Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer only if u know correct answer...I have already I reported against incorrect answer...in case incorrect answer...I will report against answer... please keep in mind

answer only if u know correct answer...I have already I reported against incorrect answer...in case incorrect answer...I will report against answer... please keep in mind

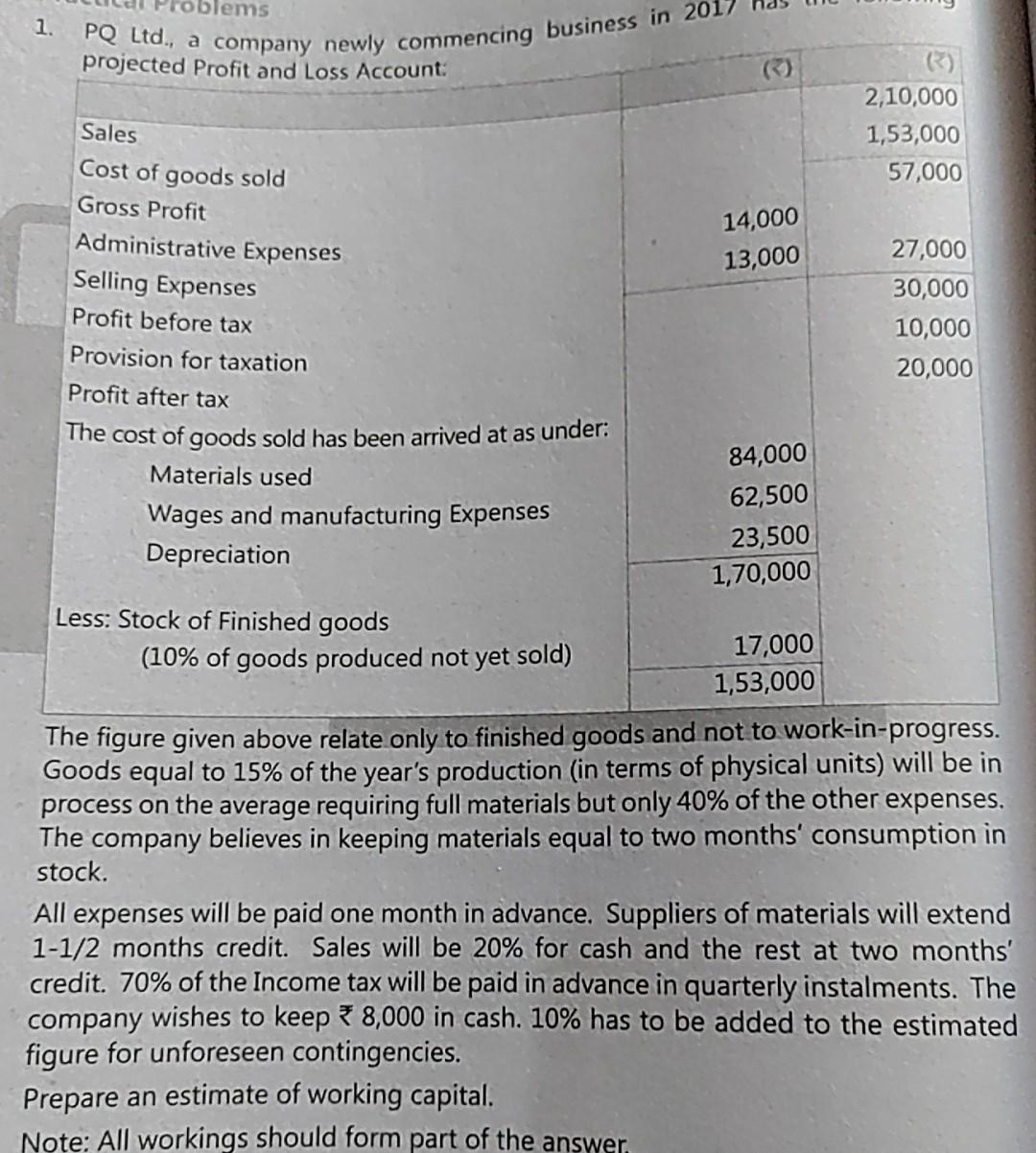

1. 14,000 13,000 oblems PQ Ltd., a company newly commencing business in 201 projected Profit and Loss Account: 2,10,000 Sales 1,53,000 Cost of goods sold 57,000 Gross Profit Administrative Expenses 27,000 Selling Expenses 30,000 Profit before tax 10,000 Provision for taxation 20,000 Profit after tax The cost of goods sold has been arrived at as under: 84,000 Materials used 62,500 Wages and manufacturing Expenses 23,500 Depreciation 1,70,000 Less: Stock of Finished goods 17,000 (10% of goods produced not yet sold) 1,53,000 The figure given above relate only to finished goods and not to work-in-progress. Goods equal to 15% of the year's production (in terms of physical units) will be in process on the average requiring full materials but only 40% of the other expenses. The company believes in keeping materials equal to two months' consumption in stock. All expenses will be paid one month in advance. Suppliers of materials will extend 1-1/2 months credit. Sales will be 20% for cash and the rest at two months' credit. 70% of the Income tax will be paid in advance in quarterly instalments. The company wishes to keep 8,000 in cash. 10% has to be added to the estimated figure for unforeseen contingencies. Prepare an estimate of working capital. Note: All workings should form part of the answer 1. 14,000 13,000 oblems PQ Ltd., a company newly commencing business in 201 projected Profit and Loss Account: 2,10,000 Sales 1,53,000 Cost of goods sold 57,000 Gross Profit Administrative Expenses 27,000 Selling Expenses 30,000 Profit before tax 10,000 Provision for taxation 20,000 Profit after tax The cost of goods sold has been arrived at as under: 84,000 Materials used 62,500 Wages and manufacturing Expenses 23,500 Depreciation 1,70,000 Less: Stock of Finished goods 17,000 (10% of goods produced not yet sold) 1,53,000 The figure given above relate only to finished goods and not to work-in-progress. Goods equal to 15% of the year's production (in terms of physical units) will be in process on the average requiring full materials but only 40% of the other expenses. The company believes in keeping materials equal to two months' consumption in stock. All expenses will be paid one month in advance. Suppliers of materials will extend 1-1/2 months credit. Sales will be 20% for cash and the rest at two months' credit. 70% of the Income tax will be paid in advance in quarterly instalments. The company wishes to keep 8,000 in cash. 10% has to be added to the estimated figure for unforeseen contingencies. Prepare an estimate of working capital. Note: All workings should form part of theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started