Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer its asap its financial management subject EW AND SELF-TEST PROBLEM 2.1 Cash Flow for Mara Corporation This problem will give you some practice working

answer its asap its financial management subject

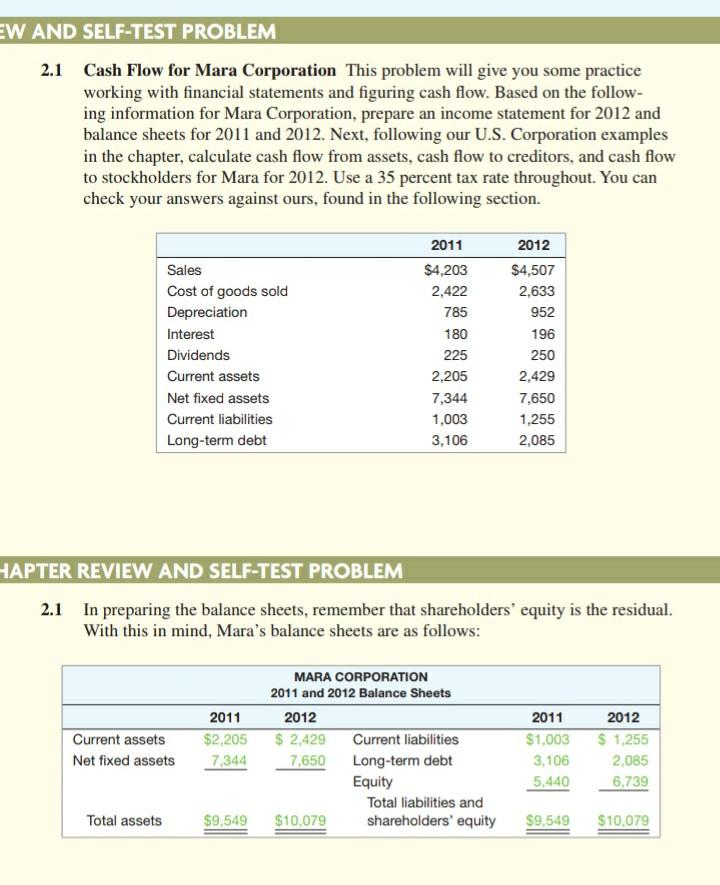

EW AND SELF-TEST PROBLEM 2.1 Cash Flow for Mara Corporation This problem will give you some practice working with financial statements and figuring cash flow. Based on the follow- ing information for Mara Corporation, prepare an income statement for 2012 and balance sheets for 2011 and 2012. Next, following our U.S. Corporation examples in the chapter, calculate cash flow from assets, cash flow to creditors, and cash flow to stockholders for Mara for 2012. Use a 35 percent tax rate throughout. You can check your answers against ours, found in the following section. 2012 $4,507 2,633 952 2011 $4,203 2,422 785 180 225 2,205 7,344 1,003 3,106 Sales Cost of goods sold Depreciation Interest Dividends Current assets Net fixed assets Current liabilities Long-term debt 196 250 2,429 7,650 1.255 2,085 HAPTER REVIEW AND SELF-TEST PROBLEM 2.1 In preparing the balance sheets, remember that shareholders' equity is the residual. With this in mind, Mara's balance sheets are as follows: 2011 $2,205 Current assets Net fixed assets MARA CORPORATION 2011 and 2012 Balance Sheets 2012 $ 2,429 Current liabilities 7,650 Long-term debt Equity Total liabilities and $10,079 shareholders' equity 2011 $1.003 3,106 5,440 2012 $ 1,255 2,085 6.739 7,344 Total assets $9,549 $9,549 $10,079Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started