Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer number 5 question 5 ) Prepare the audit adjustment at December 31, 2021 to correct the amount of machinery, long-term liabilities, and other related

answer number 5

question

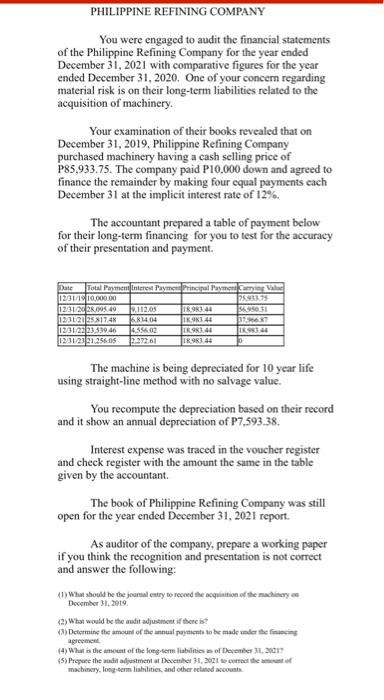

PHILIPPINE REFINING COMPANY You were engaged to audit the financial statements of the Philippine Refining Company for the year ended December 31, 2021 with comparative figures for the year ended December 31, 2020. One of your concern regarding material risk is on their long-term liabilities related to the acquisition of machinery. Your examination of their books revealed that on December 31, 2019. Philippine Refining Company purchased machinery having a cash selling price of P85,933.75. The company paid P10.000 down and agreed to finance the remainder by making four equal payments each December 31 at the implicit interest rate of 12%. The accountant prepared a table of payment below for their long-term financing for you to test for the accuracy of their presentation and payment. Date Total Payment InterTaym Principal Payment med 12301810,000.00 123120 28.095.49 10.112.05 TR963:46 450 31 123120 25X174 6.83404 IK.344 1231 23 23.539.46 433540 IR 983 44 1931 2321.256.05 IR 9140 The machine is being depreciated for 10 year life using straight-line method with no salvage value. You recompute the depreciation based on their record and it show an annual depreciation of P7,593.38 Interest expense was traced in the voucher register and check register with the amount the same in the table given by the accountant The book of Philippine Refining Company was still open for the year ended December 31, 2021 report As auditor of the company, prepare a working paper if you think the recognition and presentation is not correct and answer the following: ) What should be the journal entry to record the acquisition of the machinery December 31, 2019 (2) What would be the antit justifier is? Determine the amount of the annual payments to be made under the financing (4) What is the ancient of the long-term liabilities of December 2017 (5) Prepare the audit adjustment at December 31, 2021 comment machinery, long-term liabilities, and other related con PHILIPPINE REFINING COMPANY You were engaged to audit the financial statements of the Philippine Refining Company for the year ended December 31, 2021 with comparative figures for the year ended December 31, 2020. One of your concern regarding material risk is on their long-term liabilities related to the acquisition of machinery. Your examination of their books revealed that on December 31, 2019. Philippine Refining Company purchased machinery having a cash selling price of P85,933.75. The company paid P10.000 down and agreed to finance the remainder by making four equal payments each December 31 at the implicit interest rate of 12%. The accountant prepared a table of payment below for their long-term financing for you to test for the accuracy of their presentation and payment. Date Total Payment InterTaym Principal Payment med 12301810,000.00 123120 28.095.49 10.112.05 TR963:46 450 31 123120 25X174 6.83404 IK.344 1231 23 23.539.46 433540 IR 983 44 1931 2321.256.05 IR 9140 The machine is being depreciated for 10 year life using straight-line method with no salvage value. You recompute the depreciation based on their record and it show an annual depreciation of P7,593.38 Interest expense was traced in the voucher register and check register with the amount the same in the table given by the accountant The book of Philippine Refining Company was still open for the year ended December 31, 2021 report As auditor of the company, prepare a working paper if you think the recognition and presentation is not correct and answer the following: ) What should be the journal entry to record the acquisition of the machinery December 31, 2019 (2) What would be the antit justifier is? Determine the amount of the annual payments to be made under the financing (4) What is the ancient of the long-term liabilities of December 2017 (5) Prepare the audit adjustment at December 31, 2021 comment machinery, long-term liabilities, and other related con 5) | Prepare the audit adjustment at December 31, 2021 to correct the amount of machinery, long-term liabilities, and other related accounts. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started