answer number 7 & 8 please, thankyou

answer number 7 & 8 please, thankyou

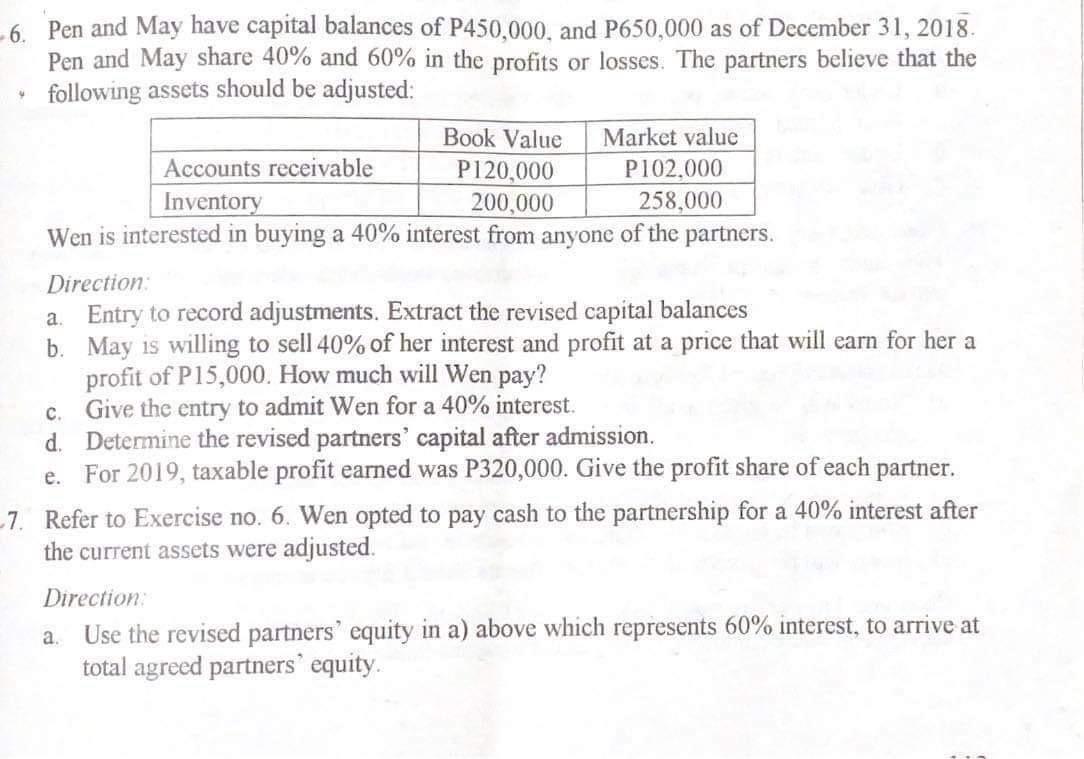

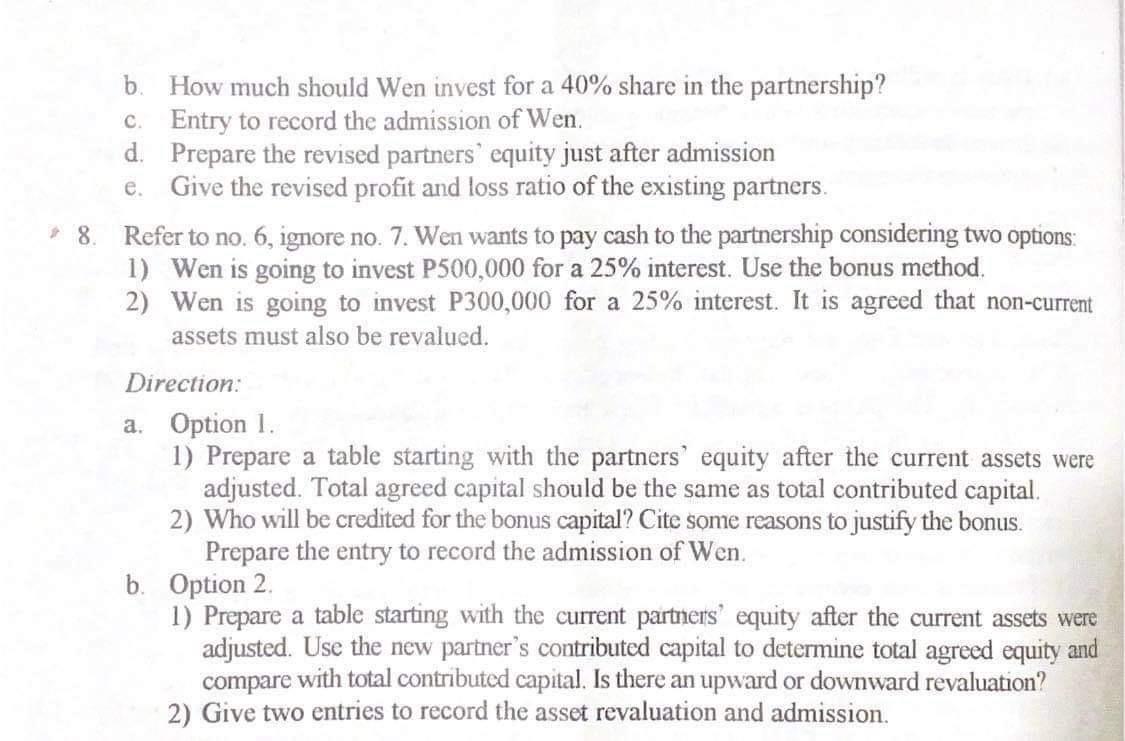

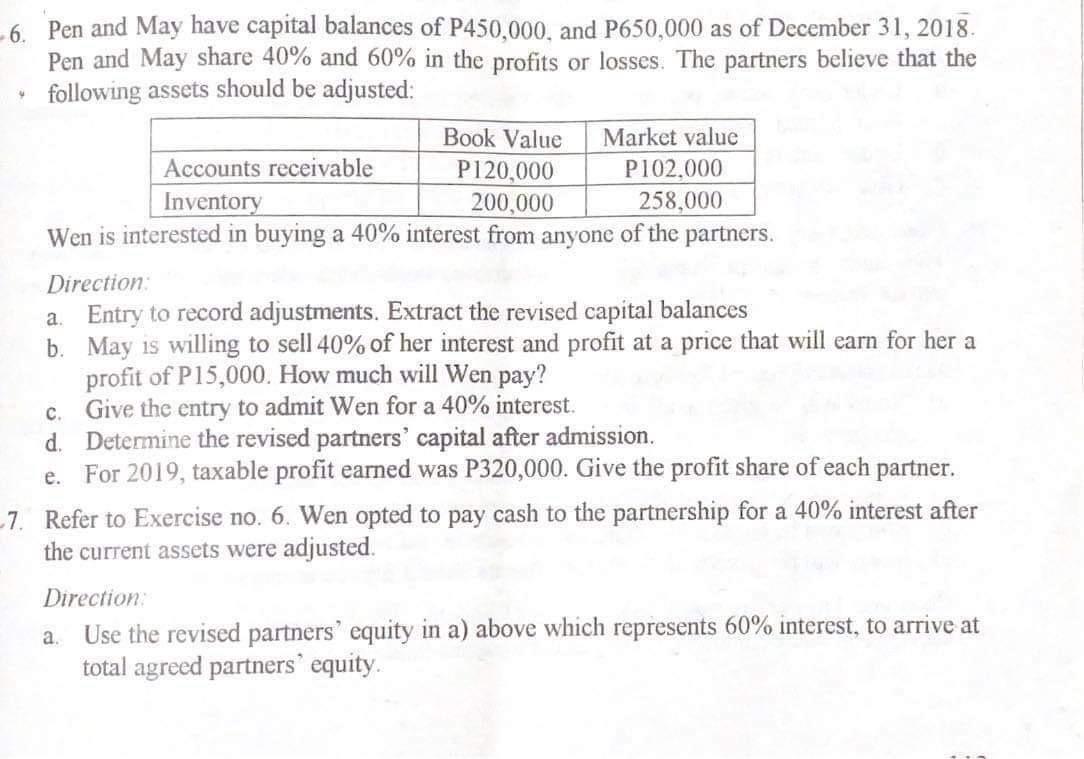

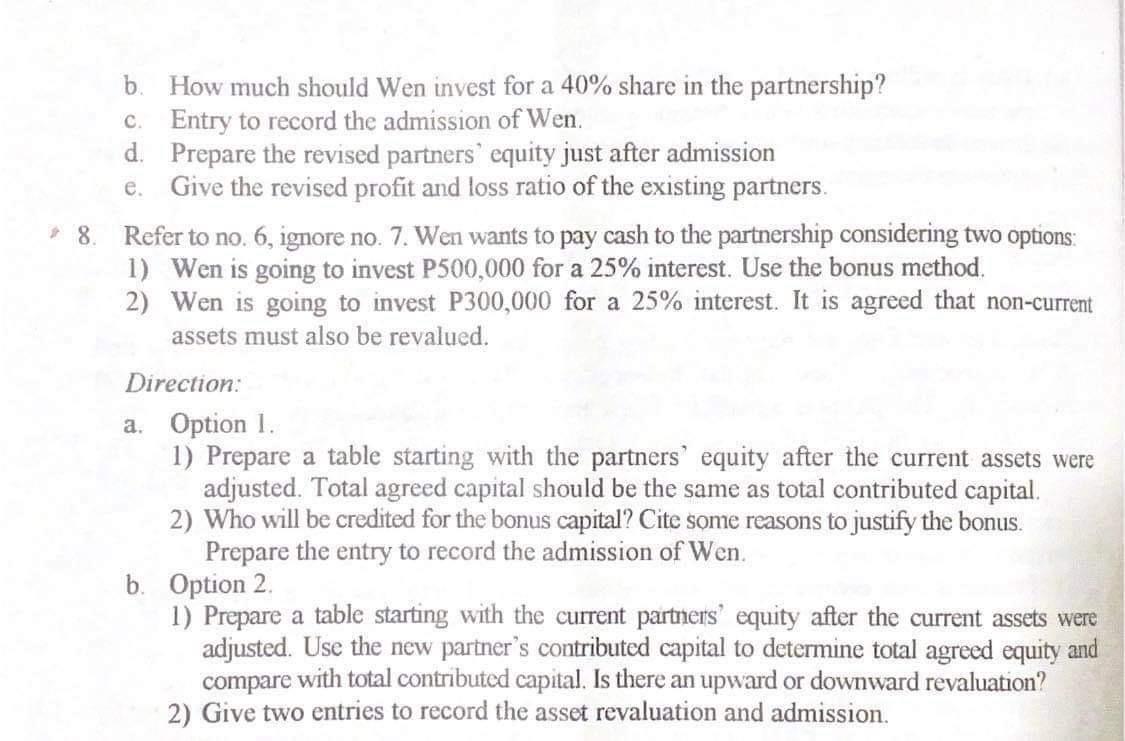

6. Pen and May have capital balances of P450,000, and P650,000 as of December 31, 2018. Pen and May share 40% and 60% in the profits or losses. The partners believe that the following assets should be adjusted: Book Value Market value Accounts receivable P120,000 P102.000 Inventory 200,000 258,000 Wen is interested in buying a 40% interest from anyone of the partners. Direction a. Entry to record adjustments. Extract the revised capital balances b. May is willing to sell 40% of her interest and profit at a price that will earn for her a profit of P15,000. How much will Wen pay? Give the entry to admit