his car in his driveway, he wondered what he should say to his c the next day. E Exhibit 1 - RVPT Shareholder Ownership by percentage and estimated retirement dates Number of Projected 2018 shares % ownership retirements 12 time in 2019; intends to fully retire Shareholder 1 190.877847 10% in 2020 Shareholder 2 190.877847 10% 2022 Shareholder 3 190.877847 10% 2022 Shareholder 4 190.877847 10% 2023 Shareholder 5 190.877847 10% 2024 Shareholder 6 190.877847 10% 2026 Shareholder 7 190.877847 10% 2028 Shareholder 8 133.6144929 7% 2027 Shareholder 9 133.6144929 7% 2028 Shareholder 10 133.6144929 7% 2030 Shareholder 11 57.2633541 3% 2032 Shareholder 12 57.2633541 3% 2032 Shareholder 13 57.2633541 3% 2036 100.00% TOTAL 1908.77847 Source: RVPT company documents Exhibit 2 - Physical therapists employed by age and by Gender, 2018 T S People Workforce M whe nhuma Source: Data USA https://datausa.io/profile/soc/physical-therapists Exhibit 3 - RVPT Balance Sheet 2016-20181 2018 2017 2016 Current Assets Cash on hand Property and equipment Other assets Total Current Assets $700,347.30 $4,682,810.82 $1,052,256.48 $6,435,414.60 $971,010.56 $4,361,972.16 $862,759.04 $6,195,741.76 $661,817.50 $3,621,459.85 $784,031.20 $5,067,306.65 Accumulated depreciation Accumulated amortization Total Assets ($4,346,841.18) ($1,046,923.92) $1,041,649.50 (54,191,397.60) (5776,060.48) $1,228,283.68 ($3,460,998.20) ($696,134.35) $910,174.10 Total Current Liabilities $549,937.08 $425,241.44 $606,944.55 Total Long-Term Liabilities $802,913.40 $924,916.72 $195,910.90 Total Liabilities $1,352,850.48 $1,350,158.16 $802,855.45 Capital Capital Stock Treasury Stock Retained Earnings Distributions Net Income $1,079,280.36 $1,100,442.72 ($2,905,735.20) ($2,962,710.40) $1,715,045.34 $1,097,659.68 ($3,051,765.54) (2,004,988.96) $2,851,974.06 $2,647,717.28 $1,005,212.10 ($1,884,693.60) $954,283.55 ($1,982,759.25) $2,015,275.85 Total Capital ($311,200.98) (5121,874.48) $107,318.65 Total Liabilities and Capital $1,041,649.50 $1,228,283.68 $910,17 E Source: RVPT company documents 2016-2018 2018 2017 $24,049,546,56 $313.345.76 (556,128.80) (5172,28856) 524,134,524.96 2016 $19.844.77230 $265,119.35 ($57.210.90) ($300,000.00) $19,748,680.75 $363.610.00 $13,660,016.24 $164,049.60 5151.472.88 $218.543.52 $29,475.68 $77,305.28 $214,272.24 $199.139.20 $66,5744 $11.722.88 $95,165.92 $15,251,8.40.88 $297,165.70 $11,197,159.80 $160.211.80 $139,397.30 $162,070,95 $18,454.70 $70,362.70 $183,028.90 $98,891.20 $51,379.80 $5,660.10 $78,762.60 $12,462,545.55 Exhibit 4 - RVPT Income Statement 2016-20182 REVENUES Fees collected $24.915,55874 Minc. Income $343,949.10 Refunds ($111.82566) Revenue adjustments 50 Total Revenue $29,147,682.18 VARIABLE EXPENSES Bonus wages and tax $501,907.32 Wages $16,754,545.50 Advertising $159,130 20 Professional supplies $206,514.30 Outside labor $431,63238 Travel $37,551.30 Auto expenses $101,532.84 Education $316,840.56 Office supplies $306,127.50 Laundry $73,569.54 Dues and subscriptions $11.842.20 Employee Fringes $108,466.80 Total variable expenses $19,009.660.44 FIXED EXPENSES Rent $1,909,260.80 Payrollanes $1,265,896.50 Licenses and does $814,007.94 401K ER match $552,100.50 Pool rentals $51,562.02 Utilities $13,617.78 Telephone $266,511.72 Repairs and maintenance $35,932 56 Health insurance $1,141,214.76 Liability insurance $124,677.66 Insurance fees $10,977.24 Depreciation $143.834 Life insurance $0 Legal and accounting 3151,970,82 401K profit sharing $549,937.08 Philanthropy $11.153.70 Bank service charge $80,250.74 Postage $17.995.08 Amortization Expense $144,453.56 Equipment lease and rental $23,518.14 Business meeting $9,064.74 Sales tax $2.582.64 Interest expenses $37.93.20 Illinois corporate tax $16,677.00 Allocations administrative bills ($141.006.84) Total fixed expenses $7,286,047.68 Total Expenses $26,295,708.12 Net income (los) $2,851,974.06 Net Profit Margin (los) 9.78% Source: RVPT company documents 2016-2018 $1,563,193.84 $1,025 204.96 $53803256 $431,955.68 $55,201.12 $99.277.36 $235.502.0 $23,614.24 $912,052.96 $116,098.32 314,310.40 $402.515.3 $0 $195.998.40 $425,241.44 $9.673.04 $46,462.00 $18,472,48 $13,976,56 $55,741.92 $8.598.72 $4.216.16 $24,006,32 $15,632.24 $2.08) 56,234,976.80 $21,486,809.68 $2,647,717.28 10.97% $1,327,99930 $821.161.00 $348.243.40 $366,055.90 $58,572.25 $86,570,65 5203.31235 $20,185,60 $752.295.50 $96,823.05 $82,818.15 $314,604.85 $3,904.50 $81.673.40 5498,344.35 $8.397.05 $29,854.70 $21.997.80 $12,764.20 $58,426.90 $14.356.00 55,133.80 $4,394.70 $53,567.65 $1.90) $5,270,899.35 $17,733,404.90 $2,015,275.85 10.2% 10 V Making Better Lives. Rock Valley PHYSICAL THERAPY Board of Directors CEO CFO COO VP Growth & Development Controller Hu Director Information Services Administrat Manag Bill Mann Regional Manager Quality Mana Mariling