Question: ANSWER IS INCORRECT. Please show your work so I know what I did wrong. I will only give a thumbs up if work is shown.

ANSWER IS INCORRECT. Please show your work so I know what I did wrong. I will only give a thumbs up if work is shown. Answer can be solved using formula, Excel, or a financial calculator. Thank you!

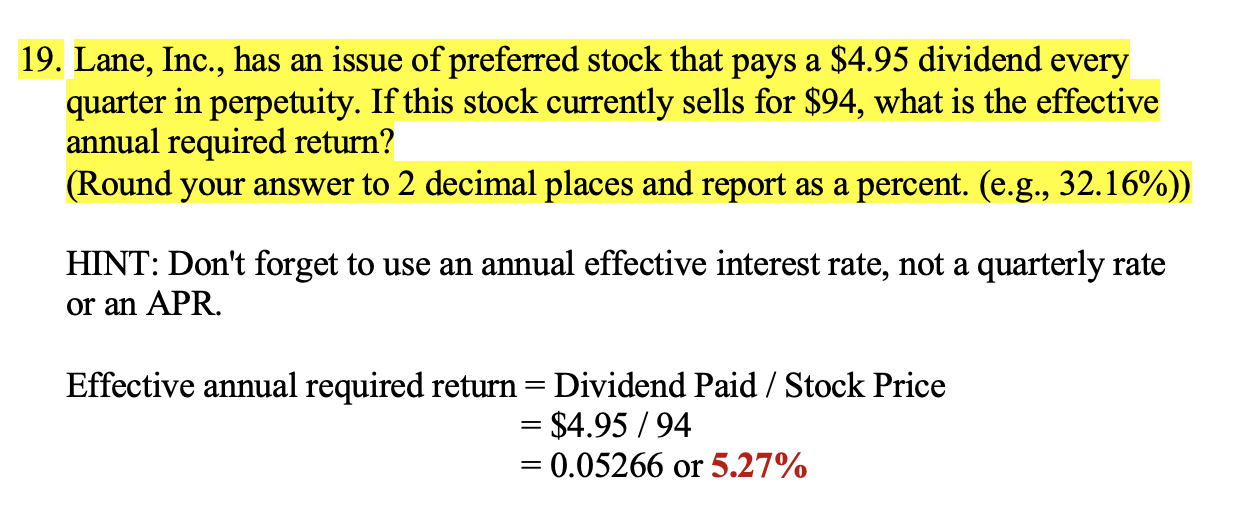

19. Lane, Inc., has an issue of preferred stock that pays a $4.95 dividend every quarter in perpetuity. If this stock currently sells for $94, what is the effective annual required return? (Round your answer to 2 decimal places and report as a percent. (e.g., 32.16%)) HINT: Don't forget to use an annual effective interest rate, not a quarterly rate or an APR. Effective annual required return = Dividend Paid / Stock Price = $4.95 / 94 = 0.05266 or 5.27%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts