Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer number 7 Other parts are posted here, please check INSTRUCTIONS: (1) Complete the adjustments section of the worksheet [WS]. Use the following information. (a)

answer number 7

Other parts are posted here, please check

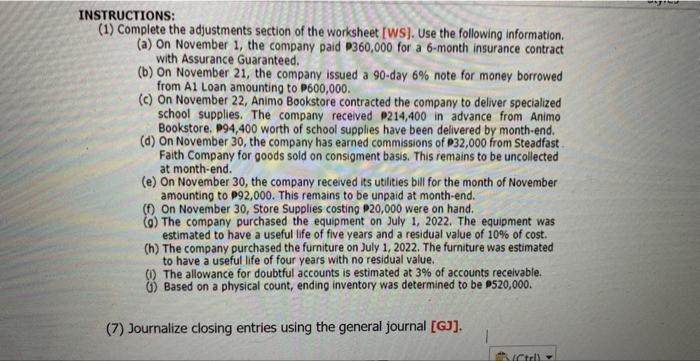

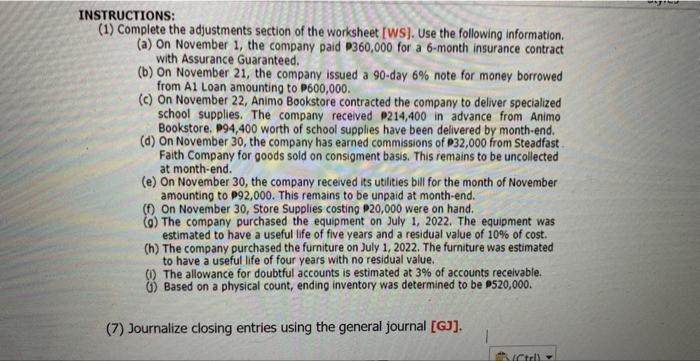

INSTRUCTIONS: (1) Complete the adjustments section of the worksheet [WS]. Use the following information. (a) On November 1, the company paid 9360,000 for a 6-month insurance contract with Assurance Guaranteed. (b) On November 21, the company issued a 90-day 6% note for money borrowed from A1 Loan amounting to P600,000. (c) On November 22, Animo Bookstore contracted the company to deliver specialized school supplies. The company received 9214,400 in advance from Animo Bookstore, 194,400 worth of school supplies have been delivered by month-end. (d) On November 30 , the company has earned commissions of 932,000 from Steadfast Faith Company for goods sold on consigment basis. This remains to be uncollected at month-end. (e) On November 30 , the company received its utilities bill for the month of November (f) On November 30, Store Supplies costing 920,000 were on hand. (9) The company purchased the equipment on July 1, 2022. The equipment was estimated to have a useful life of five years and a residual value of 10% of cost. (h) The company purchased the furniture on July 1, 2022. The furniture was estimated to have a useful life of four years with no residual value. (i) The allowance for doubtful accounts is estimated at 3% of accounts recelvable. (j) Based on a physical count, ending inventory was determined to be 9520,000 . (7) Journalize closing entries using the general journal [G]]. INSTRUCTIONS: (1) Complete the adjustments section of the worksheet [WS]. Use the following information. (a) On November 1, the company paid 9360,000 for a 6-month insurance contract with Assurance Guaranteed. (b) On November 21, the company issued a 90-day 6% note for money borrowed from A1 Loan amounting to P600,000. (c) On November 22, Animo Bookstore contracted the company to deliver specialized school supplies. The company received 9214,400 in advance from Animo Bookstore, 194,400 worth of school supplies have been delivered by month-end. (d) On November 30 , the company has earned commissions of 932,000 from Steadfast Faith Company for goods sold on consigment basis. This remains to be uncollected at month-end. (e) On November 30 , the company received its utilities bill for the month of November (f) On November 30, Store Supplies costing 920,000 were on hand. (9) The company purchased the equipment on July 1, 2022. The equipment was estimated to have a useful life of five years and a residual value of 10% of cost. (h) The company purchased the furniture on July 1, 2022. The furniture was estimated to have a useful life of four years with no residual value. (i) The allowance for doubtful accounts is estimated at 3% of accounts recelvable. (j) Based on a physical count, ending inventory was determined to be 9520,000 . (7) Journalize closing entries using the general journal [G]] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started