Coordinator Coording Executive Billy Cher Cale Code Chical Man preth Coordi Aniston CM Clin Front Office Tech Shale 3 About Us This is physical therapy on a mission Our Mission We are a patient-centered therapist-led organization dedicated to improving the health of our Midwest communities. The patient is at the center of our efforts, not just a number on the bottom line like you'll find in some large healthcare companies. This is why our owners consist of practicing therapists instead of bean counters--our leadership team went to school to learn how to care for patients, not maximize profits. Thousands of loyal patients can attest to the difference. Our Vision Rock Valley Physical Therapy, a therapist owned practice, will be admired as the Midwest center of excellence for rehabilitative solutions, recognized for exceeding expectations in the care and concern of our patients, known for being the most ethical healthcare partner, the place where each employee feels genuinely ap realizes his or her maximum potential ed and E NI RE Rock Valley Physical Therapy: Private Equity and Culture Terry McGovern, University of Wisconsin-Parkside Charles Hilterbrand, University of Mississippi A BIG WIN AND A BIG DECISION It was mid-April of 2018 in Molinc, Illinois. Dr. Mike Horsfield, CEO, MBA, and board-certified specialist in orthopedic physical therapy (PT) of Rock Valley Physical Therapy (RVPT), had come to a fork in the road during his commute home which reminded him of his workplace dilemma. Tomorrow evening, Horsfield had a meeting scheduled with the other 12 RVPT shareholders, all of whom were board-certified and practicing PTs. The group was celebrating a successful year of growth that resulted in RVPT becoming the largest privately held PT group in America and the largest in the Midwest Region of the U.S.. Horsfield had been approached with a tempting buyout offer from a private equity (PE) firm. Horsfield thought to himself, "Things were going well and that was part of the problem." RVPT experienced meteoric growth through acquisitions from 2013 to 2018, more than doubling the number of clinics. The company used bank financing to fund its aggressive growth strategy. Most of the key shareholders and executive officers at RVPT were nearing retirement (See Exhibit 1), which overlapped with their 5-year growth strategy. The line of credit extended by the bank was sufficient to finance RVPT's stated growth strategy, but it was not enough to also cover shareholder buybacks and exit packages for key non-shareholder employees. Horsfield needed to find a way to compensate exiting executives and key staff while continuing the company's growth strategy. The PE offer might accomplish this, but at what cost to RVPT's culture? WORKING AS A PHYSICAL THERAPIST Physical therapists played a key role with recuperation, therapy, and prevention of chronic ailments, discases, or injuries. They assisted patients to regain their movement and manage their pain. PT's offered their services in many different settings including hospitals, outpatient clinics, private practices, sports and fitness facilities, home health programs, work settings, and senior care facilities. Copyright 2020 by the Care Research Jomal and by Terry McGovern and Charles Hilterbrand. The authors developed this field-rescatched case for class discussion rather than to illustrate either effective or ineffective handling of the situation. Contact person: Terry M McGovern, University of Wisconsin-Parkside megovert@wp.edu. The company, case characters and situation are real however, financial figures have been disguised at the request of the company, Physical therapists treated a broad range of patients with different demographic backgrounds. This included senior citizens recovering from stroke to young athletes rehabilitating sports injuries. There were also a wide range of specializations among PTS. RVPT included specialized expertise in occupational health and wellness, fitness services, corporate wellness, orthopedics, sports, specialized hand therapies, neurological rehabilitative treatments, sports performance, and women's health.2 THE PHYSICAL THERAPY INDUSTRY As of 2018, the PT industry in the U.S. consisted of 113,178 mostly independent clinics earning $35.2B in revenue, $4.7B in profits. There were no major players in the PT industry. The largest three PT practices accounted for only 8.4% of the industry revenue; no one PT firm earned more than 5% of the total industry revenue. Wages were the primary costs for PT clinics accounting for 56% of a typical PT clinic's operation based on national averages.