Answered step by step

Verified Expert Solution

Question

1 Approved Answer

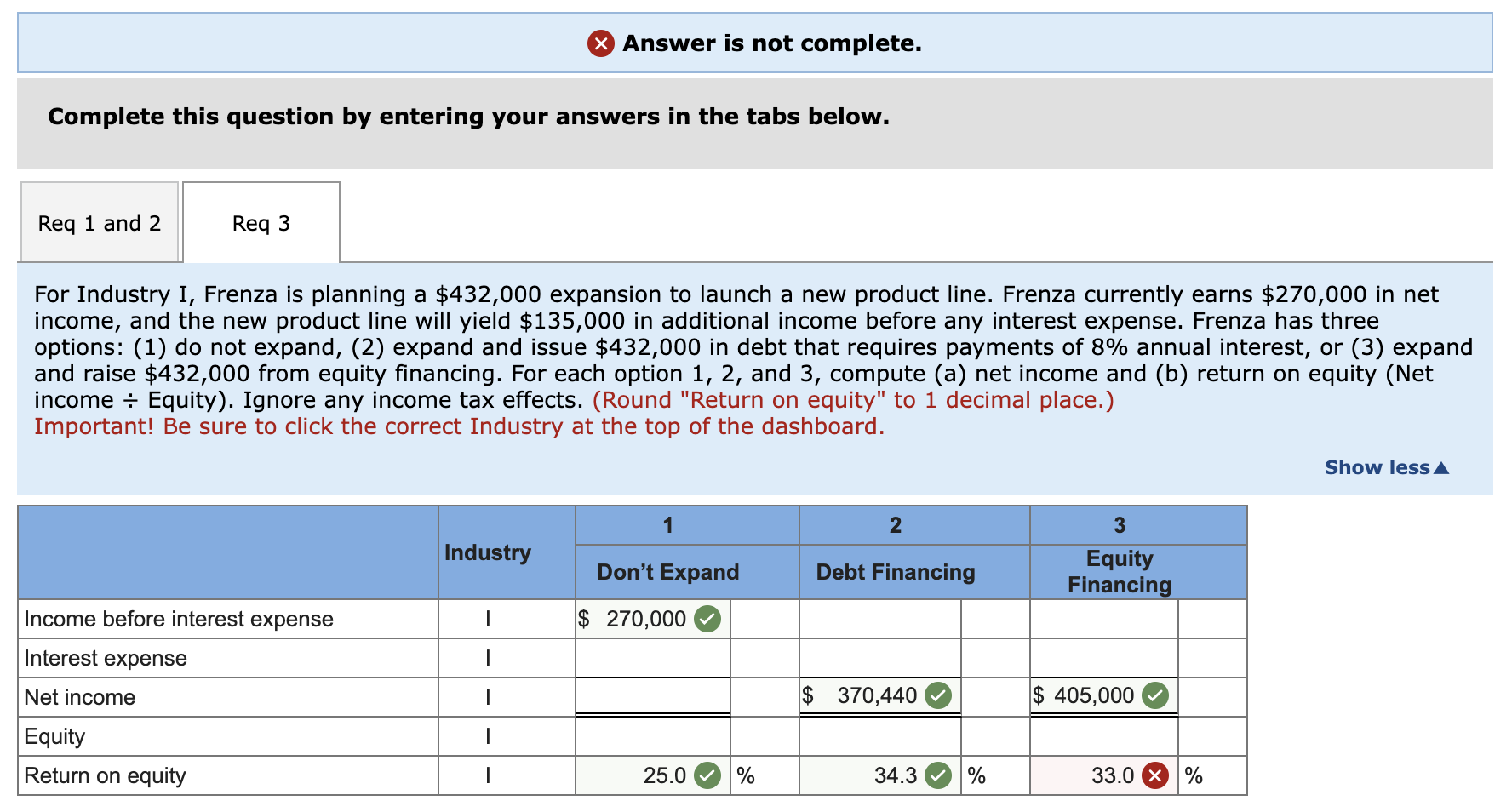

Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 and 2 For Industry I, Frenza is planning

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Req and

For Industry I, Frenza is planning a $ expansion to launch a new product line. Frenza currently earns $ in net income, and the new product line will yield $ in additional income before any interest expense. Frenza has three options: do not expand, expand and issue $ in debt that requires payments of annual interest, or expand and raise $ from equity financing. For each option and compute a net income and b return on equity Net income Equity Ignore any income tax effects. Round "Return on equity" to decimal place.

Important! Be sure to click the correct Industry at the top of the dashboard.

Show less

tabletableIncome before interest expensetableIndustryIDont Expand,Debt Financing,tableEquityFinancing$vvInterest expense,I,,,,,,,Net income,I,,,,$EquityI,,,,,,,Return on equity,I,vvtimes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started