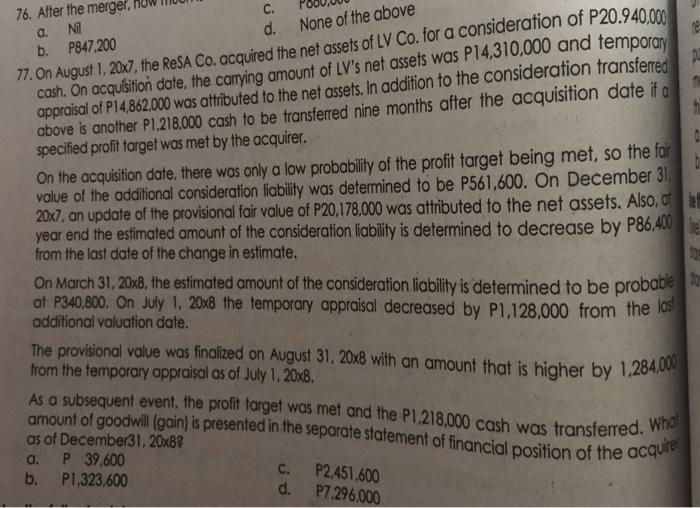

76. After the merger. a. Nil c. b. P847,200 d. None of the above 77. On August 1, 20x7, the ReSA Co. acquired the net assets of LV Co. for a consideration of P20.940,000 cash. On acquisition date, the carrying amount of LV's net assets was P14,310,000 and temporary appraisal of P14,862,000 was attributed to the net assets. In addition to the consideration transferred above is another P1.218.000 cash to be transferred nine months after the acquisition date ifo specified profit target was met by the acquirer. The provisional value was finalized on August 31, 20x8 with an amount that is higher by 1.284.000 amount of goodwill (gain) is presented in the separate statement of financial position of the acquire As a subsequent event, the profit target was met and the P1.218,000 cash was transferred. Wha! On the acquisition date, there was only a low probability of the profit target being met, so the far value of the additional consideration liability was determined to be P561,600. On December 31, 20x7. an update of the provisional fair value of P20,178,000 was attributed to the net assets. Also, at year end the estimated amount of the consideration liability is determined to decrease by P86,400 de from the last date of the change in estimate. On March 31, 20x8, the estimated amount of the consideration liability is determined to be probable at P340,800. On July 1, 20x8 the temporary appraisal decreased by P1,128,000 from the los additional valuation date. from the temporary appraisal as of July 1, 20x8. to as of December 31, 20x8 a. P 39,600 b. P1,323,600 C.P2.451,600 d. P7.296,000 76. After the merger. a. Nil c. b. P847,200 d. None of the above 77. On August 1, 20x7, the ReSA Co. acquired the net assets of LV Co. for a consideration of P20.940,000 cash. On acquisition date, the carrying amount of LV's net assets was P14,310,000 and temporary appraisal of P14,862,000 was attributed to the net assets. In addition to the consideration transferred above is another P1.218.000 cash to be transferred nine months after the acquisition date ifo specified profit target was met by the acquirer. The provisional value was finalized on August 31, 20x8 with an amount that is higher by 1.284.000 amount of goodwill (gain) is presented in the separate statement of financial position of the acquire As a subsequent event, the profit target was met and the P1.218,000 cash was transferred. Wha! On the acquisition date, there was only a low probability of the profit target being met, so the far value of the additional consideration liability was determined to be P561,600. On December 31, 20x7. an update of the provisional fair value of P20,178,000 was attributed to the net assets. Also, at year end the estimated amount of the consideration liability is determined to decrease by P86,400 de from the last date of the change in estimate. On March 31, 20x8, the estimated amount of the consideration liability is determined to be probable at P340,800. On July 1, 20x8 the temporary appraisal decreased by P1,128,000 from the los additional valuation date. from the temporary appraisal as of July 1, 20x8. to as of December 31, 20x8 a. P 39,600 b. P1,323,600 C.P2.451,600 d. P7.296,000