+ Projecting future wage costs depended on the forecasted supply and demand for PT's. The demand for PTs was expected to grow 28% from 2016-2026; this was much faster than the 7% rate forecasted for all industries. PT job growth was due to a large and aging baby boomer population consisting of seniors who stayed active but were also vulnerable to age-related health conditions such as strokes, which often required PT due to loss of movement. Additionally, PT job growth was also tied to mobility problems created by chronic conditions such as obesity and diabetes. Like many industries, technology played a significant role with PT diagnosis, treatment, and patient engagement. These innovations included: Smartphone apps that provided medical glossaries, video demonstrations of exercises, diagnostic tools, clinical tests, and ability to do 360-degree anatomy scans. PTGenie (https://mypugenic.com/ was an example of a PT apps Exoskeleton suits made of aluminum or titanium that patients wore to help with a range of biomechanical alignments and movements. Ekso Suit was an example of this technology: Rehab robots that assisted PTs with exercises reduced the recovery time for patients dcaling with brain injuries. Robots increased the number of exercise repetitions performed by a patient. Lokomat, a robotic treadmill that promoted task-specific repetitive movement was an example of a rehabilitative robot; Video game platforms that used motion-sensor movements, such as Nintendo's Wii, improved patient engagement with their recovery and allowed patients to rchab at home; Virtual reality (VR) allowed for the use of immersive, interactive therapies in a VR environment. VR had been used in PT for over 10 years, but a recent technology called CAREN (Computer Assisted Rehabilitation Environment) provided new possibilities for patient diagnosis and treatment; Telemedicine, which used pre-existing technology like the Microsoft Xbox Kinect, allowed for web-based therapy programs that incorporated instructional videos, coaching, monitoring, ey and educational material. Jintronix and Reflexion Health such products, and Wearables that tracked body movements, both in and outside of the clinical setting, which provided real-time interventions to reduce injuries were also coming into the PT market. The requirement to keep up with industry standards also came with the financial burden of equipment acquisition, training requirements, and ongoing maintenance. In terms of PT retirement, for some professions it was common to work past the traditional retirement age of 65, but this was not the case for PTs. PTs were among the most likely to have retired early compared to other jobs; PTs retired at an earlier age than 70% of other professionals . Only 0.82% of PTs continued working past the age of 65. A sizeable number of PTs retired in their 50's (See Exhibit 2). Rock VALLEY PHYSICAL THERAPY RVPT was founded in 1984 when Steve Layer and Mark Levsen merged their private practices. Horsfield joined RVPT in 1993. At that time, RVPT consisted of one independent clinic, one joint-venture clinic with a hospital that specialized in occupational health, and a service agreement with the same hospital that provided inpatient and outpatient services. In 1993 RVPT employed 15 people. By 2011, when Horsfield became CEO, the company had grown to 16 clinics with $11.6M in revenues and 150 employees. RVPT's operations were distributed and semi-independent, each clinic manager, who was also a PT, had a considerable amount of autonomy in their clinic. The scattered operations made communications and information management a challenge for RVPT. In January of 2013, Horsfield challenged the executive group to consider the company's future. He commented, We were at a point where we had to decide whether we wanted to dig in and stay at our current size as local provider or if we should expand and become more of a regional player. We saw what was happening in healthcare with consolidation and insurance networks and realized that being stuck in the middle ground was dangerous because you did not have leverage with payers, and you did not have access to resources like some of the bigger PT groups. So, we decided to focus on growth. In the summer of 2013 RVPT hired an outside consultant who assisted the company in creating a Balanced Scorecard (BSC) enterprise management system and they developed a 5-year strategy. The BSC structure helped focus and align key performance measures in the areas of employee learning and growth, processes, customers, and finances. Learning and growth was the most measured arca of the enterprise-level scorecard which included 12 overall key measures; the BSC included 3 employee learning and growth objectives with five measures. Working with the consultant got results: in 2016 RVPT, for the first time in its 32-year history, provided over $1M in employee bonuses. By the spring of 2018, RVPT had grown to 43 clinics, nearly $30M in annual revenues, and over 400 employees (See