Answered step by step

Verified Expert Solution

Question

1 Approved Answer

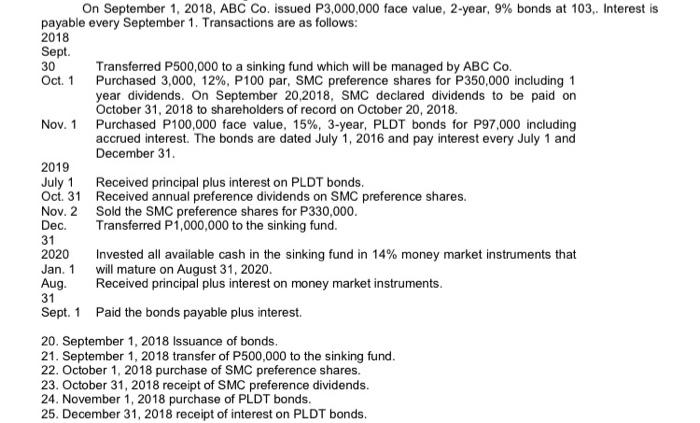

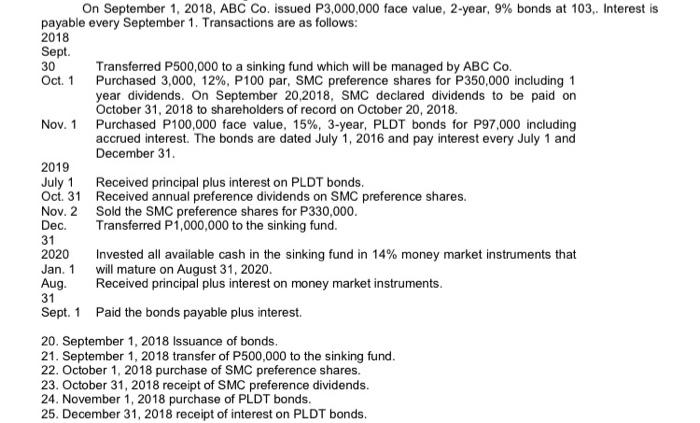

Answer numbers 20 to 25 using the information below On September 1, 2018, ABC Co. issued P3,000,000 face value, 2-year, 9% bonds at 103, Interest

Answer numbers 20 to 25 using the information below

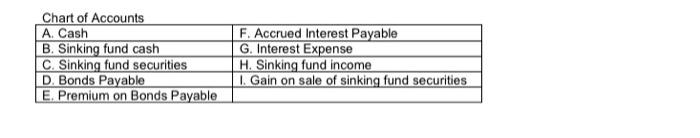

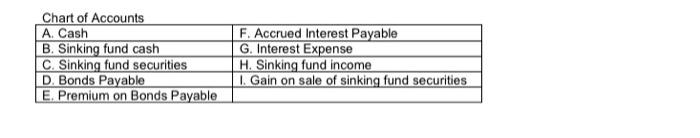

On September 1, 2018, ABC Co. issued P3,000,000 face value, 2-year, 9% bonds at 103, Interest is payable every September 1. Transactions are as follows: 2018 Sept. 30 Transferred P500,000 to a sinking fund which will be managed by ABC Co. Oct. 1 Purchased 3,000, 12%, P100 par, SMC preference shares for P350,000 including 1 year dividends. On September 20,2018, SMC declared dividends to be paid on October 31, 2018 to shareholders of record on October 20, 2018. Nov. 1 Purchased P100,000 face value, 15%, 3-year, PLDT bonds for P97,000 including accrued interest. The bonds are dated July 1, 2016 and pay interest every July 1 and December 31 2019 July 1 Received principal plus interest on PLDT bonds. Oct. 31 Received annual preference dividends on SMC preference shares. Nov. 2 Sold the SMC preference shares for P330,000. Dec. Transferred P1,000,000 to the sinking fund. 31 2020 Invested all available cash in the sinking fund in 14% money market instruments that Jan. 1 will mature on August 31, 2020. Aug. Received principal plus interest on money market instruments. 31 Sept. 1 Paid the bonds payable plus interest. 20. September 1, 2018 Issuance of bonds. 21. September 1, 2018 transfer of P500,000 to the sinking fund. 22. October 1, 2018 purchase of SMC preference shares. 23. October 31, 2018 receipt of SMC preference dividends. 24. November 1, 2018 purchase of PLDT bonds. 25. December 31, 2018 receipt of interest on PLDT bonds. Chart of Accounts A. Cash B. Sinking fund cash C. Sinking fund securities D. Bonds Payable E. Premium on Bonds Payable F. Accrued Interest Payable G. Interest Expense H. Sinking fund income 1. Gain on sale of sinking fund securities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started