Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer me fast please THNKU. Edward Enterprises is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm

answer me fast please THNKU.

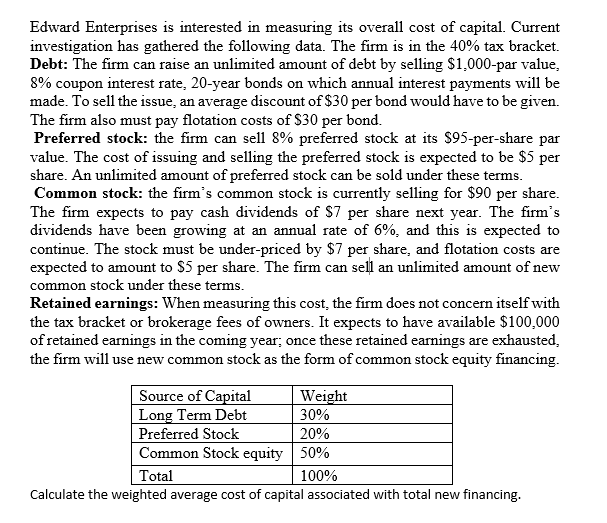

Edward Enterprises is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is in the 40% tax bracket. Debt: The firm can raise an unlimited amount of debt by selling $1,000-par value, 8% coupon interest rate, 20-year bonds on which annual interest payments will be made. To sell the issue, an average discount of $30 per bond would have to be given. The firm also must pay flotation costs of $30 per bond. Preferred stock: the firm can sell 8% preferred stock at its $95-per-share par value. The cost of issuing and selling the preferred stock is expected to be $5 per share. An unlimited amount of preferred stock can be sold under these terms. Common stock: the firm's common stock is currently selling for $90 per share. The firm expects to pay cash dividends of $7 per share next year. The firm's dividends have been growing at an annual rate of 6%, and this is expected to continue. The stock must be under-priced by $7 per share, and flotation costs are expected to amount to $5 per share. The firm can sell an unlimited amount of new common stock under these terms. Retained earnings: When measuring this cost, the firm does not concern itself with the tax bracket or brokerage fees of owners. It expects to have available $100,000 of retained earnings in the coming year; once these retained earnings are exhausted, the firm will use new common stock as the form of common stock equity financing. Source of Capital Weight Long Term Debt 30% Preferred Stock 20% Common Stock equity 50% Total 100% Calculate the weighted average cost of capital associated with total new financing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started