Exhibits 3 and 4). The 2019-2023 RVPT strategic plan called for robust expansion that doubled the revenue from $30M to $60M and nearly doubled the number of clinical sites. This required additional capital which placed the executive team and shareholder precarious situation as they balanced growth and RVPT's unique culture whil planned to honor shareholders' and long-time employees' desires to retire. COMPANY CULTURE A unique aspect to RVPT was that its entire executive team were all licensed PT's (See Exhibit 5). The sharcholders did not put profit at the top of their priorities, quality of patient care, employee concem, and community engagement were of greater importance than company profits. This management model had played a major role in attracting independent clinics. Much of the recent expansion of RVPT was driven by managers of former independent clinics who contacted Horsfield directly and proposed to merge their respective practices into RVPT. This collective mindset of putting people before profits was reflected in RVPT's corporate values (See Exhibit 6) and the mission and vision statements (See Exhibit 7). Horsfield commented "I work alongside people who are about making a difference versus making a nest egg. This is what draws independent clinics to RVPT." RVPT's workplace culture received outside recognition as the company was ranked several times (2013, 2015, 2017) by the Des Moines Register as one of the best places to work in the state of lowa. RVPT enjoyed an exceptionally low therapist turnover rate of 4.5%, which was well below the American Physical Therapy Association's industry-average turnover rate of 10%. A PT who had managed one of RVPT's clinics remarked, "Rock Valley is a company owned by therapists, who invest in their employees and support their families, invest in their communities, expect excellence, and continually strives to be better tomorrow." Another therapist commented, "Rock Valley is a healthcare company that still continues to look at each patient as a person rather than a number. It is a company that is truly dedicated to getting you better or finding someone that can." A third therapist observed, "Rock Valley feels like home. We are a family that takes care of each other and our communities." RVPT routinely provided over 1% of its total profits to various community programs such as the HAVlife program. HAVlife was a non-profit organization that helped disadvantaged children aged 10-15 reach their potential in music, arts, and athletics. RVPT employees and funds supported the HAVlife All-Stars Football Camp that allowed special needs children to participate in a memorable camp experience with former University of lowa football players and coaches. RVPT employees also volunteered with the Quad Cities marathon and the Fishing Has No Boundaries initiative which provided recreational fishing opportunities for people with disabilities. RVPT PT's served as PT student mentors and lecturers in local college educational health programs and PT's delivered training services to several local area K-12 schools at highly reduced rates. Rock Valley's "Rock U" leadership development and therapist mentorship program was widely acclaimed for improving the technical excellence of new therapists who joined the company or students who conducted rotations at RVPT as part of their schooling, Other PT companies had taken notice and began similar mentoring programs. With all of the growth, the culture of RVPT had changed. One shareholder, who had been with the company for over 20 years, noted, Going from 3 clinics when I started to 50 clinics has changed parts of the culture. I like to think the culture of patient care continues to be there and an important part of who we are. The employee culture has changed from a time where everyone knew everyone to now, most people not knowing many of the employees except for a few. There are some that express they wish it were back to the old days to know everyone and feel like your input is more valuable. feel the culture remains strong, just different Another sharcholder, who had played a key role in developing the growth strategy, commented, Yes, the culture has changed. We have brought on new talent with skills that have allowed us to grow while maintaining our core values. We have developed formal processes to ensure our clinician development and mentoring produces the results we value. We have a leadership training program that allows us to respond to opportunities for growth rather than passing because we did not have the right person at the time. So, I would definitely say the growth has been for the better. The only downside is not knowing everyone's name at company gatherings, right now anyway. THE BUSINESS OF HEALTH CARE Horsfield, who received his MBA in 2001, was the only PT and