Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer it step by step b. Wow much will the firm need in 180 days in U.S. dollars given that the firm executes a forward

answer it step by step

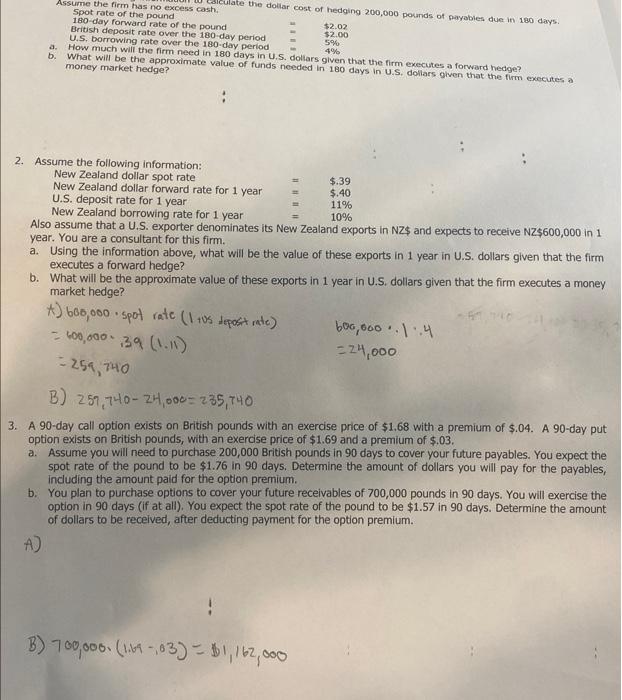

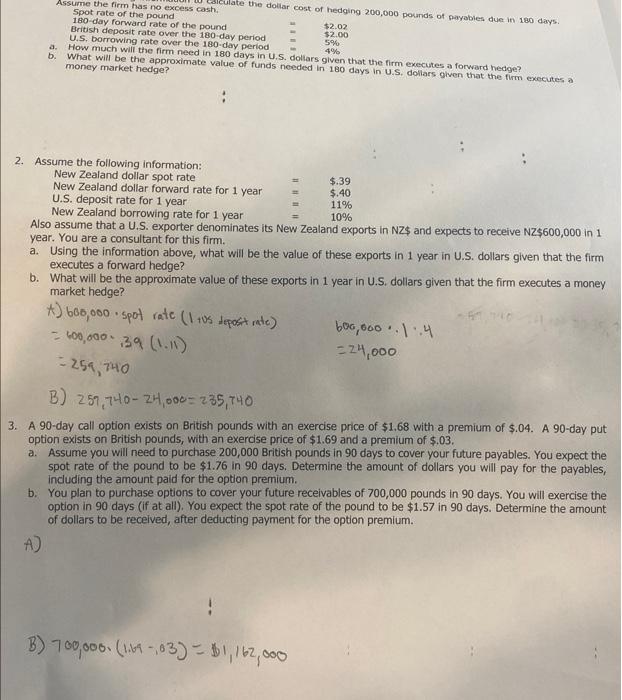

b. Wow much will the firm need in 180 days in U.S. dollars given that the firm executes a forward hedge? monoy market hedge? MIsu assume that a U.S. exporter denominates its New Zealand exports in NZ\$ and expects to receive NZ\$\$600,000 in 1 year. You are a consultant for this firm. a. Using the information above, what will be the value of these exports in 1 year in U.S. dollars given that the firm executes a forward hedge? b. What will be the approximate value of these exports in 1 year in U.S. dollars given that the firm executes a money market hedge? t) 606,000 - spot rate (1+us tepost rate) =400,000.39(1.11)=254,740 600,0001,4=24,000 B) 259,74024,000=235,740 3. A 90-day call option exists on British pounds with an exercise price of $1.68 with a premium of $.04. A 90 -day put option exists on British pounds, with an exercise price of $1.69 and a premium of $.03. a. Assume you will need to purchase 200,000 British pounds in 90 days to cover your future payables. You expect the spot rate of the pound to be $1.76 in 90 days, Determine the amount of dollars you will pay for the payables, including the amount paid for the option premium. b. You plan to purchase options to cover your future receivables of 700,000 pounds in 90 days. You will exercise the option in 90 days (if at all), You expect the spot rate of the pound to be $1.57 in 90 days. Determine the amount of dollars to be received, after deducting payment for the option premium. A) B) 700,000(1.69.03)=01,162,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started