Answered step by step

Verified Expert Solution

Question

1 Approved Answer

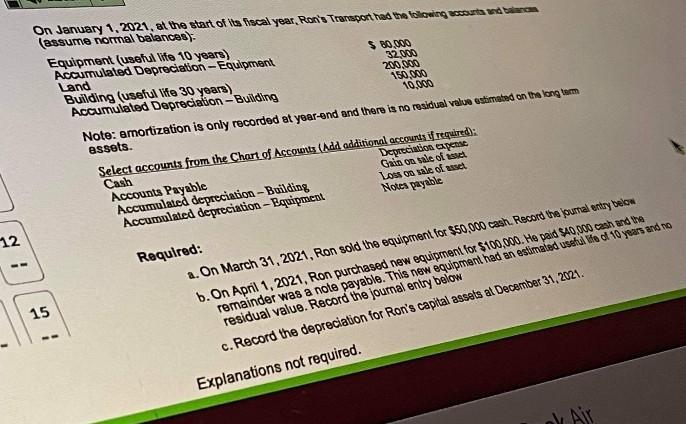

answer me quickly On January 1, 2021, at the start of Vis fiscal year, Ron's Transport had the liceing buta te (assume normal balances) Equipment

answer me quickly

On January 1, 2021, at the start of Vis fiscal year, Ron's Transport had the liceing buta te (assume normal balances) Equipment useful lite 10 years) Accumulated Depreciation - Equipment $80.000 Land 32.000 Building (useful life 30 years) 200.000 150.000 Accumulated Depreciation - Building 10.000 Note: amortization is only recorded at year-end and there is no residual value estimated on the long term assets. Select accounts from the Chart of Accounts (Add additional accounts if required): Cash Depreciation Eapenas Gain on sale i Accounts Payable Los tale of asset Accumulated depreciation - Building Notes payable Accumulated depreciation - Equipment 12 15 Required: a. On March 31, 2021, Ron sold the equipment for $50,000 cash. Record the purtal entry below b. On April 1, 2021, Ron purchased new equipment for $100,000. He paid $40 cash and the remainder was a note payable. This new equipment had an estimated use de dl 10 years and to residual value. Record the journal entry below c. Record the depreciation for Ron's capital assets al December 31, 2021 Explanations not requiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started