shareholder with formal business training. He was a shareholder who served as CEO and was the one that the others looked to for advice on the future of RVPT as a business. Horsfield presented the company financials along with areas that where he believed improvements were necessary to maximize RVPT's profits and maintain its commercial viability. Horsfield was certain that RVPT could perform better. Other PT shareholders however, had disagreed with how Horsfield viewed the practice as a business. They felt that RVPT had excelled because of great patient care. One shareholder echoed the sentiments of most of the clinicians, saying "I am still a firm believer that "Great care is good business so ensuring RVPT can continue to practice in the best interest of the patient and be paid fairly for the services provided will lead to long term business success." Horsfield understood the importance of the patient, but he also felt a well-managed business and a needed growth strategy ensured RVPT's long-term survival. PE firms had access to business experts, professional managers, and a large amount of money that could be used to expand RVPT and allow shareholders to exit when they wanted to retire. He remarked, The private equity people we talked to think we should be making 20% profit based on EBITDA instead of our 12%, but I don't think that would be consistent with who we are; we could go from 12% to 15% though. I wish we'd have had somebody as a shareholder or at a board meeting sometimes say "hey, how come we're not making more money? If we hit all the targets on our scorecard, we would easily be at that 15% number-we just need to find the right buttons to push to get there. PRIVATE EQUITY PE investments were referred to as "private" because the ownership interest was not publicly traded (6.c., stock was not sold on public stock market). PE firms served as a banker for private investors. The PE firm identified profitable companies that sought investment. PE's provided a business plan or prospectus of the future for the targeted company after acquisition from a PE firm, raised money for private investors that had an interest in investing in a stated target company, and structured an acquisitio paired the targeted company with the private investors. A single PE firm might : numerous funds simultaneously. These private investors included a range of stakeholders university endowments, qualified pension plans, insurance companies, banks, charities, corporate entities that looked to diversify their investment portfolios, and extremely wealthy individuals. The investment structure involved the use of a limited partnership to hold a newly established investment fund. The investors who contributed capital received an ownership interest as limited partners in a newly created fund and received a percentage interest in that fund based on the amount of their capital contribution. The PE firm served as the general partner. The general partner then directed the fund to acquire the targeted company and take control of the new company with the intent of tuming a profit. After acquisition of the target company, the PE fimm was tasked with providing a return to its investor clients. The newly formed company, under the direction of the PE firm, was instructed to perform its daily functions in a manner consistent with hitting profitability margins. PE was enticing to investors for the following reasons 1. Taking companies private was profitable - The PE firm owns the entire company. The PE firm retained all profits from the company and had complete control over capital allocation including cash flow. 2. Equity returns in short time frames - PE firms had full benefits of ownership (profits), and then resold the companies at a future date. PE firms often have the intent to sell off the company within a stated number of years or upon meeting certain metrics. 3. Leverage - PE funds took money from investors and then may leverage it with bank loans and bond issues from their newly acquired companies to boost returns for their investors. 4. Exits - PE funds were usually designed to exist only for a period spanning less than a decade. When the fund reached the end of its designed life, it'exited' its holdings by selling them. A common exit was to sell a PE position to a competing firm, or to list private companies in its portfolio on the public markets through an initial public offering (IPO) PE firms earned their money by charging a management fee to their investors. The management fee often involved a 'hurdle rate and a profit split agreement. The hurdle rate was the minimum amount of return promised to the investors by the PE firm. Once the PE-owned company made profits that exceeded the hurdle amount, the PE company received a split of the profits.30 The shareholders in the