Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer now please The current value of BSE SENSEX is 10000 and the annualized dividend yield on the index is 5%. A six-month-futures contract on

Answer now please

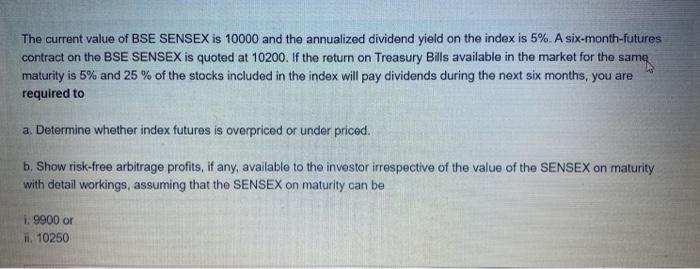

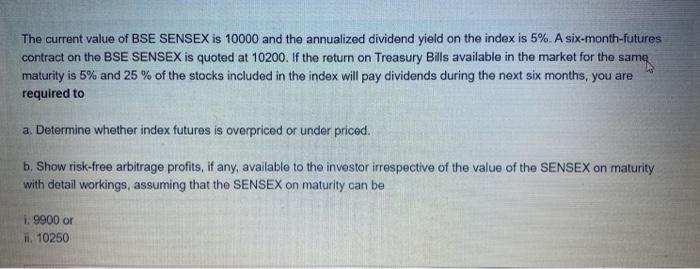

The current value of BSE SENSEX is 10000 and the annualized dividend yield on the index is 5%. A six-month-futures contract on the BSE SENSEX is quoted at 10200. If the return on Treasury Bills available in the market for the sam maturity is 5% and 25% of the stocks included in the index will pay dividends during the next six months, you are required to a. Determine whether index futures is overpriced or under priced. b. Show risk-free arbitrage profits, if any, available to the investor irrespective of the value of the SENSEX on maturity with detail workings, assuming that the SENSEX on maturity can be i. 9900 or ii. 10250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started