answer need to be typed

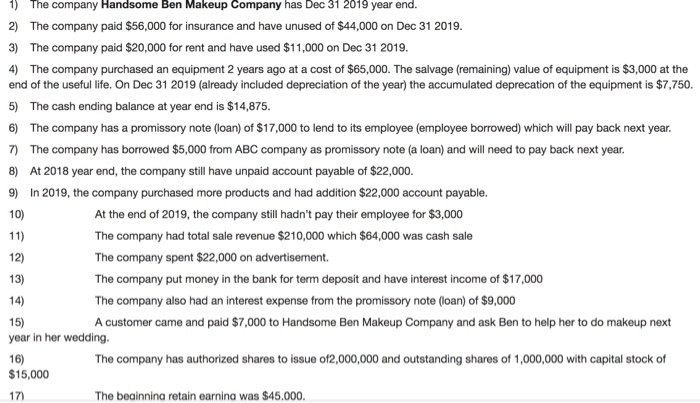

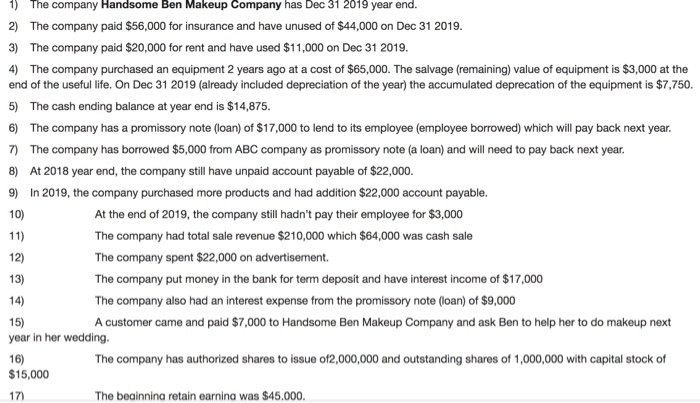

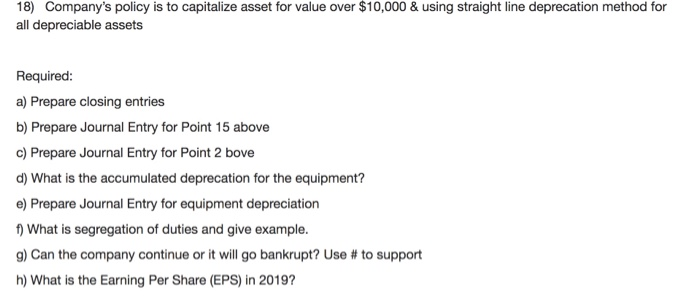

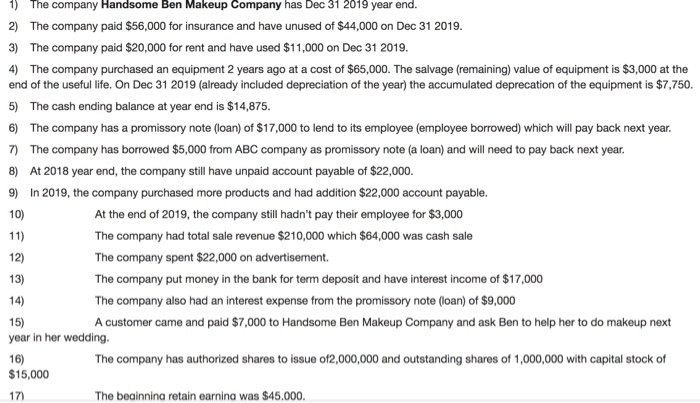

1) The company Handsome Ben Makeup Company has Dec 31 2019 year end. 2) The company paid $56,000 for insurance and have unused of $44,000 on Dec 31 2019. 3) The company paid $20,000 for rent and have used $11,000 on Dec 31 2019. 4) The company purchased an equipment 2 years ago at a cost of $65,000. The salvage (remaining) value of equipment is $3,000 at the end of the useful life. On Dec 31 2019 (already included depreciation of the year) the accumulated deprecation of the equipment is $7,750. 5) The cash ending balance at year end is $14,875. 6) The company has a promissory note (loan) of $17,000 to lend to its employee (employee borrowed) which will pay back next year. 7) The company has borrowed $5,000 from ABC company as promissory note (a loan) and will need to pay back next year. 8) At 2018 year end, the company still have unpaid account payable of $22,000. 9) In 2019, the company purchased more products and had addition $22,000 account payable. 10) At the end of 2019, the company still hadn't pay their employee for $3,000 11) The company had total sale revenue $210,000 which $64,000 was cash sale 12) The company spent $22,000 on advertisement 13) The company put money in the bank for term deposit and have interest income of $17,000 14) The company also had an interest expense from the promissory note (loan) of $9,000 15) A customer came and paid $7,000 to Handsome Ben Makeup Company and ask Ben to help her to do makeup next year in her wedding. 16) The company has authorized shares to issue of2,000,000 and outstanding shares of 1,000,000 with capital stock of $15,000 The beginning retain earning was $45.000. 17 18) Company's policy is to capitalize asset for value over $10,000 & using straight line deprecation method for all depreciable assets Required: a) Prepare closing entries b) Prepare Journal Entry for Point 15 above c) Prepare Journal Entry for Point 2 bove d) What is the accumulated deprecation for the equipment? e) Prepare Journal Entry for equipment depreciation 1) What is segregation of duties and give example. g) Can the company continue or it will go bankrupt? Use # to support h) What is the Earning Per Share (EPS) in 2019