targeted firm would be paid in exchange for their shares. The executives were normally retained for a contractually stated period, but they could also be replaced by professional managers acquired through the PE's hiring processes. Typically, the PE firm guided the future direction of the company regardless of the PE's ownership percentage. Exceptions could be negotiated but each exception reduced the amount the PE would pay for each owner's share. The PE firm's goal was to maximize profit through efficiency gains, standardized processes, and enterprise growth to sell the company at a profit, providing an attractive return to its investors. Although PE had a reputation for negatively impacting a company's culture due to efficiency efforts such as reducing the workforce and putting profits before people, academic studies found no empirical evidence that proved PE negatively impacted culture on a consistent basis. Although 'strip it and flip it may have been the PEm in the carly days, it was no longer the case according to one PE investor.' Aneca PE was described as either a devil (firing employees and destroying company or an angel (revitalizing companies, and creating / saving jobs) but the multifaco.ca effects on employees post-buyout and the large amount of variation between types of PE buyouts such as industry type, private or public company, or timing, had made it impossible to pinpoint PE's impact on culture. 12 13 14 PE AND HEALTHCARE PE investment in healthcare had risen in the past twenty years. There was less than $5B of PE capital invested in healthcare in 2000, and it grew to $100B in 2018.15 In 2004 there were fewer than 600 PE arrangements in healthcare, and in 2018 there were more than 1,500. PE firms offered medical groups like RVPT stability in the dynamic healthcare industry, economies of scale given the PE may own multiple healthcare entities, high EBITDA multiples well above what any young PT could have offered, and a viable exit strategy to support shareholder retirement. A common criticism of the acquisition of healthcare practices by PE firms was misaligned priorities. The new PE ownership and staff of the acquired company often had similar operational goals, but different overall priorities. A survey at the 2018 Health Care Services PE Symposium provided an example of the dichotomy between the priorities of PE owners and healthcare front line employees. The survey found that 46% of PE executives and 31% of PE management teams believed vision and ability to deal with change were the top characteristics of CEOs in healthcare. Only 8% of the PE professionals believed knowledge of the healthcare industry was an important attribute of effective CEOs. There was evidence that nursing homes experienced greater increases in efficiencies after PE buyouts, however, there was strong evidence of declines in patient health and lower compliance with quality of care standards. 17 Because of the potential conflicts of interest between patient care and profit motives, the Corporate Practice of Medicine (CPOM) doctrine was created. The CPOM doctrine was developed due to state medical practice laws and public policy concerns. CPOM prevented corporations from practicing medicine or retaining a physician to provide professional medical services. 's The CPOM doctrine addressed many concerns, however, the key concerns included: 1) The allowance of businesses to practice medicine or employ physicians that could result in the commercialization of healthcare; 2) A firm's obligation to its shareholders may be misaligned with a physician's duties to his or her patient; and 3) Employment of a physician by a business may hinder the doctor's independent medical opinion. PE firms worked around the CPOM doctrine by forming management services organizations (MSOs) and a professional medical corporation (PMO). The MSO provided costs savings to the medical group's practice through traditional business practices such as centralizing support services and leveraging economies of scale. The MSO may also purchase the non-medical assets such as office buildings and equipment for cash or cquity. The PMC was physician-owned, and it employed the doctors and non-physician practitioners. The MSO and PMC had contractual agreements where the PMC agreed to provide professional expertise and the MSO agreed to provide administrative and management services for a fixed fee or a percentage of the mele group's revenue. PE AND RVPT In building the 2019-2023 strategic plan, the RVPT executive team decided to focus on doubling their revenue. Horsfield noted, "We were starting to see larger PT companies consolidating and expanding. Some were approaching our markets. We felt it was important for RVPT to continue growing and to establish moats around our markets before it was too