Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer is NOT D please help Analysis of debt ratios Financial information for two companies competing in the cosmetics industry - The Estee Lauder Company

answer is NOT D please help

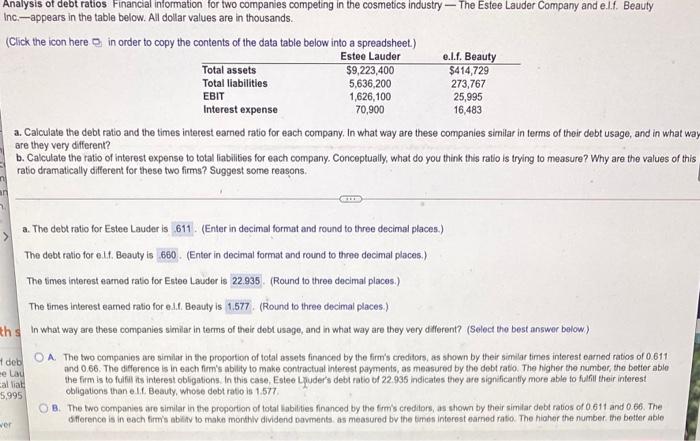

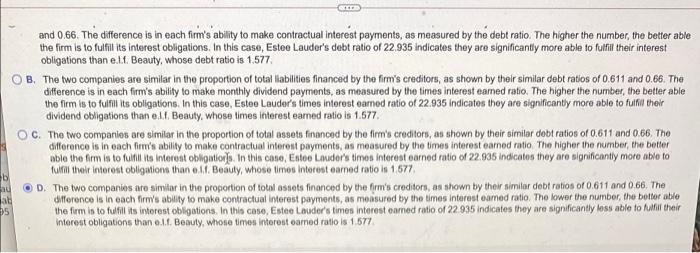

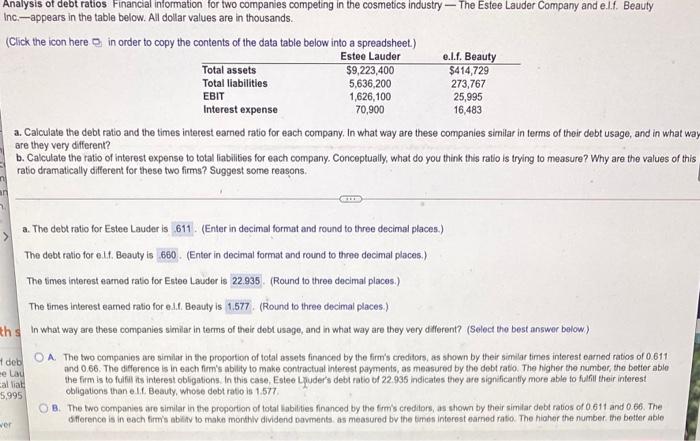

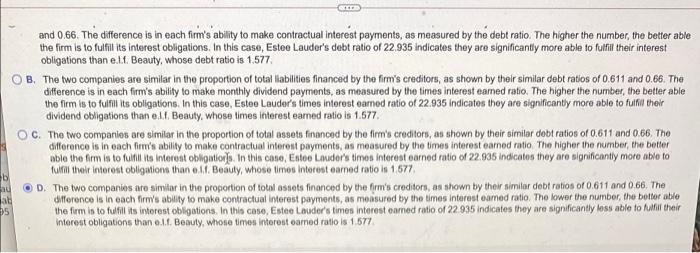

Analysis of debt ratios Financial information for two companies competing in the cosmetics industry - The Estee Lauder Company and e.lf. Beauty Inc.-appears in the table below. All dollar values are in thousands (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) Estee Lauder e.Lf. Beauty Total assets $9,223,400 $414,729 Total liabilities 5,636,200 273,767 EBIT 1,626,100 25,995 Interest expense 70,900 16,483 a. Calculate the debt ratio and the times interest earned ratio for each company. In what way are these companies similar in terms of their debt usage, and in what way are they very different? b. Calculate the ratio of interest expense to total liabilities for each company. Conceptually, what do you think this ratio is trying to measure? Why are the values of this ratio dramatically different for these two firms? Suggest some reasons. a. The debt ratio for Estee Lauder is 611. (Enter in decimal format and round to three decimal places.) The debt ratio for elf. Beauty is 680. (Enter in decimal format and round to three decimal places.) The times interest eamed ratio for Estee Lauder is 22.935 (Round to three decimal places.) The times interest earned ratio for edi, Beauty is 1.577 (Round to three decimal places.) ths In what way are these companies similar in terms of their debt usage, and in what way are they very different? (Select the best answer below) deb OA. The two companies are similar in the proportion of total assets financed by the firm's creditors, as shown by their similar times interest earned ratios of 0.611 e La and 066. The difference is in each firm's ability to make contractual interest payments, as measured by the debt ratio. The higher the number, the better able the firm is to fulfil its interest obligations in this case, Estee Lpuder's debt ratio of 22.935 indicates they are significantly more able to fulfil their interest 5.995 obligations than e. Beauty, whose debt ratio is 1577 OB. The two companies are similar in the proportion of total abilities financed by the firm's creditors, as shown by their similar debt ratios of 0.611 and 0.66. The difference is in each firm's ability to make monthly dividend payments, as measured by the timen Interest earned tatio The higher the number the botter able calliat and 0.66. The difference is in each firm's ability to make contractual interest payments, as measured by the debt ratio. The higher the number, the better able the firm is to fulfill its interest obligations. In this case, Estee Lauder's debt ratio of 22.935 indicates they are significantly more able to fulfill their interest obligations than ef Beauty, whose debt ratio is 1.577 OB. The two companies are similar in the proportion of total liabilities financed by the firm's creditors, as shown by their similar debt ratios of 0.611 and 0.66. The difference is in each firm's ability to make monthly dividend payments, as measured by the times interest eamed ratio. The higher the number, the better able the firm is to fulfil its obligations. In this case, Estee Lauder's times interest earned ratio of 22.935 indicates they are significantly more able to fulfil their dividend obligations than all Beauty, whose times interest earned ratio is 1.577. OC. The two companies are similar in the proportion of total assets financed by the firm's creditors, as shown by their similar debt ratios of 0.611 and 066. The difference is in each firm's ability to make contractual interest payments, as measured by the times interest earned ratio The higher the number the better able the firm is to fulfil its interest obligations. In this case, Entoo Louder's times interest corned ratio of 22.936 indicates they are significantly more able to fulfill their interest obligations than a Beauty, whose times interesteamed ratio is 1577 D. The two companies are similar in the proportion of total ostets financed by the firm's creditors, as shown by their similar debt ratios of 0.611 and 066. The difference is in each firm's ability to make contractual interest payments, as measured by the times interest oamed ratio. The lower the number, the botter able 35 the firm in to fulfill its interest obligations. In this case, Estee Lauder's times interest eamed ratio of 22 935 indicates they are significantly less able to fulfil their interest obligations than 11. Beauty, whose times interest oamed ratio is 1.577 au

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started