Answer only C and D!

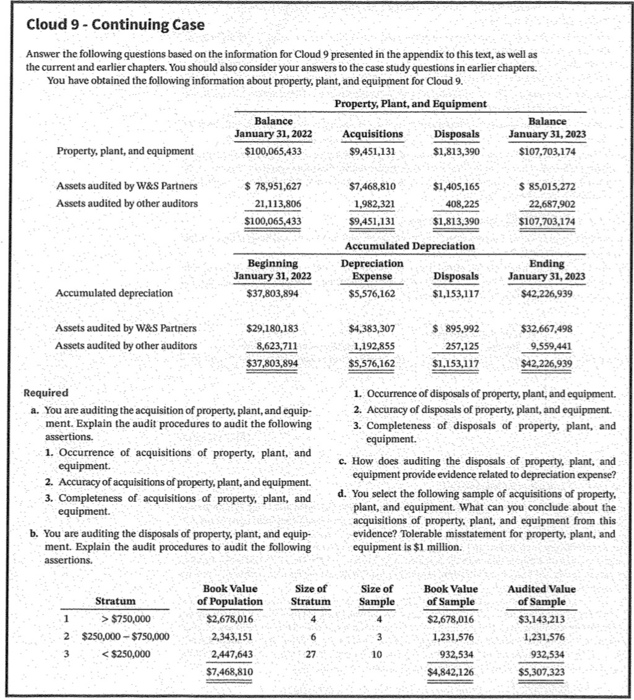

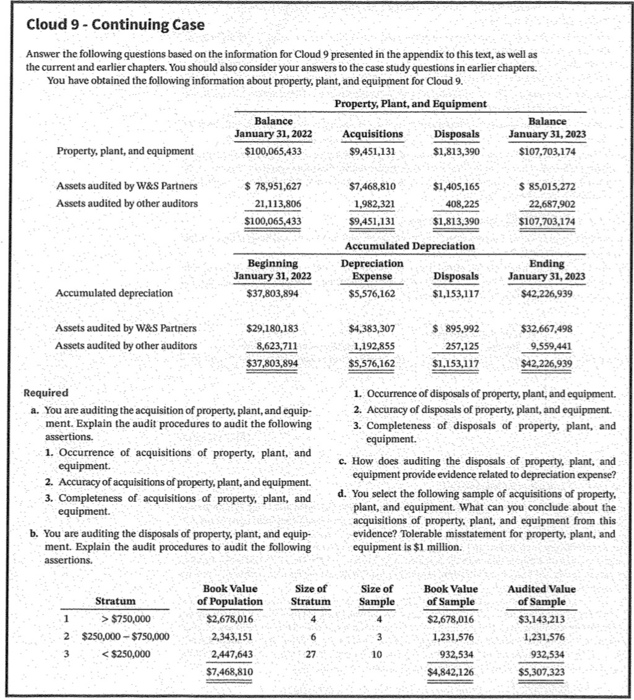

Cloud 9 - Continuing Case Answer the following questions based on the information for Cloud 9 presented in the appendix to this text, as well as the current and earlier chapters. You should also consider your answers to the case study questions in earlier chapters. You have obtained the following information about property, plant, and equipment for Cloud 9. Property, Plant, and Equipment Balance January 31, 2022 Acquisitions Disposals January 31, 2023 Property, plant, and equipment $100,065,433 $9.451,131 $1,813,390 $107,703,174 Balance $1,405,165 Assets audited by W&S Partners Assets audited by other auditors $ 78,951,627 21,113,806 $100,065,433 $7,468,810 1,982,321 $9.451,131 408,225 $1,813,390 $ 85,015,272 22,687,902 $107,703,174 Beginning January 31, 2022 $37,803,894 Accumulated Depreciation Depreciation Expense Disposals $5,576,162 $1,153,117 Ending January 31, 2023 $42,226,939 Accumulated depreciation Assets audited by W&S Partners Assets audited by other auditors $29,180,183 8,623,711 $37,803,894 $4,383,307 1,192,855 $5,576,162 $ 895,992 257,125 $1,153,117 $32,667,498 9,559,441 $42.226,939 Required a. You are auditing the acquisition of property, plant, and equip- ment. Explain the audit procedures to audit the following assertions. 1. Occurrence of acquisitions of property, plant, and equipment. 2. Accuracy of acquisitions of property, plant, and equipment. 3. Completeness of acquisitions of property, plant, and equipment b. You are auditing the disposals of property, plant, and equip- ment. Explain the audit procedures to audit the following assertions. 1. Occurrence of disposals of property, plant, and equipment. 2. Accuracy of disposals of property, plant, and equipment. 3. Completeness of disposals of property, plant, and equipment. c. How does auditing the disposals of property, plant, and equipment provide evidence related to depreciation expense? d. You select the following sample of acquisitions of property. plant, and equipment. What can you conclude about the acquisitions of property, plant, and equipment from this evidence? Tolerable misstatement for property, plant, and equipment is $1 million Size of Stratum Size of Sample 4 Stratum 1 > $750,000 2 $250,000 - $750,000 3