late. Nearly all of our acquisitions consisted of independent clinics who wanted to join us after they leamed PTs were running the company." While the rapid growth was needed, it was not without tradeoffs. Horsfield observed "The culture of RVPT, which is our strength, was changing with the expansion Manager meetings that once consisted of just a dozen people now involved over 50 managers." Not only had the culture changed, but RVPT also had to consider potential changes to its executive team. Horsfield stated, "We'll see roughly twenty percent of our non-shareholders and seventy percent of our shareholders retiring between 2020-2028. These were the people who built RVPT. We needed to think about how we will provide for them financially and the future of RVPT." RVPT's position as the largest privately held PT group in the Midwest drew much interest from PE investors. Horsfield usually had 4-5 calls each week from PE firms. Most offers were 8 to 10 times EBITDA, but Horsfield had a recent offer for 12 times EBITDA from a Los Angeles-based PE firm. The PE firm had excess funds available for a limited time and it wanted to avoid returning this uninvested capital to its investors. The excess funds prompted the PE firm to make a higher initial offer to RVPT. The PE viewed RVPT's aggressive growth and performance orientation as an ideal match for the PE's philosophy of buying companies with solid business fundamentals and rapidly building the future value of that company for a future exit. This strategy was called a buy and build approach. Business success as measured by performance metrics would have been the top priority for the PE MSO, followed by the provision of quality care, and the continued maintenance of a positive image within the communities that were served by the practice. If all of the fiscal goals were met within the timeline set by the PE, it was anticipated that RVPT would be merged into a similar physical therapy group or issued as a public offering so the PE firm could turn a profit on its investment. At that point, the remaining employees would have to adapt to yet another ownership structure The PE had alternative investments and a limited time frame, so it had given Horsfield a two-week period to decide on the offer. Horsfield knew that he was obliged to report the offer to the other shareholders, and he intended to do so the next evening However, he had not decided whether he should advocate for pursuing the PE offer or push against it. As the only MBA among the RVPT sharcholders, Horsfield knew his opinion on the PE offer would be highly valued by his colleagues. CONTEMPLATION In the final minutes of his commute, Horsfield thought about how the quick access to capital and strong valuation offer made the PE proposal tempting Horsfield knew that PE investment would allow RVPT to provide a sizeable bonus to reward long time shareholders and employees who were critical to building the company and facing retirement in the coming years. On the other hand, Horsfield knew some PT clinics that sold to PE. He recalled that every PT he had spoken with that had done a PE deal, told him how great it was for about the first year or two working for the PE and then a change sent most of them off into retirement soon thereafter. Either they had been pushed aside or they could not handle the culture change. Horsfield recalled another conversation with a CEO from a PT group from the Northeast region of the U.S. who told him you are nuts to even think about it. Just sell it to a PE and walk away!" Horsfield acknowledged the PE would continue to expand RVPT, hire professional managers, and make needed changes to ensure that RVPT was more efficient; all actions that were vital for RVPT to remain viable in the competitive PT industry. Bringing PE into the practice, however, risked destroying RVPT's therapist- centric management model. Horsfield also realized that PE also risked changing RVPI's strong patient-centric culture which also played a key role in attracting and retaining valuable talent. The PE manager who contacted Horsfield with the offer noted, "Culture is a huge factor in healthcare. Why change a strong culture? We would want to leave it as it is. Our goal would be to preserve the legacy of the shareholders and support the leadership team the shareholders have groomed to take over. Horsfield recognized the culture of RVPT had already changed due to the rapid growth and the implementation of more standardized processes and performance metrics. He felt compelled to decide on a position related to the PE offer before the next day's meeting with the other shareholders, not only because of the PE timeline, but because of the upcoming retirements. RVPT had people who wanted to retire, but RVPT lacked the resources available to support buyouts. Hors