Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer letter d . You are given: ProdCF PY + Invinc 0 1 -40 2 46 3 4 51 5 Taxes -216.0 58.4 108.0 30.4

Answer letter d

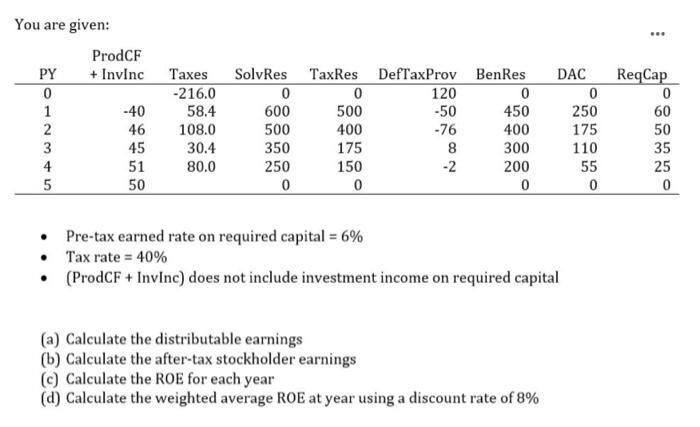

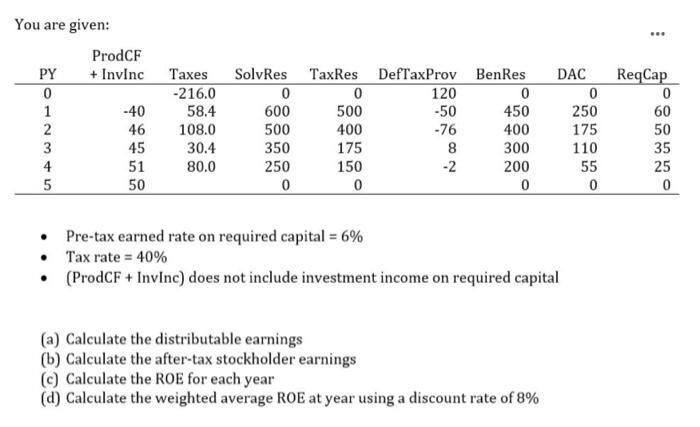

. You are given: ProdCF PY + Invinc 0 1 -40 2 46 3 4 51 5 Taxes -216.0 58.4 108.0 30.4 80.0 Solves TaxRes DefTaxProv BenRes 0 0 120 0 600 500 -50 450 500 400 -76 400 350 175 8 300 250 150 -2 200 0 0 0 DAC 0 250 175 110 55 0 ReqCap 0 60 50 35 25 0 45 50 Pre-tax earned rate on required capital = 6% Tax rate = 40% (ProdCF + Invinc) does not include investment income on required capital (a) Calculate the distributable earnings (b) Calculate the after-tax stockholder earnings (c) Calculate the ROE for each year (d) Calculate the weighted average ROE at year using a discount rate of 8% . You are given: ProdCF PY + Invinc 0 1 -40 2 46 3 4 51 5 Taxes -216.0 58.4 108.0 30.4 80.0 Solves TaxRes DefTaxProv BenRes 0 0 120 0 600 500 -50 450 500 400 -76 400 350 175 8 300 250 150 -2 200 0 0 0 DAC 0 250 175 110 55 0 ReqCap 0 60 50 35 25 0 45 50 Pre-tax earned rate on required capital = 6% Tax rate = 40% (ProdCF + Invinc) does not include investment income on required capital (a) Calculate the distributable earnings (b) Calculate the after-tax stockholder earnings (c) Calculate the ROE for each year (d) Calculate the weighted average ROE at year using a discount rate of 8%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started