Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER IS INCORRECT. Please show your work so I know what I did wrong. I will only give a thumbs up if work is shown.

ANSWER IS INCORRECT. Please show your work so I know what I did wrong. I will only give a thumbs up if work is shown. Answer can be solved using formula, Excel, or a financial calculator. I would prefer to see the work done on a financial calculator if applicable. Thank you!

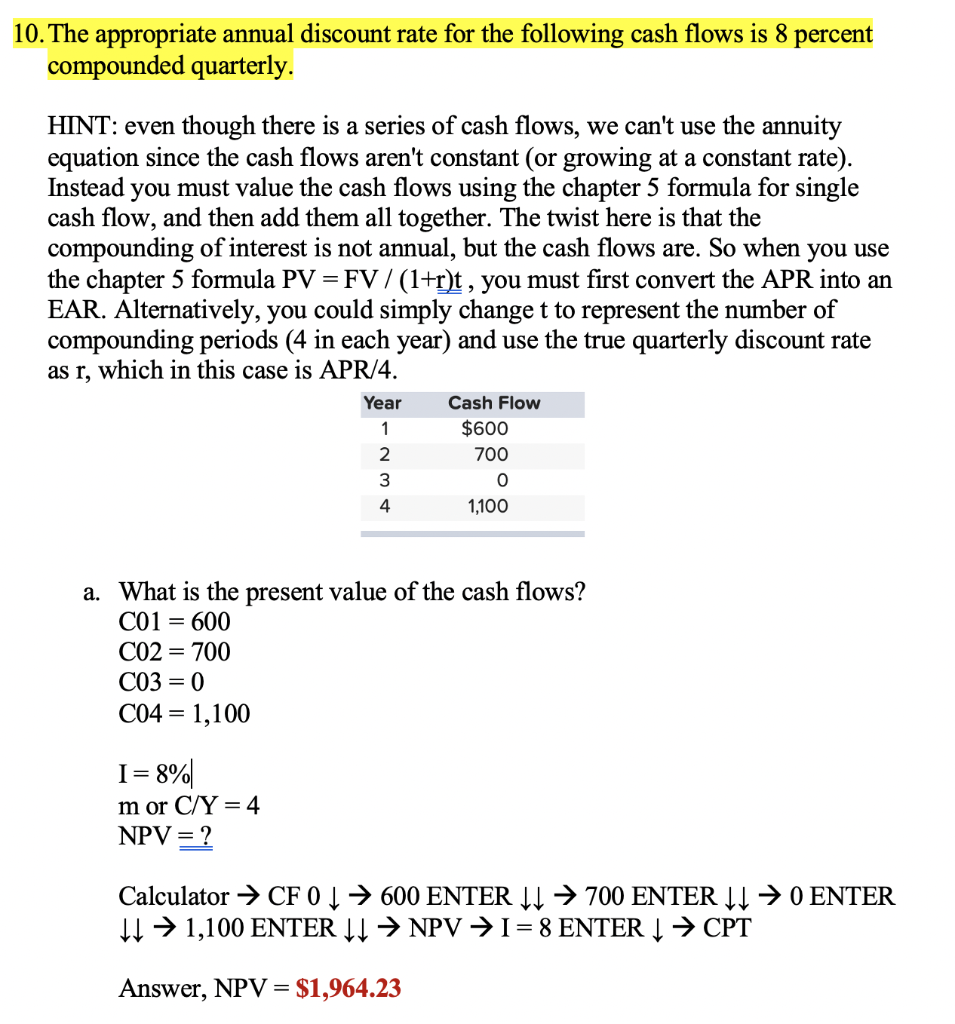

10. The appropriate annual discount rate for the following cash flows is 8 percent compounded quarterly. HINT: even though there is a series of cash flows, we can't use the annuity equation since the cash flows aren't constant (or growing at a constant rate). Instead you must value the cash flows using the chapter 5 formula for single cash flow, and then add them all together. The twist here is that the compounding of interest is not annual, but the cash flows are. So when you use the chapter 5 formula PV = FV / (1+r)t , you must first convert the APR into an EAR. Alternatively, you could simply change t to represent the number of compounding periods (4 in each year) and use the true quarterly discount rate as r, which in this case is APR/4. Year 1 2 3 4 Cash Flow $600 700 0 1,100 a. What is the present value of the cash flows? C01 = 600 CO2 = 700 CO3 = 0 C04 = 1,100 I=8% m or C/Y=4 NPV = ? Calculator CF 0 1 600 ENTER II 700 ENTER II 0 ENTER 11 + 1,100 ENTER 11 NPV = I=8 ENTER 1 CPT Answer, NPV = $1,964.23Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started