Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer only number 4 Problem I: On 10/17/2020, Hector company (which has a 12/31 year-end) sold to a Canadian firm inventory for C$100,000. Payment is

Answer only number 4

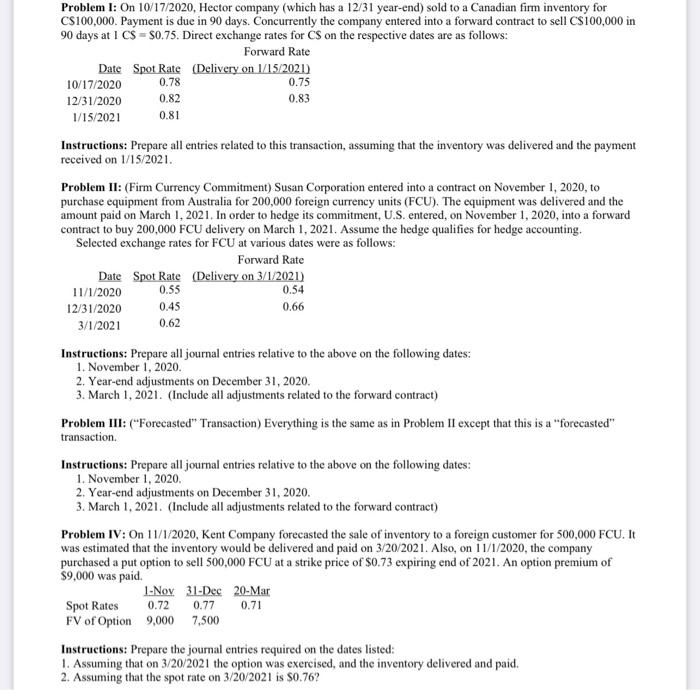

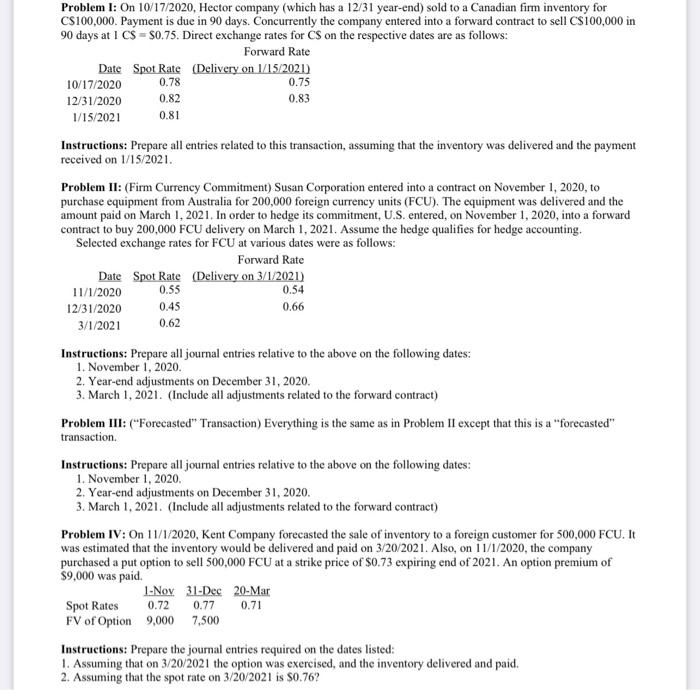

Problem I: On 10/17/2020, Hector company (which has a 12/31 year-end) sold to a Canadian firm inventory for C$100,000. Payment is due in 90 days. Concurrently the company entered into a forward contract to sell C $100,000 in 90 days at 1CS=$0.75. Direct exchange rates for CS on the respective dates are as follows: Instructions: Prepare all entries related to this transaction, assuming that the inventory was delivered and the payment received on 1/15/2021. Problem II: (Firm Currency Commitment) Susan Corporation entered into a contract on November 1, 2020, to purchase equipment from Australia for 200,000 foreign currency units (FCU). The equipment was delivered and the amount paid on March 1, 2021. In order to hedge its commitment, U.S. entered, on November 1, 2020, into a forward contract to buy 200,000 FCU delivery on March 1, 2021. Assume the hedge qualifies for hedge accounting. Selected exchange rates for FCU at various dates were as follows: Instructions: Prepare all journal entries relative to the above on the following dates: 1. November 1, 2020. 2. Year-end adjustments on December 31, 2020. 3. March 1, 2021. (Include all adjustments related to the forward contract) Problem III: ("Forecasted" Transaction) Everything is the same as in Problem II except that this is a "forecasted" transaction. Instructions: Prepare all journal entries relative to the above on the following dates: 1. November 1,2020. 2. Year-end adjustments on December 31, 2020. 3. March 1, 2021. (Include all adjustments related to the forward contract) Problem IV: On 11/1/2020, Kent Company forecasted the sale of inventory to a foreign customer for 500,000FCU. It was estimated that the inventory would be delivered and paid on 3/20/2021. Also, on 11/1/2020, the company purchased a put option to sell 500,000FCU at a strike price of $0.73 expiring end of 2021 . An option premium of $9,000 was paid. Instructions: Prepare the journal entries required on the dates listed: 1. Assuming that on 3/20/2021 the option was exercised, and the inventory delivered and paid. 2. Assuming that the spot rate on 3/20/2021 is $0.76

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started