Wen for a 40% interest. d. Determine the revised partners' capital after admission. e. For 2019, taxable profit earned was P320,000. Give the profit share of each partner. -7. Refer to Exercise no. 6. Wen opted to pay cash to the partnership for a 40% interest after the current assets were adjusted. Direction Use the revised partners' equity in a) above which represents 60% interest, to arrive at total agreed partners' equity. C. a b C 8 How much should Wen invest for a 40% share in the partnership? Entry to record the admission of Wen. d. Prepare the revised partners' equity just after admission e. Give the revised profit and loss ratio of the existing partners. Refer to no. 6, ignore no. 7. Wen wants to pay cash to the partnership considering two options: 1) Wen is going to invest P500,000 for a 25% interest. Use the bonus method. 2) Wen is going to invest P300,000 for a 25% interest. It is agreed that non-current assets must also be revalued. Direction: a. Option 1. 1) Prepare a table starting with the partners' equity after the current assets were adjusted. Total agreed capital should be the same as total contributed capital. 2) Who will be credited for the bonus capital? Cite some reasons to justify the bonus. Prepare the entry to record the admission of Wen. b. Option 2 1) Prepare a table starting with the current partners' equity after the current assets were adjusted. Use the new partner's contributed capital to determine total agreed equity and compare with total contributed capital. Is there an upward or downward revaluation? 2) Give two entries to record the asset revaluation and admission

answer number 7 & 8 please, thankyou

answer number 7 & 8 please, thankyou