Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer is provided , but I don't understand how we get there. please show all steps and calculations so I can understand how to solve.

Answer is provided , but I don't understand how we get there. please show all steps and calculations so I can understand how to solve. thank you

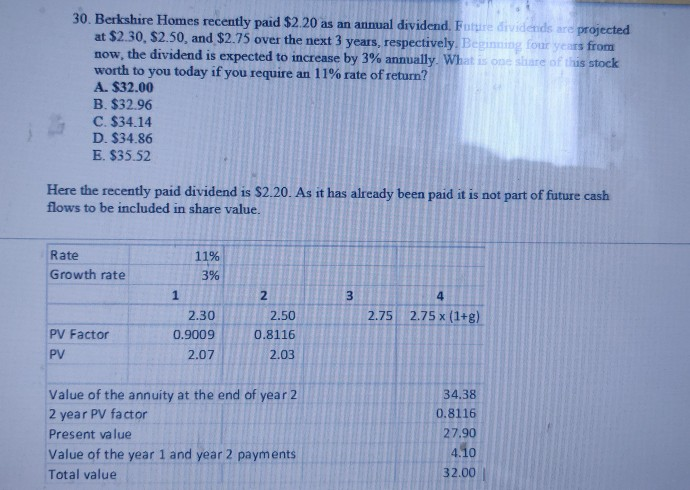

30. Berkshire Homes recently paid $2.20 as an annual dividend. Future dividends are projected at $2.30. $2.50, and $2.75 over the next 3 years, respectively. Beginning four years from now, the dividend is expected to increase by 3% annually. What is one share of this stock worth to you today if you require an 11% rate of return? A. $32.00 B. $32.96 C. $34.14 D. $34.86 E. $35.52 Here the recently paid dividend is $2.20. As it has already been paid it is not part of future cash flows to be included in share value. Rate Growth rate 11% 3% 1 2 3 4 2.75 X (1+g) 2.75 2.30 0.9009 PV Factor PV 2.50 0.8116 2.03 2.07 Value of the annuity at the end of year 2 2 year PV factor Present value Value of the year 1 and year 2 payments Total value 34.38 0.8116 27.90 4.10 32.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started